Company Overview

Established in 1991, Marco Polo Marine is an integrated marine logistics company with two business segments –

| 1) Ship Chartering Division relating to the chartering of Offshore Supply Vessels (OSV), tugboats and charters, and 2) Shipyard Division relating to shipbuilding and provision of ship maintenance, repair, outfitting, and conversion services. |

Link to Stock Screener company page.

What are the key growth aspects for Marco Polo Marine over the next 1-2 years?

The Group is seeing tremendous opportunities within the offshore wind farm sector, in particular the Asia-Pacific region. The increased interest and investment in offshore wind projects will drive the demand for vessels that support these offshore wind farms' installation, construction, and maintenance.

| "Overall in FY2022, the Group recorded the highest operational EBITDA of S$24.2 million since our debt restructuring in 2017." |

We are currently constructing our first Commissioning Service Operation Vessel (CSOV) which is expected to be ready in 1Q 2024. In December 2022, we entered into a Memorandum of Understanding (MOU) with Vestas Taiwan for the chartering of our CSOV.

Leveraging on our successful track record in the Taiwan offshore wind sector, we have been actively seeking partnerships in new markets.

On 6 December 2022, we took a significant step into the Japanese market by signing a landmark MOU with "K" Line Wind Service, Ltd (KWS) to explore potential vessel opportunities in the Japanese Offshore Wind Market.

On 11 January 2023, we entered the South Korean market through an MOU with Namsung Shipping Co., Ltd. (Namsung) and HA Energy Co., Ltd. (HA-E).

Describe Marco Polo Marine’s recent financial performance.

▪ In 1HFY2023, the Group’s revenue doubled year-on-year (y-o-y) to S$55.9 million. The increase in 1HFY2023 revenue was driven by both the Ship Chartering and Shipyard segments.

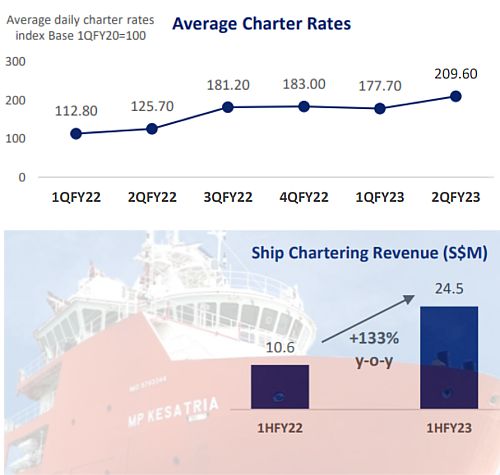

▪ 1HFY2023 Revenue growth from Ship Chartering more than doubled y-o-y due to higher vessel utilisation, increased charter rates, and the consolidation of revenue from subsidiaries PT Pelayaran Nasional Bina Buana Raya (BBR) in Indonesia and PKRO in Taiwan.

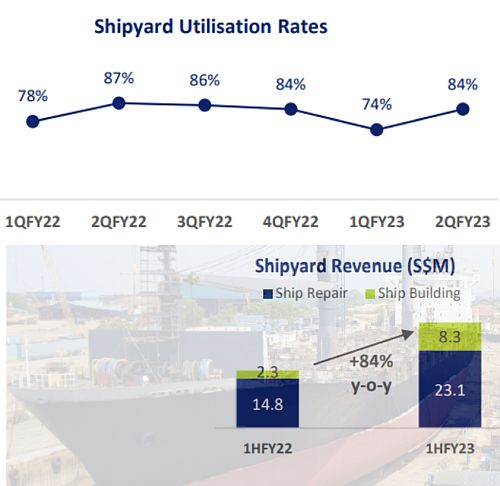

▪ The Shipyard segment also experienced remarkable revenue growth in 1HFY2023, driven by higher contract values for ship repair projects and increased revenue from shipbuilding activities.

The Group has commenced new build contracts for the construction of vessels with progressive deliveries up to 1HFY2024. Our shipyard’s average utilisation rate continued to remain robust in 2QFY2023 at 84%.

Excluding foreign exchange losses and one-off items, the Group’s earnings before interest, taxes, depreciation and amortisation (EBITDA) nearly tripled in 1HFY2023 to S$15.5 million, compared to S$5.8 million in 1HFY2022.

Overall in FY2022, the Group recorded the highest operational EBITDA of S$24.2 million since our debt restructuring in 2017.

| Could you elaborate on the future direction for the Group? ▪ Shipyard – The Group has been stepping up marketing efforts to actively engage regional ship owners in Indonesia to secure more shipbuilding projects. We are also expanding our international customer base for ship repair and maintenance. To date, we have secured several new build contracts for the construction of vessels, with deliveries scheduled up until 1HFY2024. ▪ Ship Chartering – We will continue to support the Taiwan offshore wind farm market through our subsidiary, PKRO. We are currently constructing our own CSOV, which will be integrated into our fleet around 3QFY2024. This addition will significantly enhance our capabilities to effectively meet the unique requirements of the offshore wind farm industry. |

The above content was excerpted from the SGX website. For more, click here.