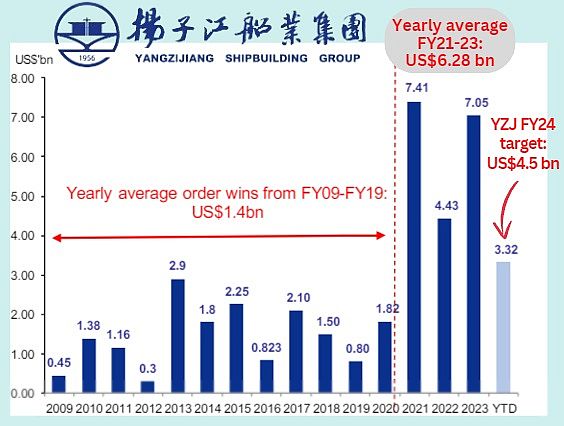

| • Yangzijiang Shipbuilding presented a sterling 1Q2024 business update. Notably, it has a backlog of US$16.1 billion worth of ships to deliver. That's 193 ships. • And it achieved orders of US$3.3 billion year-to-date, just shy of its US$4.5 billion target for the entire year. Just US$4.5 billion? Seems like Yangzijiang is getting extra picky of future orders. • The Chinese and Singapore-listed shipyard group (market cap: S$8.7 billion) is undoubtedly an excellent shipbuilder. In addition, it is benefitting from a buoyant global shipbuilding market driven by regulatory pushes for maritime decarbonization. • More than half of Yangzijiang's orders are for greener vessels whose engines are capable of running on alternative fuels such as methanol or liquefied natural gas (LNG).  • Yangzijiang's orderbook, whose progression is shown below, is not only massive but reflects a shipbuilder that has made a quantum leap in its order-clinching ability over the past 3 years. It's a bigger beast. And, not surprisingly, its stock price has gone up almost 100% in the past 12 months (ie from $1.22 to $2.22 recently).  Source: CGS-CIMB, Company, NextInsight Source: CGS-CIMB, Company, NextInsight• Read more in excerpts from CGS International's latest report below ... |

CGS International analysts: Lim Siew Khee & Meghana Kande

■ We up our order win target for YZJSB to US$5.5bn for 2024, affirmed by the company’s YTD order wins of US$3.32bn with deliveries scheduled in 2027.

■ Retain Add with a higher TP of S$2.35 as our thesis of margin expansion remains with steel costs at c.Rmb4k/tonne amidst firm ship prices. |

|||||

| Order win surprise, no discussion on US/China tariff war |

In the results briefing, YZJSB said that the key positive surprise for YTD orders came from containerships backed by strong freight rates supporting ship owners’ profitability which spurred newbuild orders.

In addition, Red Sea uncertainty and change in shipping routes also caused pre-emptive orders from owners.

There has also been healthy demand for gas carriers.

In 1Q24, YZJSB delivered 28 vessels and is on track to deliver 63 vessels in FY24F.

On the US-China steel tariff war, YZJSB said that customers have not started any discussion on this topic (read: owners are focusing on profitability for now).

| Conservative guidance on orders and capacity expansion |

Management is not changing its guidance of US$4.5bn order win target for 2024 on conservative grounds.

However, enquiries remain healthy for VLEC (Very Large Ethanol Carriers) and VLAC (Very Large Ammonia Carriers).

Supply shortage of methanol has also caused some customers to enquire on LNG-fuelled vessels.

| "There are still slots available for vessels to be delivered in 2027. There are also enquiries for 2028 deliveries but YZJSB is selective and will only focus on high priced/margin contracts for negotiation." - CGS International |

On average, YZJSB now takes about 13-14 months to deliver a vessel, with strike steel revenue recognition of 20%.

Despite management guidance, we are raising our order win target to US$5.5bn in 2024F given YTD’s strength.

On capacity expansion, management said there are talks but at a very preliminary stage and remains conservative on this.

Pricing stable, margin expansion on track

Steel price remains stable at Rmb4k/tonne, supporting our thesis on margin expansion. We keep our shipbuilding GPM at 24.5% for FY24F and 25.5% for FY25-26F.

|

Full report here.