• After we published an article recently, a long-standing shareholder of China Sunsine emailed his comments for publication below.  He wanted to highlight competitive strengths of the company that have, and will continue to, shore up its business. Read on .... |

NextInsight's introductory remark in "This S-chip just made S$37 m profit in 1H23. Will it weather a storm in 2H?" is insightful.

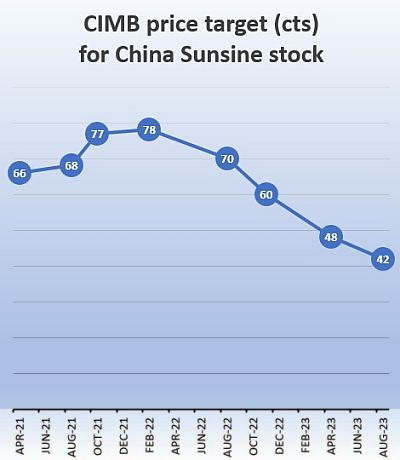

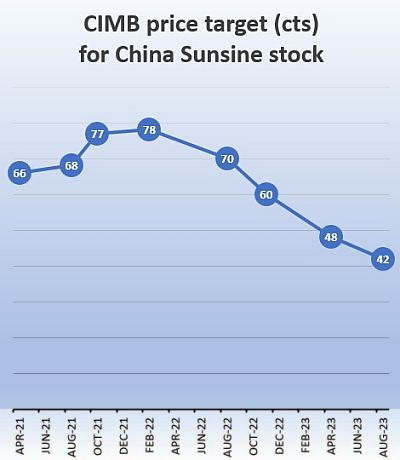

CIMB's target price for Sunsine share tracks rubber chemical prices. When the outlook was favourable, the target price went as high as 78c.

Conversely, the target price plunged to 48c in April 23 and dropped further to 42c in August.

The six-cent drop in the space of four months (April - Aug 2023) is baffling when CIMB now projects the 2023 profit to be 10% higher (RMB 359m vs RMB 327m).

The six-cent drop in the space of four months (April - Aug 2023) is baffling when CIMB now projects the 2023 profit to be 10% higher (RMB 359m vs RMB 327m).

I note that CIMB is pessimistic of Sunsine's margin going forward.

It said: "While Sunsine is optimistic of achieving further sales volume growth, we think its profit spread (on a per tonne basis) could remain under pressure with the adoption of its flexible pricing strategy amid intense market competition."

It said: "While Sunsine is optimistic of achieving further sales volume growth, we think its profit spread (on a per tonne basis) could remain under pressure with the adoption of its flexible pricing strategy amid intense market competition."

The broking firm apparently has not taken note of the improved gross profit margin in 2Q23 (25.3% vs 1Q23's 22.4%) was achieved on lower ASP:

|

1Q23 |

2Q23 |

1H23 |

|

|

Revenue (RMB’m) |

863 |

866 |

1,729 |

|

Sales vol (tonnes) |

48,875 |

50,873 |

99,748 |

|

ASP (RMB/tonne) |

17,426 |

16,760 |

17,093 |

|

Gross profit (RMB m) |

193 |

219 |

412 |

|

Gross margin (%) |

22.4 |

25.3 |

23.8 |

Analysts worry about the competition that Sunsine faces. But has Sunsine been sitting idly to see its profit whittling down?

Sunsine has in fact been dealing with competition on two fronts:

|

• Firstly, it has been expanding its production capacity. When new capacity comes onstream, it lowers prices, if need be, in order to sell more while remaining profitable because of the lower unit cost.

Additionally, as new capacity is paid from internal resources, Sunsine is spared the burden of loan servicing. • Secondly, for new capacity it introduces continuous production processes instead of traditional intermittent methods.

The NextInsight article "CHINA SUNSINE: Gearing up for higher output and cleaner, efficient production" dated 16 May 2021 explains how continuous processes improve efficiency and lower costs. |

The article adds that Sunsine will progressively upgrade old capacity to adopt continuous methods.

I am wondering why analysts have turned a blind eye to, or are ignorant of, these initiatives.

The issue of overcapacity/competition was dealt with on two previous occasions -- AGM 2021 and AGM 2022 -- and I was taken aback by the robust replies of the board.

Going by their track record, I do not think they have overstated their confidence.

|

Q&A for AGM 2021 -- reply to shareholder's question

"Is the concern of oversupply of rubber accelerators valid?" Company’s response: There has always been an oversupply situation in China’s rubber chemicals industry. The Group is aware that some manufacturers which claim to have certain production capacity may not be able to produce up to that capacity. For example, a manufacturer announced that they have a 30,000-tonne per annum production capacity, but the maximum volume they can produce might only be above 10,000 tonnes a year.

In addition, the market recognition of prominent players is higher than other smaller producers. Over the years, the Group has been able to achieve an equilibrium between production and sales. As such, management is not concerned about the overcapacity situation in the industry. Q&A for AGM22 -- reply to shareholder's question

The 2021 results announcement stated that some rubber chemical producers have implemented their expansion plans, and Sunsine expects intensified competition among the bigger players. Will the Board share the expansion plans it knows of? Is the concern of oversupply of rubber accelerators valid?

Company’s response: To our knowledge, all our major competitors have expansion plans. For example, Sennics (Lianyungang) plans to expand accelerators’ capacity; Kemai (Cangzhou) plans to expand capacity for accelerators, IS and anti-oxidants; and Yanggu Huatai also plans to increase its accelerators’ capacity.

The Company is monitoring the market closely, and while we are concerned about the oversupply situation, we are also very confident that we are able to continue to serve our customers well and expand our sales volume. |

CIMB's analyst report said:

"China Sunsine’s 2Q23 net profit of Rmb128m (+90% qoq, -53% yoy) brought 1H23 net profit (-54% yoy) to 59% of our FY23F forecast. We deem this as a low-quality beat, given that the outperformance was mainly driven by non-operational items (FX gains, interest income). 2Q23 sales volumes rose 4% qoq and 5% yoy, with its more flexible pricing strategy; however, revenue was flattish qoq as ASP eased on the back of 1) intensified market competition, and 2) a decline in raw material costs. 2Q23 GPM improved by 2.8% pts qoq to 25.2% but was weaker vs. the high base last year (2Q22: 34.6%)."

"China Sunsine’s 2Q23 net profit of Rmb128m (+90% qoq, -53% yoy) brought 1H23 net profit (-54% yoy) to 59% of our FY23F forecast. We deem this as a low-quality beat, given that the outperformance was mainly driven by non-operational items (FX gains, interest income). 2Q23 sales volumes rose 4% qoq and 5% yoy, with its more flexible pricing strategy; however, revenue was flattish qoq as ASP eased on the back of 1) intensified market competition, and 2) a decline in raw material costs. 2Q23 GPM improved by 2.8% pts qoq to 25.2% but was weaker vs. the high base last year (2Q22: 34.6%)."

Here's my take:

CIMB's assertion that 2Q23 profit was a "low-quality beat" therefore lacks basis.

|

• Interest income and forex gains were RMB 19.8m and RMB 24.4m respectively in 1H23.

• Interest income was likely to be even in 1Q and 2Q.

Even if the entire RMB 24.4m forex gains were from 2Q23, 2Q23 adjusted profit would still be 54% above 1Q23 reported profit. |

|

RMB’m |

1Q23 |

2Q23 |

Change |

1H23 |

|

Reported profit |

67 |

128 |

91% |

195 |

|

Profit less forex gain |

67 |

103 |

54% |

170 |

CIMB's assertion that 2Q23 profit was a "low-quality beat" therefore lacks basis.