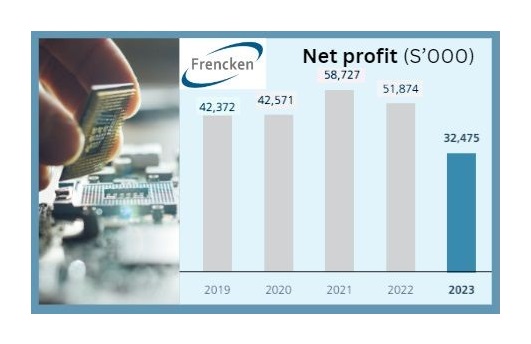

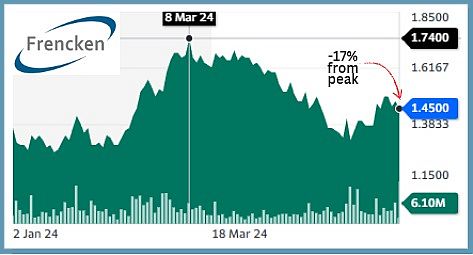

• After a sharp fall in net profit in 2023 (see chart), is Frencken Group poised to benefit from a recovery in the global semiconductor industry? Its 1Q2024 results are kind of mixed: Revenue rose, gross margin rose and net profit surged 73% to S$9.0 million. That's on a year-on-year comparison. On a quarter-to-quarter basis, net profit was 32% lower. • Its stock price corrected after the FY23 results, and reached a trough just before the release of the 1Q24 results. It has since moved up (from $1.39 to $1.45).  • The semiconductor segment accounts for about 40% of Frencken's revenue. Clients include TSMC and Applied Materials. Frencken offers its extensive expertise in mechatronics engineering, integrated manufacturing services, and customized solutions. It also boasts of a global presence and problem-solving capabilities. Going forward, the semiconductor industry will undoubtedly enjoy strong growth driven by advancements in AI, IoT, and other high-tech areas. Maybank has chosen Singapore-listed Frencken as its top pick among Singapore tech stocks. Read more below ... |

Excerpts from Maybank KE report

Analyst: Jarick Seet

Frencken Group Ltd (FRKN SP)

AMAT partnership to drive more growth

|

| FY24E semi-con recovery with ramp up in FY25E |

|

Frencken |

|

|

Share price: $1.45 |

Target: |

FRKN’s semi-con segment did well in 1Q24 due to higher sales from its key customer in Europe and improving sales from Asia.

Management expects a gradual recovery in FY24 for its semi-con segment from its various NPIs in progress in Europe and Asia.

It has also relocated its US operations to a larger facility and expanded its motor business, supporting semi-con equipment customers.

It is also working with a US front-end equipment customer to expand its range of programmes, which is likely to translate to higher revenue in the future.

We understand that certain NPIs are slated to ramp up, especially in FY25E.

| QoQ improvement likely |

We expect 2Q24 to be better than 1Q24 and subsequent quarters in 2H24 to be stronger QoQ, mainly due to new NPIs, in the semi-con, automotive, life science and medical sectors.

Margins should also continue to pick up due to higher operating leverage.

South East Asia utilisation has picked up to 60-70% from 50+% in 3Q23, which is highly encouraging and should point to a stronger 2Q24E YoY.

|

Full report here.