Excerpts from Maybank KE report

Analyst: Gene Lih Lai, CFA

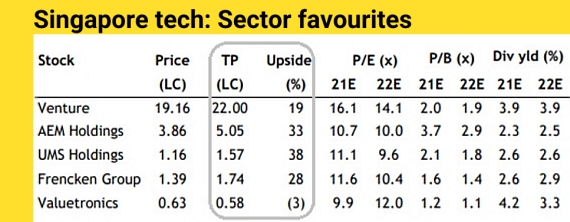

Drivers intact; Beneficiaries of advanced packaging

We note over a longer horizon, share prices correlate highly to consensus EPS revisions, and have little correlation to 10Y UST yields. As we see upside drivers to UMS and Frencken, we now value them at 15x/14.5x FY21E P/E respectively, as our previous ROE-g/COE-g method does not capture these. Hence our UMS/Frencken TP are up 17%/25% to SGD1.57/1.74 respectively. Sector favourites are UMS, Frencken, Venture and AEM. |

| Theses unchanged |

Observations of our coverage universe and their customers support our theses.

We see UMS as the best candidate to ride out chip shortages, as it is a beneficiary of foundry spending.

Meanwhile, Venture’s and Frencken’s end-markets are improving, and they are expecting several customers to launch new products in FY21.

While we are concerned about HDMT TH (high density modular test test handlers) high-base effects for AEM in FY21E, we see upside drivers from:

i) accretive M&A; and

ii) stronger-than-expected cloud/ 5G spending in 2H21.

| Higher TP for UMS and FRKN due to upside drivers |

For UMS, we believe potential upside drivers include:

| i) positive surprise of current business momentum in 2021 amid Applied Materials’ (AMAT) robust outlook; ii) new business opportunities (e.g. Lam Research building supply chain in Penang/ UMS courting potential new customer). |

For Frencken, we and consensus’ net margins are 7-8% for FY21-23E, but we believe Frencken has scope to outperform these from levers such as:

i) greater value-add with customers in coming years; and

ii) continual cost control.

Performance, power, area-cost and time to market demands from inflections like Big Data, IoT and AI are putting limits on traditional Moore’s law scaling. |

Key risks in our sector include: i) chip shortages/ slower-than-expected recoveries curtailing volumes; and ii) excessively weak USD.

Full report here.