| Some 2 months ago, Geo Energy Resources delivered an unusual piece of news: A Swiss fund had committed to buy US$35 million worth of its equity. This would be executed through purchases on the open market and via treasury shares from Geo Energy.  Fast forward to 28 March: Geo posted a stock exchange filing saying that the Swiss fund, Resources Invest, had indeed become a substantial shareholder with close to 82 million shares of Geo, or a 5.8% stake. Based on 45 SG cents/share for 14.9 m treasury shares and an assumed 35 SG cents/share average for the remaining 67.1 m open market shares, the total consideration was S$30 million or so. It will not stop there. As announced previously, Resources Invest intends to buy another tranche of treasury shares in March 2025 for US$5 million, which is 50 SG cents per share. |

|

Stock price |

34 c |

|

52-wk range |

21 – 44.5 c |

|

PE (ttm)* |

5.7 |

|

Market cap |

$473 m |

|

Shares outstanding |

1.39 b |

|

Dividend |

5.9 % |

|

1-yr change |

0% |

|

P/B |

0.9 |

|

* 4.45 US cents EPS |

|

The substantial investment by Resource Invest in the treasury shares comes with free warrants whose exercise prices are 55 SG cents and S$1 a share.

These prices are pretty high compared to recent trading prices of Geo stock.

Geo's chief operating officer, Philip Hendry, said at a FY23 results briefing last week: "The takeaway is, a reputable business in Europe, we are talking about a private company in Switzerland, has shown strong confidence in our mining operations by becoming our substantial shareholder."

| Near-term dynamics |

Geo has announced that its 2024 production target is 10.5 million tonnes of coal, up from the realised 8.6 million tonnes in 2023 (see table below).

The 2025 production target is likely to be approximately the same as 2024.

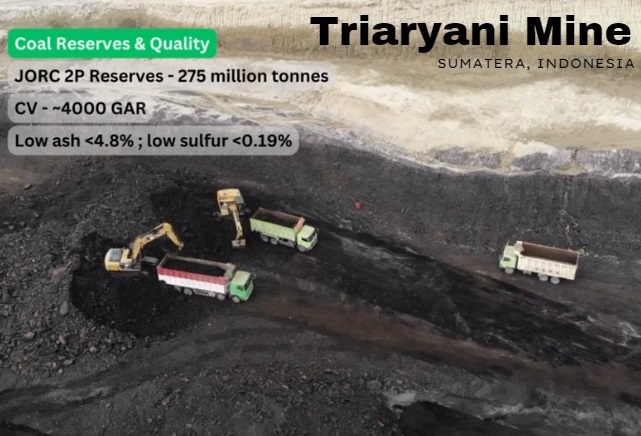

"At this point, we do not see a significant increase or significant decrease," said Mr Hendry. The Triaryani mine has a very large resource with a mine life of 20+ years. By end-2023, Geo Energy had accumulated a 73.11% stake in PT Golden Eagle Energy which owns the Triaryani mine.

The Triaryani mine has a very large resource with a mine life of 20+ years. By end-2023, Geo Energy had accumulated a 73.11% stake in PT Golden Eagle Energy which owns the Triaryani mine.

The big action starts in 2026 when a significantly shorter and bigger-capacity hauling road is ready for transporting coal from the Triaryani mine to a new port facility.

|

Geo Energy’s mines |

Production |

|

|

2024 target |

2023 actual* |

|

|

SDJ & TBR |

8.0 |

8.1 |

|

TRA |

2.5 |

0.3# |

|

*0.2 million tonnes were also produced by BEK mine in 2023 |

||

The new road will be dedicated to coal hauling (instead of mixed-use as is the case with the current route) and will reduce the travelling distance from the 137 kilometers to 92 kilometers.

This project, estimated to cost US$120-US$150 million, is yet to start and is expected to be completed around Dec 2025.

The ready-for-development infrastructure belongs to PT Marga Bara Jaya (“MBJ”) which Geo bought a 33% stake in 2023 along with an option to increase it to 58.7%.

The plan is for a contractor to fund the project and, upon completion, a mix of bank borrowings and cash may be used to pay the contractor.

All users of the road and port will pay for usage, generating cashflow for MBJ and positioning the assets possibly for an IPO. Subsequently, Geo aims to steadily increase its coal production to over 25 million tonnes annually.

Subsequently, Geo aims to steadily increase its coal production to over 25 million tonnes annually.

That's a massive doubling or thereabouts of its output in recent years, which implies significant potential for profits assuming coal prices stay strong.

To questions on the production cost and the strip ratio of the mines this year, CFO Adam Tan said: "Our production cost is linked to coal prices, so if coal prices come down so would the production cost for our mines.

"We do expect the strip ratio to come down a bit this year to the low 4s. Last year it was at about 5 and I think we will have some cost reduction this year."

|

Lower strip ratios -- ie less dirt to be removed to access the coal -- combined with higher production volumes augur well for profits. Throw in strong prices for coal and shareholders can't ask for more. |