| Lendlease Reit (“Lendlease”) caught my attention as according to consensus, it offers a potential dividend yield of around 7.1% in each of FY23F and FY24F (financial year ends in June). Furthermore, 7 analysts have rated Lendlease a buy with average analyst target price of $0.85, representing a potential capital appreciation of around 28.8%. Lendlease closed at $0.660 on 30 Jun 2023. For a reit, such returns, if they indeed materialise, are rather substantial. As such, this leads me to dig deeper into the reit. Last month, I was fortunate to meet Mr Kelvin Chow, CEO of Lendlease Global Commercial Trust Management Pte. Ltd (“The Manager”) and Ms Ling Bee Lin, senior investor relations of The Manager for a 1-1 meeting. Below are my key takeaways from my meeting and from what I gather from the various analyst reports and my other readings. |

Source: Bloomberg

Source: Bloomberg

Description of Lendlease

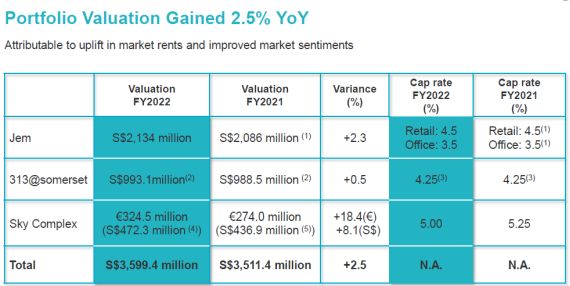

Its portfolio comprises leasehold properties in Singapore namely Jem (an office and retail property) and 313@somerset (a prime retail property) as well as freehold interest in Sky Complex (three grade-A office buildings) in Milan. These five properties have a total net lettable area of approximately 2.2m square feet, with an appraised value of S$3.6b as at 30 Jun 2022. Other investment includes development of a multifunctional event space on a site adjacent to 313@somerset.

Why am I interested in Lendlease?

| A) Analysts are positive |

Eight analysts cover Lendlease with either buy, add or outperform calls. Seven analysts have target prices ranging from $0.75 – 1.00. Coupled with the estimated dividend yield of around 7.1%, total potential return is approximately 36% if the consensus is right.

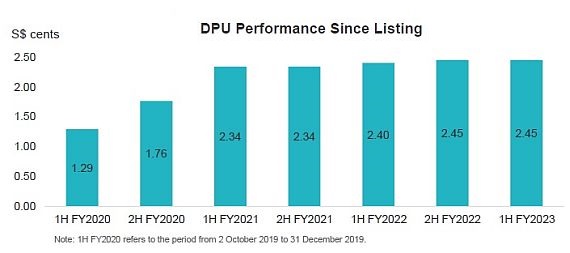

| B) Excellent record in growing its DPU on a yearly basis |

Lendlease has an impressive track record of growing its distribution per unit (“DPU”) on a year-on-year basis, even during pandemic. Management shared that Lendlease’s key objectives are to provide unitholders with regular and stable distributions, achieve long-term growth in distribution per unit and net asset value per unit, and maintain an appropriate capital structure.

As such, based on my personal guess, barring any unforeseen circumstances and deterioration in company’s fundamentals, it is likely that Lendlease can distribute at least $0.049 / share in the next 12 months, translating to around 7.4% dividend yield.

| C) Exciting organic growth ahead |

Lendlease may have exciting organic growth from two fronts.

Firstly, Lendlease is currently working on feasibility studies on how best to develop its untapped 10,200 square feet of GFA. Management shared that in order to minimise disruption to the tenants and to its business, they are discussing with their consultants and doing feasibility studies on converting part of levels 6-7 of the carpark to retail. They hope to unveil more details in 1HFY24F (Jul-Dec 2023).

Secondly, the construction for the redevelopment of Grange Road carpark to become a multifunctional event space for Live Nation is expected to commence in 2HCY23. According to management, construction likely takes approximately a year to complete, subject to the usual construction constraints such as building materials and manpower. JEM is one of 2 properties in Singapore and three freehold office properties located in Milan under the REIT. They have a total appraised value of S$3.6 billion.

JEM is one of 2 properties in Singapore and three freehold office properties located in Milan under the REIT. They have a total appraised value of S$3.6 billion.

This site is substantially leased to Live Nation which is growing its presence in Singapore. In fact, Singapore seems to be go-to place for concerts as evidenced by Coldplay and Taylor Swift’s concerts.

Lendlease is hopeful that this “collaboration” with Live Nation can bring multiple benefits. Besides the usual rent which it collects from Live Nation, there may be cross selling opportunities as tickets may be sold in package, tied to certain shops at 313@Somerset. Moreover, the events hosted by Live Nation are likely to bring in additional footfall to 313@Somerset.

| D) Strong inorganic growth – acquires a 7.7% effective stake in Parkway Parade |

On 5 Jun 2023, Lendlease announced that it has acquired a 10.0% interest in Parkway Parade Partnership Pte Ltd, which holds a 77.1% stake in Parkway Parade, giving Lendlease a 7.7% effective stake in Parkway Parade.

With the likely completion of Marine Parade MRT in 2024, the accessibility of Parkway Parade will be greatly increased. Lendlease is planning to launch asset enhancement initiatives such as a proposed MRT linkway through the basement to help to channel the crowd to the mall given direct connectivity. Management is hopeful for Parkway Parade to contribute positively starting in 1QFY24F.

| E) Let’s not forget about Jem which is a GEM |

Not much has been written on Jem recently which Lendlease has a 100% stake in. This comprises of an office and retail property. According to management, the office asset is yielding stable returns.

On the retail side, Jem is an extremely bustling shopping center. In the near term, Jem is likely to see increased footfalls as the link bridge connecting Jem to Perennial Business City has been completed last year.

