| This is one of the most eye-catching buyouts in a long time among Singapore-listed stocks. A small-cap company gets an offer to buy 72% of some of its subsidiaries for almost 4X the company's recent market cap.  Relocating sophisticating manufacturing equipment is a core business of Chasen. Photo: Company Relocating sophisticating manufacturing equipment is a core business of Chasen. Photo: CompanyIn what could be a Xmas present for shareholders, Chasen Holdings (market cap: S$18 million) announced after the market closed last Friday that it had accepted an offer of S$67,401,360 from "an international company". That's more than 3X the market cap of Chasen.

The past stock performance sort of reflects Chasen's track record of dividends and earnings, which has not been scintillating (see table). |

But where Chasen was strong in was its net asset value -- which stood at 16.8 cents per share as at end-Sept 2023, translating into S$65 million.

But where Chasen was strong in was its net asset value -- which stood at 16.8 cents per share as at end-Sept 2023, translating into S$65 million.

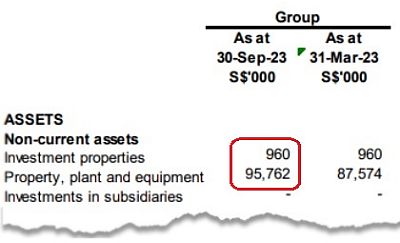

Its property, plant and equipment on the balance sheet stood at S$95.8 million while an investment property was valued close to S$1 million (see screenshot).

Chasen said the buyout offer it received is on a "cash-free and debt-free basis".

That means the buyer will not assume any debt of the subsidiaries nor will the buyer get to keep any of their cash.

Chasen said the net amount it expected to receive will be approximately S$59,261,760. (This is presumably after deducting professional fees and what not).

The deal sounds pretty firm at this stage and appears to be a sequel to Chasen's attempt, some 4 years ago, to spin-off 2 subsidiaries on the Hong Kong stock exchange. (See: CHASEN: Progressing towards spin-off of 2 subsidiaries)

At that time, then Non-Executive Chairman Eric Ng said: “Right now, if you add up the value of all the subsidiaries, they far exceed the value of the parent company. So, the only thing to do is to let the subsidiaries go to realise the full value of the Group.”

Of course, Chasen said the recent buyout offer is "still subject to final agreements as well as the necessary approvals and clearances from all required governmental and regulatory bodies and any other third-parties and the shareholders of the Company."

Chasen added the customary (but important) caveat: "The Board wishes to emphasize that there is no certainty or assurance that any transaction will occur."

Chasen did not say, among other things:

| • .... what the identity of the buyer is. • .... which subsidiaries are covered by the deal. • .... how the buyout valuation was arrived at. • .... what it will do with the cash windfall. • .... what Chasen's financial structure looks like post-completion. |

Lots of questions are outstanding and until there are answers, presumably when the above-mentioned hurdles are cleared, the market will be sitting on edge and some speculation will drive people's decisions to buy or sell or hold the stock.

On the use of the cash windfall, investors naturally want to know if special dividends are coming.

It's relevant to consider that Chasen is pursuing a large investment to grow its logistics business.

In Sept this year, the company held a ground-breaking ceremony for a new facility -- an integrated logistic warehouse cum corporate HQ -- in Singapore, which will cost S$78 million.

Some background on Chasen:

The current business core was injected into a listco via a reverse takeover in 2007. Chasen's business segments are:

Justin Low, MD of Chasen Holdings, owns a 13.15% stake and is the No.1 shareholder.• Specialist Relocation Solutions: Chasen relocates its customers' sophisticated machinery and equipment to, within, and from one country to another. Justin Low, MD of Chasen Holdings, owns a 13.15% stake and is the No.1 shareholder.• Specialist Relocation Solutions: Chasen relocates its customers' sophisticated machinery and equipment to, within, and from one country to another. • Third Party Logistics: Services comprise packing, warehousing, transportation, freight forwarding, customs brokerage and other supply chain services. • Technical & Engineering: Covers design, fabrication and installation of steel structures, mechanical and electrical installations, parts refurbishment, engineering and spares support, facilities management and maintenance, contract manufacturing, process engineering services, 4G & 5G telecommunications, ordnance, solar panel installation, scaffolding equipment and services and construction activities. |