| SGX Mainboard-listed diversified logistics group Chasen Holdings reported improved performance for its Technical & Engineering (“T&E”) segment, which lifted gross profit for the three months ended 31 Dec 2022 (“3QFY2023”) by 13% to S$7.6 million. The gross profit was achieved despite a 2% decline in quarterly revenue to S$42.3 million. Resumption of positive profit margin to the T&E projects and increase in solar panel installation projects were offset by delays in the Specialist Relocation segment due to the Dynamic Zero policy in the People’s Republic of China. Third-Party Logistics (“3PL”) activities softened.

Gross profit margin for 3QFY2023 increased 2.5% to 18.1%, as margins in all three business segments improved. |

|

Stock price |

6.1 c |

|

52-week |

5.6 – 7.4 c |

|

PE (ttm) |

11.4 |

|

Market cap |

S$24 m |

|

52-week change |

-23% |

|

Dividend |

-- |

|

P/B |

0.37 |

|

Source: Yahoo! |

|

The Group recorded 9MFY2023 net profit after tax of S$1.3 million compared to S$3.3 million a year ago, mainly due to lower receipt of government grants, higher operations expenses and increased finance expenses amid higher interest rates.

Net asset value per share amounted to 16.4 Singapore cents as at 31 December 2022 compared to 16.7 Singapore cents as at 31 March 2022.

With the PRC’s recent lifting of COVID-related restrictions, the Group expects mid-term business recovery as projects resume. Operating costs remain a challenge.

While this may potentially be driving a slowdown in economic activities, it will push companies to accelerate their strategic shift to mitigate this risk through re-shoring and decentralizing their manufacturing footprint globally, presenting business opportunities for the Group’s Specialist Relocation and 3PL business segments.

• Specialist Relocation segment: The Group will continue to diversify into the semiconductor and automotive industries, while seeking opportunities within the PRC’s display panel sector as it transitions from TFT LCD screens to OLED technology.

Chasen also plans to secure new projects from semiconductor and equipment manufacturers in Malaysia and Singapore, as well as electronics and PV solar module players in Vietnam and India.

• 3PL: The Group broadly sees the demand for its cross-border transportation services peaking as pandemic-related disruption eases.

However, business will remain resilient as customers, who switched from air and sea freight to the Group’s 3PL services during the pandemic, have seen value in Chasen’s outstanding service quality, which has been further enhanced with the recent integration of railway as an alternative mode of transport.

In addition, business activities on warehousing, freight-forwarding and local/long-haul trucking was significantly higher and are expected to offset any potential decline in cross-border transportation services.

Demand for warehouse service is expected to increase in the quarters ahead. In response, the Group will offer its local transportation services, adding value to customers, and lifting revenue.

The Group is also participating in “SG Arrival Card” Cargo, a seamless clearance initiative that would greatly speed up the time required for the Group’s container truck drivers to clear the Singapore land checkpoints to less than five minutes, compared to manual paper clearance, which would take 10-15 minutes.

• T&E segment: The Group will build its pipeline of solar panel installation projects in Singapore and improve its component and parts manufacturing capabilities, with the aim to capture projects within emerging core technologies such as 5G, Internet of Things, MedTech and the automotive sector.

The T&E business segment will focus on improving its bottom line significantly as it capitalizes on post-COVID economic recovery to grow the Group’s top line across the region.

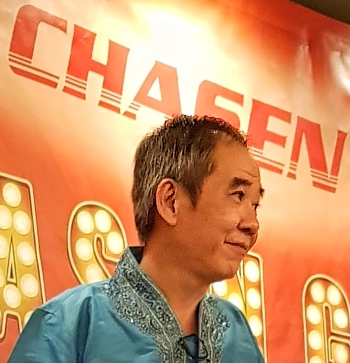

Justin Low, MD of Chasen Holdings. Mr Low Weng Fatt, Chasen’s MD and CEO, said, “Chasen’s diversified business and geographical spread has allowed us to remain broadly resilient as well as capitalized on opportunities arising from our customers’ re-shoring, de-centralising production locations and adjusting their inventory strategies. Justin Low, MD of Chasen Holdings. Mr Low Weng Fatt, Chasen’s MD and CEO, said, “Chasen’s diversified business and geographical spread has allowed us to remain broadly resilient as well as capitalized on opportunities arising from our customers’ re-shoring, de-centralising production locations and adjusting their inventory strategies. "The lifting of all COVID restrictions in the PRC is positive news for the resumption of projects and a return to normalcy in the medium term." |