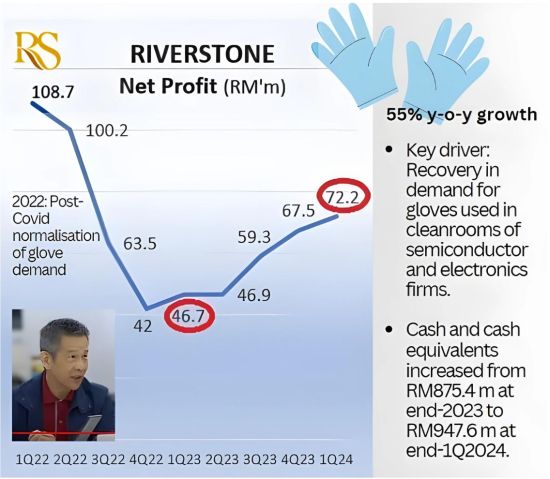

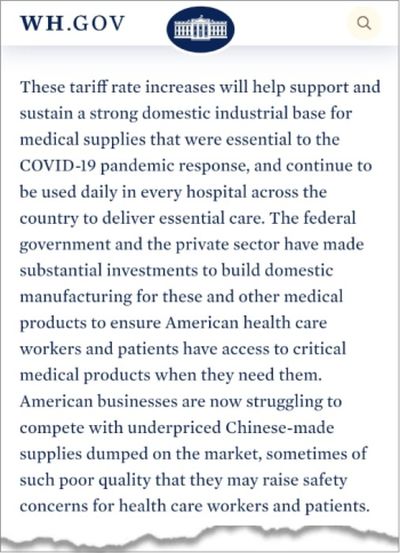

| • During the Covid pandemic, many new glove manufacturers sprung up in China to ride on the huge demand for healthcare gloves. The new competition and excess production capacity led to a surplus of inventory post-pandemic and a plunge in selling prices. • Profits then eluded many regional players, mostly those based in Malaysia. The exception was Singapore-listed Riverstone Holdings (market cap: S$1.4 billion), which has an established business producing gloves for use in electronics cleanrooms as well. • That's why its stock has been an outperformer among its peers. It is up 39% so far this year (from 70 cents to 97 cents). And this is after going x-dividend for its FY23 final & special dividends totalling 3.559 cents/share.  • Its trailing PE of 20+ is not cheap. But Riverstone's high dividend payouts coupled with rising profitability and an outstanding cash balance -- these help explain its attraction to investors. • A new development is brightening the prospects for non-China glove producers. As we know, the US isn't enamoured with China on many fronts. Of late, it has been getting tough on China's glove producers by announcing tariffs to be implemented from 2026:  Source: White House press release Source: White House press releaseIn addition, the US has taken practical steps in recent times to turn away (sub-standard) Chinese glove products, as UOB Kay Hian's report today describes. Read more below.... |

Excerpts from UOB KH report

Analysts: John Cheong & Heidi Mo

Riverstone Holdings (RSTON SP)

Despite a higher ROE and dividend yield, Riverstone is trading at an undemanding 17x 2025F PE vs peers’ average of 47x. The rise in US FDA import alerts flagging quality issues with China medical gloves, compounded with the US tariff hike, is likely to benefit Malaysian glove makers like Riverstone. Though the group faced shipment delays, management sees it easing. Expansion plans remain on track and we anticipate better margins. Maintain BUY with a higher target price of S$1.16. |

WHAT’S NEW

• Quarterly record-high US FDA import alerts on China glove makers. US Food and Drugs Administration (FDA) import alerts on China glove makers due to quality concerns have hit quarterly highs in 4Q23 and 1Q24, as seen in the RHS figure on the next page.

|

Riverstone |

|

|

Share price: |

Target: |

This means that FDA has enough evidence for detention without physical examination (DWPE) of products that are in violation of its laws and regulations.

If the manufacturer is unable to rebut the violation within 10 working days, the products will be issued with a refusal of admission and be destroyed or exported from the US within 90 days of refusal.

• Ripple effects from Red Sea Crisis. The Red Sea has led to many shipping companies rerouting their ships on longer journeys and therefore, delays in shipment deliveries.

This particularly impacts international shipments from Southeast Asia to the US and Europe.

Management shared that it had faced some shipping delays due to port congestion and increased vessel waiting times since April, but observed slight easing in July.

| "Riverstone offers the most attractive valuation in the glove industry with a 40% discount in terms of PE multiple and 7x higher dividend yield vs peers." |

STOCK IMPACT

• Potential trade diversion from China to Malaysia. The FDA import alerts could be prolonged for Chinese producers as they have consistently been unable to achieve the standard of quality that Malaysia has since 2010 as seen in the RHS figure on the next page.

Additionally, the US tariffs on China medical-grade gloves will be sharply raised from 7.5% to 25% effective 2026, reducing the price competitiveness of China glove makers.

These factors point to possible demand recovery and market share growth for Malaysia players like Riverstone in the coming quarters.

• Improving production efficiency on capacity expansion. Management highlighted that its capacity expansion is on track, with three production lines to be completed by end-24 and another three lines by 2025.

The added capacity will boost its total capacity from 10.5b to 11.2b gloves (+7%), producing higher-margin customised gloves.

This translates to lower downtime, thereby improving efficiency and margins for the group.

• Riverstone offers the most attractive valuation in the glove industry with a 40% discount in terms of PE multiple and 7x higher dividend yield vs peers.

Riverstone’s 2025F PE of 17x is at a 40% discount vs peers’ average of 47x and it offers a way more attractive dividend yield of 7.3% vs peers’ average of 0.5%.

We think Riverstone is a good proxy to the recovery in the healthcare glove industry while offering downside protection given its dominant position in the cleanroom glove sector.

• Strong balance sheet supports higher payout ratio. Backed by its healthy 1Q24 cash balance of RM947.6m (about 20% of market cap) and operating cash flow, we expect 2024- 26 payout ratio to exceed 100% to reward shareholders (2023: 151%; 2022: 116%).

This translates to an attractive dividend yield of 7.3% for 2024.

John Cheong, analystEARNINGS REVISION/RISK John Cheong, analystEARNINGS REVISION/RISK • We raise our 2024-26 earnings by 3-6%, projecting a three-year net profit CAGR of 12% in in 2023-26. We factor in 1-2ppt higher gross margin assumptions of 36-38% to account for potential cost efficiencies upon capacity expansion, partially offset by more healthcare sales in the product mix from the US. VALUATION/RECOMMENDATION • Maintain BUY with a 4% higher PE-based target price of S$1.16 (S$1.12 previously), pegged to 20x 2025F PE, or 1.5SD above the long-term historical mean. Riverstone is trading at a deep 40% discount to its Malaysian peers’ trading multiple of 47x 2025F PE despite the group’s higher margins and ROE vs peers. SHARE PRICE CATALYST • Capacity expansion-driven growth. • Higher demand from the US for cleanroom and healthcare gloves. • Higher dividend payouts. |

Full report here