| After a scintillating 2022 performance, AEM Holdings is facing a bleak 2023 with its 1H profit of S$19.7 million down a hefty 76% y-o-y. The 2H will get worse before things look up in 2024, going by AEM's guidance. Its customers' capex has been pushed out to 2024 and there are delays in their new device launches which would have sparked orders for AEM's back-end test equipment. Adding to the woes, AEM is taking a US$20 million provision in 3Q2023 for an arbitration settlement with Japanese competitor Advantest. (See: AEM takes US$20 m hit. Stock stays steady, analyst is sanguine. Why?) |

At the recent 1H earnings call, the word from AEM's CEO, Chandran Nair, is, look beyond the current semi-conductor/electronic industry downturn and expect a recovery in 2024. There already are early signs of a 2024 recovery:

Based on a sampling of analyst reports, minimal earnings -- including the impact of the US$20 m provision -- are forecast for 2023. Then comes a strong rebound in 2024.

Accordingly, the analysts' target prices are by and large above the current stock price ($3.25) with mostly buy/overweight calls. (See table below)

|

Research house |

Call |

Target |

Profit forecast |

|

|

2023 |

2024 |

|||

|

CGS-CIMB |

Reduce |

2.92 |

5.6 |

88.5 |

|

Maybank KE |

Buy |

3.77 |

10 |

98 |

|

JP Morgan |

Overweight |

4.05 |

(4) |

90 |

|

UOB KH |

Buy |

3.65 |

1 |

88 |

|

HSBC |

Buy |

3.80 |

9 |

77 |

|

DBS |

Hold |

3.11 |

20.3 |

96.2 |

|

Citi |

Buy |

3.78 |

31 |

97 |

|

Average |

3.58 |

10.4 |

90.7 |

|

|

Compiled by NextInsight |

||||

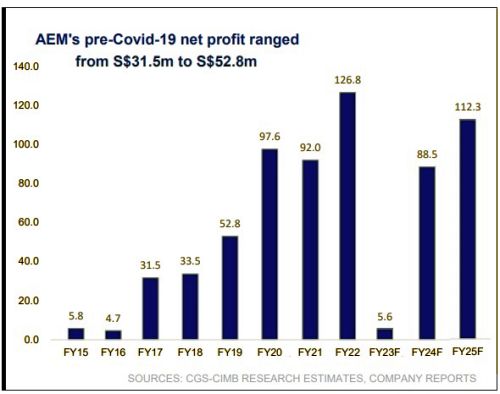

The chart below shows the meteoric rise in profitability of AEM through the years. Then comes 2023 and a CGS-CIMB forecast plunge. Growth then resumes. Or it could come even faster, as the analyst notes below:

| "As demand conditions in the semicon business can turn quickly, AEM’s major customer could also bring forward its purchase requirements, which could lead to upside risks to our current FY24F-25F revenue assumptions. Also, new customers’ decisions to bring forward their planned product launches could positively impact AEM’s revenue." -- CGS-CIMB analyst William Tng |

Below are excerpts from DBS Research report:

Analyst: Lee Keng LING

| Profits slashed by costly arbitration settlement |

Investment Thesis:

Retains technological superiority in system level test. AEM is a pioneer in providing SLT (system level test) solutions and is currently around one generation ahead of its competitors.

Given its technological superiority, we believe AEM is well positioned to ride on the growing SLT market that has benefitted from increased complexity of chips and increased test coverage requirements, alongside the need for advanced heterogeneous packaging.

New technology drives growth in test spend, leading to higher demand for AEM’s offerings in the long term. Notwithstanding near-term volatility, the semiconductor industry is well poised for growth owing to the push towards digitalisation.

McKinsey projects that the semiconductor industry will become a trillion-dollar industry by 2030.

Industry megatrends such as artificial intelligence, 5G, and Internet of Things will pave the way for growth in test spend, owing to higher test volumes and test times.

Longer test times would also require more of AEM’s components due to wear and tear.

Near term remains fundamentally challenging for AEM on key customer weakness but there is optimism as the market cheers the chip bottom. Headwinds persist, and Intel’s weakness is expected to continue through FY23, albeit improving modestly in 2H23.

Consensus estimates Intel’s capex – a key driver of AEM’s revenue – at US$22.1bn for FY23, c.12% below US$25.1bn in FY22.

Overall, we believe the near term outlook remains challenging for AEM, with FY23 revenue guidance 44-47% lower than FY22.

However, a key customer returning to profitability in 2Q23 spells a more positive outlook for AEM.

| Maintain HOLD with lower TP S$3.11 (vs S$3.35 previously). Our TP remains pegged to 10x FY24F earnings. We have reduced our FY23F revenue forecast by 20% as the semiconductor recovery is deferred to 2024. With lower top-lines, weaker margins, and substantial expenses from the arbitration settlement, we slash our FY23F earnings by 75%. We also lower our FY24F revenue and earnings estimates by 6% and 7% on a still cautious macroeconomic environment and low visibility. |

Key Risks

Single-customer concentration risk, geopolitical events, and a prolonged slowdown in the macroeconomy.