| Wee Hur Holdings’ workers' dormitory business is poised to double its contribution to the company’s coffers with the launch of Pioneer Lodge. While the looming lease expiry of its established Tuas View dorm hangs over the business, management is optimistic about securing a renewal with the Jurong Town Corporation. In a market where worker housing is in scorching demand, this segment is a vital pillar for Wee Hur, as we gleaned from its latest results briefing. |

| Tuas View: The Cash Cow Near Full Capacity |

Wee Hur’s Tuas View dormitory, a 12-year-old operation with 15,744 beds, is nearly maxed out at 15,500 occupants.  With rates approaching S$500 per bed monthly, it’s generating roughly S$30 million in annual profit.

With rates approaching S$500 per bed monthly, it’s generating roughly S$30 million in annual profit.

The lease expires 31 Oct next year, but renewal discussions with JTC will start soon, and management sees no major hurdles to renewal (but extension of duration is the question), especially given the market’s tight supply.

Tuas View is too big a dorm to take out of the market.

Compliant with standards until 2030, Tuas View needs no immediate refurbishments.

This table shows the strong profitability of Tuas View:

|

Wee Hur: Workers’ dormitory (Tuas View mainly) |

||

| S$'000 |

1H2025 |

Full year FY2024 |

|

Total segment sales |

42,210 |

84,690 |

|

Inter-segment sales |

(228) |

(83) |

|

External revenue |

41,982 |

84,607 |

|

Segment result |

22,181 |

31,275 |

|

Data: Company |

||

| Pioneer Lodge: The New Star Ramping Up |

Pioneer Lodge, Wee Hur’s shiny new dorm in Jurong, is set to boost the business segment.

Phase One, with 3,144 beds (30% of total stock), currently has 1,000 sign-ups but has commitments for 2,500 by year-end.

Marketing for Phase Two will kick off soon with all 10,500 beds expected to be operational by December.

Thanks to its location and premium amenities like ensuite toilets, it will command higher rents than Tuas View.

Management expects occupany and revenue stabilization in 1-1.5 years, with Pioneer Lodge potentially matching Tuas View’s S$30 million contribution despite fewer beds -- thereby potentially doubling the dorm segment’s impact.

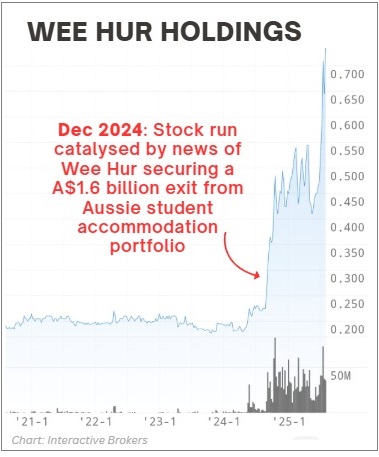

It is a key fundamental plank in the investment thesis of Wee Hur, for which Phillip Securities' latest report pegs a target price of 90 cents (current stock price: 74 cents). |

Read about another dorm operator:

From Sunset Industry to Sunrise REIT: CENTURION’s Winning Pivot over 14 Years