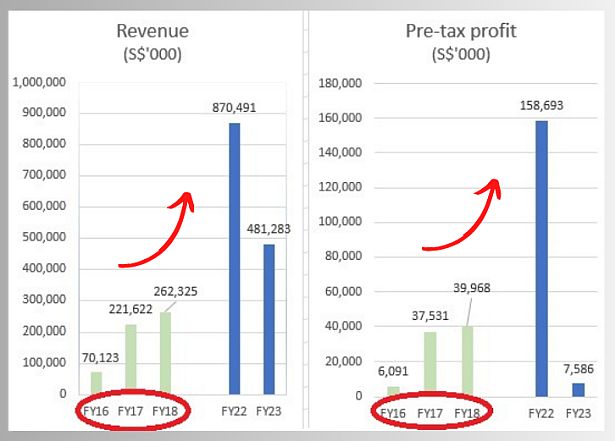

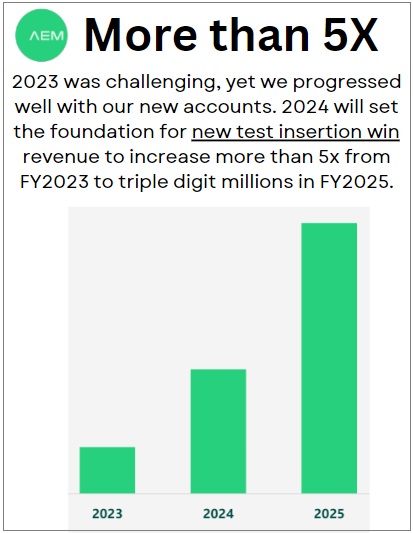

| The CEO said it. And the non-executive chairman too. At a 1Q2024 earnings call last week, both pointed to a business boom for AEM Holdings 7-8 years ago, which looks set to be repeated. Back then, AEM had successfully co-developed -- with its key customer (aka Intel Corp) -- revolutionary back-end testing equipment for the key customer. And AEM's business performance just surged for years. We revisited the data and put together these charts below. AEM's market cap at end-2016 was S$25 million. It surged past the S$1 billion mark in 2020. Astounding.  The pandemic drove up the semiconductor cycle, hence AEM's FY22 record metrics. But the industry has been on a downturn since and has bottomed. The pandemic drove up the semiconductor cycle, hence AEM's FY22 record metrics. But the industry has been on a downturn since and has bottomed.Now, AEM (market cap: S$581 million) is on the brink of a similar ramp-up in a multi-year supply to new customers, starting later this year. Indeed, AEM has projected that revenue from new customers in 2025 will be "more than 5X" that of its new customer revenue in 2023. AEM says they will contribute "triple-digit millions" in revenue. (Only time will tell if "triple-digit millions" next year turns out to be $100 m+, or $200 m+, or $300 m +, etc. Whatever it is, the figure certainly is meaningful compared to recent annual revenues of AEM). When asked, AEM says this is a blended "high-confidence estimate" that is based on confirmed and soon-to-be confirmed orders. So stay tuned for announcements on new confirmed orders then.  Source: AEM presentation Source: AEM presentationCEO Chandran Nair said: "For those of you who have invested and followed us for the last 7, 8 years, we are now in the same position as we were with our key customer as they went through a capability build and then ramped up." Chairman Loke Wai San: "I was there in 2015 when we got our first major tool win (from our key customer), growing to four that year and then scaling the year after. It feels very similar in terms of where we now are with our other customers." |

AEM is riding on the semiconductor industry's significant growth potential driven by megatrends such as artificial intelligence (AI), 5G, and the Internet of Things (IoT).

AI chips, in particular, will require much higher test times and, given that about 300 million PCs are produced a year globally, AI chips and high-performance computing and memory chips will drive opportunities for AEM.

"AEM's powerful and modular architecture helps accelerate the time to market by reducing the time and effort required to bring a device to high volume manufacturing," says Mr Nair.

AEM stands out as a rare Singapore company which has established itself on the global stage with its innovation in technology and with its financial performance.

The bright outlook for new customer orders and for industry growth is, however, now partially over-shadowed by muted demand for AEM's equipment from Intel.

Intel has embarked on efforts to reduce test times (to industry norms) and eliminate non-standard tests, posing a risk to AEM's revenue.

Analysts are waiting for AEM's guidance expected to be given with its 2Q2024 results on its near-term outlook, and recommend that investors hold back and have set lower target prices accordingly (see table below).

That's why AEM's stock took another leg down after its disappointing 1Q2024 results, trading recently at $1.90.

|

Research |

Call |

Target |

Net profit forecast |

|

|

|

2024 |

2025 |

||

|

CGS-CIMB |

Reduce |

1.84 |

22.2 |

59.2 |

|

Maybank KE |

Hold |

2.04 |

21 |

58 |

|

HSBC |

Hold |

2.00 |

47 |

86 |

|

UOB KH |

Sell |

1.67 |

20 |

43 |

|

DBS |

Hold |

1.97 |

21.2 |

66.8 |

|

Citi |

Neutral |

2.13 |

38 |

72 |

|

Average |

1.94 |

28.2 |

64.1 |

|

| What some research houses say: » Citi: Downgrade to Neutral — Until a turnaround becomes more apparent, we see limited share-price upside while downside appears protected by low valuations and upside risks in 2025E. » Maybank Kim Eng: Not time yet. Despite thinking the worst is over, and expecting more new order wins in the next few months, we think it’s better to revisit AEM closer to 4Q24 as the bulk of the ramp-up orders will only likely come in FY25E.  "We think AEM’s recent new program wins and ramp for system level test with its new customer in AI accelerators is too early to quantify given a potential ramp only in 2025." "We think AEM’s recent new program wins and ramp for system level test with its new customer in AI accelerators is too early to quantify given a potential ramp only in 2025." |

While AEM management has confidently described great growth opportunities, investors interested in the stock may be grappling with the timing of purchase.

Buy soon as the stock looks beaten down? But will it get cheaper if management's forward guidance in 2H is less exciting than expected?

Buy later when risks are reduced? But will prices be much higher?

More questions to chew on:

| • Will AEM really replicate its success with Intel across its new customer base? • How far advanced and how sustainable is AEM's technological edge? • What shape will the semiconductor industry recovery take? • Intel's core markets are chips for PCs and servers. What are the likely growth rates for PCs with AI chips, which require higher test intensities? |