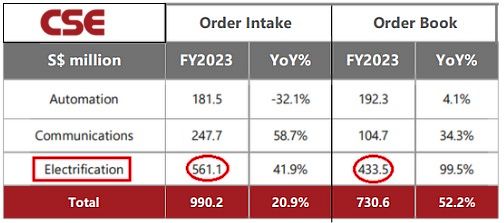

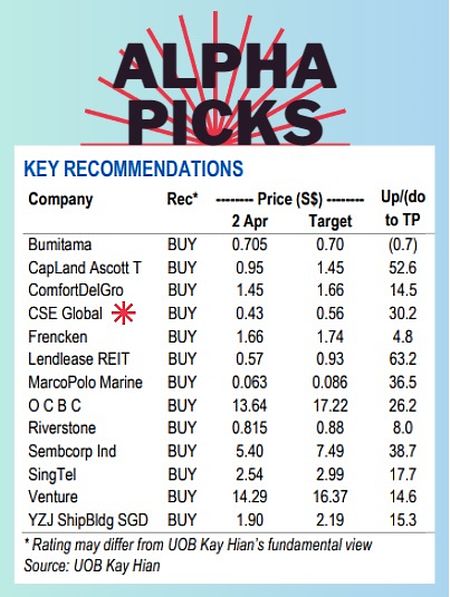

| • UOB Kay Hian puts out the monthly performance of its "alpha picks" portfolio. In 1Q24, the portfolio surged by 13.7% q-o-q, surpassing the STI by a hefty 14.2ppt. • In the latest report, for April 2024, UOB KH adds CSE Global and Lendlease REIT while removing Mapletree Industrial Trust, Civmec and Food Empire due to "a lack of near-term catalysts". • CSE (market cap: S$288 million) has a feather in its cap: at the end of 2023, its orderbook stood at a record S$730.6m (+52.2% yoy) after taking in S$990 million worth of orders during the year (2022: S$819 million). Well, that should mean its 2024 performance looks more certain. • There's a wide range of businesses in its orderbook. CSE specializes in systems integration and IT solutions across various industries -- oil and gas in the Americas as well as infrastructure and mining segments in Asia Pacific.  CSE Global's MD, Lim Boon Kheng. CSE Global's MD, Lim Boon Kheng. NextInsight file photo. • CSE's "electrification" segment has been a rising star (see table below).  The electrification business includes power systems protection & control solutions, electric equipment centres and electrical drive & high/medium voltage systems to support the electricity grid and renewables. CSE is able to supply and install commercial solar energy solutions and so on. • Read what UOBKH says about CSE below -- and its alpha picks portfolio performance .... |

Excerpts from UOB KH report:

| Alpha Picks: A Robust End To 1Q24 Broad-based outperformance. Our top performers were Riverstone (+30.8% mom), Yangzijiang Shipbuilding (YZJ, +9.1% mom) and Singtel (+7.7% mom). Riverstone surged sharply on the back of better sequential earnings for 4Q23 along with a declared special dividend while YZJ benefited from greater confidence in its 2024 outlook. Singtel rose from market speculation that the group was planning to sell its Australian business, potentially unlocking shareholder value. Our underperformers include Food Empire (-5.6% mom) and Civmec (-0.4% mom) which saw profit-taking after their respective strong performances in 1Q24. Nonetheless, both Food Empire (+23.6% mom) and Civmec (+19.4% mom) have performed well since their inclusion into our Alpha Picks portfolio. |

• Expect higher earnings in 2024 with record-high orderbook. Management has reached its goal of a ~S$1b order intake in 2023, as order intake rose 20.9% yoy to S$990.2m, while its 2023 orderbook reached a record-breaking S$730.6m (+52.2% yoy). This was boosted by order intakes in the Communications and Electrification segments, which rose by 58.7% yoy and 41.9% yoy respectively. On the back of the stronger order wins and an all-time high orderbook, we expect CSE’s 2024 earnings to see solid growth.  John Cheong, analyst• CSE’s share placement saw strong demand from reputable institutional and accredited investors. On 25 Mar 24, CSE completed a share placement held at an issue price of S$0.40 per share. John Cheong, analyst• CSE’s share placement saw strong demand from reputable institutional and accredited investors. On 25 Mar 24, CSE completed a share placement held at an issue price of S$0.40 per share. The issue price is at a 6.6% discount to the last volume weighted average price of S$0.4281. CSE has issued 60m new ordinary shares, which raised gross proceeds of S$24m and net proceeds of S$23.2m. 100% of the net proceeds will be used to fund potential acquisitions or investments in its existing markets, including the US, Australia and New Zealand. The strong support from investors illustrates confidence in CSE’s growth potential, with opportunities arising on the back of megatrends such as urbanisation, electrification and decarbonisation. • CSE continues to see stable financial performance in the infrastructure and mining & minerals sectors, supported by a steady stream of projects arising from requirements in digitalisation, communications and enhancements in physical and cyber security globally, and from data centres and water utilities in the Americas & Asia Pacific region. In 2023, CSE successfully generated >55% of its business from infrastructure and mining/minerals customers, which brought in S$679.7m or 69% of 2023’s order intake. • Maintain BUY. Our target price is pegged to 15x 2024F PE (based on an unchanged +1SD above mean). Post-share placement, our EPS growth forecasts remain strong at 9- 10% across 2024-26F while the dividend yield is attractive at around 6.4% from current price. SHARE PRICE CATALYSTS • Events: a) Large infrastructure project wins, and b) accretive acquisitions. • Timeline: 3-6 months. |

Full report here.