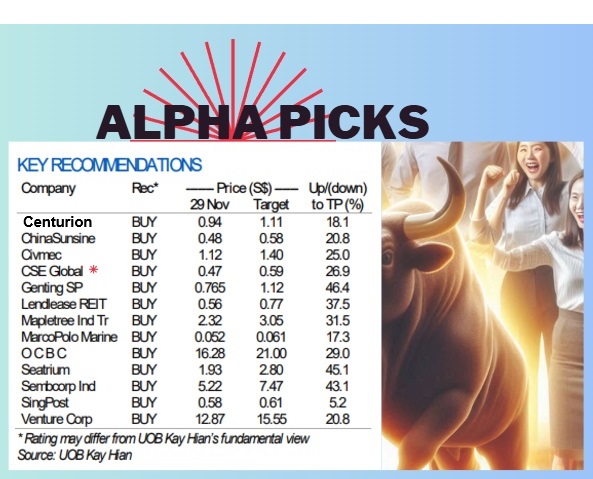

• UOB Kay Hian's alpha picks portfolio, which is updated every month, bears watching because the broker willingly puts its reputation on the line. It has worked out well. "Our Alpha Picks portfolio has now outperformed the STI in 12 out of the past 14 months," UOB KH triumphantly says in its latest note. •In its portfolio is a stock that its analysts have covered for a long time: CSE Global. CSE has been volatile in recent times, falling from 48 cents to 42 cents, on unexpected negative news in Sept -- an arbitration settlement costing US$8 million due to delays caused by supply chain hiccups during COVID-19. • But with recent order wins, and an alluring market potential in electrification in the US, the stock has regained ground, touching 47.5 cents.  Read more about CSE below .... |

Excerpts from UOB KH report

Strong broad-based performance. Our top performers were in industrials, financials and consumer staples, namely newly added CSE Global (+8.1% mom), OCBC Group (+7.2% mom) and DFI Retail Group (+7.1% mom).

CSE Global rose from steady tender wins while DFI Retail Group rose due to greater confidence in 2025’s earnings outlook.

OCBC rose due to increased expectations of a more gradual interest rate cut outlook.

Our underperformers were Genting Singapore (-8.4% mom) and Venture Corp (-3.2% mom), which were both dragged by weak 3Q24 result updates while Marco Polo Marine (-7.1% mom) fell from weaker sentiment in O&G stocks.

• Minimal change. To end of 2024, we make a slight change to our Alpha Picks portfolio by adding Centurion while removing DFI Retail Group.

We expect Centurion to benefit from its volume growth, continued positive rental reversion as well as dividend upside while taking profit on DFI Retail Group.

| CSE Global - Buy |

Analysts: John Cheong & Heidi Mo

| • Robust order pipeline. CSE continues to enjoy strong order wins, with order intake of S$565m in 9M24. Orderbook reached S$634m, signalling a healthy pipeline for the coming quarters.

CSE continues to embark on its growth strategy through capitalising on emerging trends like electrification and decarbonisation, while pursuing acquisitions in the critical communications space in the Americas region. |

||||

John Cheong, analyst• CSE continues to see stable financial performance in the infrastructure and mining & minerals sectors, supported by a steady stream of projects arising from requirements in digitalisation, communications and enhancements in physical and cyber security globally, and from data centres and water utilities in the Americas and Asia Pacific region.

John Cheong, analyst• CSE continues to see stable financial performance in the infrastructure and mining & minerals sectors, supported by a steady stream of projects arising from requirements in digitalisation, communications and enhancements in physical and cyber security globally, and from data centres and water utilities in the Americas and Asia Pacific region.

CSE will expand its engineering capabilities and technology solutions to pursue new market opportunities and diversify into new markets brought about by the emerging trends towards urbanisation, electrification and decarbonisation.

| • Maintain BUY. Our target price of S$0.59 is pegged to 13x 2025F PE (based on +1SD above mean) and implies a decent dividend yield of 6.6% as we expect CSE to maintain a full-year dividend of 2.75 S cents/share for 2024. SHARE PRICE CATALYSTS • Events:

• Timeline: 3-6 months. |

Full report here