In the long term, Jem is expected to benefit a myriad of developments ranging from government’s push to develop Jurong Lake District Development to be Singapore’s second Central Business District; upcoming development at Tengah and the potential high speed rail station at the former Jurong Country Club.

Firstly, based on a Straits Times article dated 10 Feb 2023, Jcube will be closed down on 6 Aug 2023. In its place, Capitaland Development will be constructing a 40-storey residential development with commercial space on the first and second storeys, slated for completion in 2027.

Secondly, Tengah is an up-and-coming town in the next few years. Based on a Straits Times article dated 12 Mar 2023 (click HERE ), it is postulated that Tengah will have 42,000 new homes - 30,000 HDB flats and 12,000 private housing units when it is completed in stages. Plantation Grove which yields 1,620 HDB units, is scheduled for completion in 2024. Please refer to Fig 2 below. Tengah is approximately 8 minutes’ drive and 21 minutes’ bus/MRT from Jem. Such exciting and massive developments at Tengah are likely to bode well for Jem in the long term.

In a CNBC interview aired on 6 Apr 2023 (click HERE ), Malaysia’s International Trade and Industry Minister Tengku Zafrul Aziz said Malaysia is open to revive this high-speed railway (“HSR”) project connecting Kuala Lumpur to Singapore. Singapore also mentioned last year that they are receptive to fresh proposals for this project. This HSR station is supposed to be built around the former Jurong Country Club area, which is at close proximity to Jem.

Although this is a long shot, it may be another positive potential factor in the long term.

| F) No refinancing risks till FY25F |

Lendlease has obtained a EUR300m unsecured 5-year sustainability loan facility to refinance its Euro loan due in FY24F. As a result, Lendlease does not see any refinancing risks till FY25F. For this EUR300m loan, based on reports from CGS-CIMB and UOB KH report dated 10 & 12 May 2023 respectively, both wrote the all-in interest rate for this EUR300m may be in the low 3% assuming interest rates remain at current levels.

| G) Potential appreciation in overall portfolio value |

Based on various reports and channel checks, it is likely that Lendlease’s Singapore assets may likely appreciate in value due to positive rental reversions in their next annual valuation in Jun 2023. However, Milan’s properties may or may not show an increase in value as they use a terminal cap rate in their valuations, instead of cap rate.

Notwithstanding the above, as 87% of Lendlease’s portfolio value is in Singapore with the balance in Milan (based on 3QFY23 results), there are good odds that Lendlease’s FY23F overall portfolio value should still increase on a year-on-year (“y/y”) basis. An increase in the overall portfolio value should have a positive impact on its gearing level which has risen to 40.4% post the acquisition of Parkway Parade.

| H) Low valuations; 1.0x standard deviation below its average 2Y P/BV |

Based on Bloomberg, Lendlease trades at 0.8x FY22 P/BV, 1.0x standard deviation below its average 2Y P/BV of 0.9x. Based on analysts’ estimates, at $0.660, Lendlease trades at 0.86x FY23F P/BV with a FY23F dividend yield of around 7.1%. NAV / share is around $0.772.

| I) Next dividend likely around $0.0245, to be ex around mid Aug |

Drawing reference from last year, Lendlease reported FY22 results on 8 Aug 2022. It subsequently ex div $0.0245 / share on 17 Aug 2022 and dividends were paid on 14 Sep 2022. Based on the assumption that Lendlease may dish out dividends at least equal to 4QFY22, there is a potential dividend yield of around 3.7% to be given in the next couple of months.

| Potential risks |

As with almost all investments (if not all), they do carry risks. I am only listing some pertinent ones and this is not a comprehensive list of risks. Please refer to the analyst reports HERE for more information.

| A) Business risks - weaker than expected leasing or rental reversions, slowdown in consumer spending |

Weaker than expected leasing or rental reversions or / and slowdown in consumer spending perhaps due to weaker than expected economic environment are likely to have an adverse impact on Lendlease.

| B) Sky Complex – Sky Italia break option 2026 |

Lendlease leases out its three office buildings, Sky Complex in Milan to Sky Italia on a triple net lease structure till 2032, with a break option which can be exercised in 2026. Sky Italia is the wholly owned subsidiary of Comcast, #1 broadcaster by revenue in 2023 according to Zoominfo (click HERE ).

According to management, barring unforeseen circumstances, it is unlikely that Sky Italia will exercise the break option in 2026 based on the following factors. Firstly, the break option applies to all three buildings. If Sky Italia wishes to exercise the break option, they have to exercise it for all three buildings and not one.

This may be disruptive to their business planning and activities as it may be a major shift.

Secondly, Sky Complex is extremely well connected to the train and metro station with excellent amenities.

Thirdly, Sky Italia paid EUR188 per square foot in FY23 which seems to be at a large discount to the current passing rent. Spark is already leasing out at EUR320 per square foot per annum.

Fourthly, it is likely that Sky Italia has invested quite a bit into the three office buildings (e.g., renovation + amenities etc) since they have leased there for several years, which further increases the probability that they may be staying for some time.

| C) Inflationary risks |

Much has been written on inflationary costs such as soaring electricity costs and other costs of doing business. Suffice to say besides the rental reversions or rental reviews, Lendlease has annual rental escalation in its assets to buffet such inflationary risks.

In addition, Lendlease charges service charge fees which help to cover utilities, property maintenance etc. Sky Complex is leased out Sky Italia on a triple net lease structure and annual rental escalation based on 75% ISTAT3 consumer price index variation.

With all these measures and barring a sudden surge in inflationary costs, Lendlease is optimistic that they should be able to buffet such inflationary risks.

| D) Possibility of equity fund-raising |

Post their 5 Jun 2023 announcement on a maiden stake in Parkway Parade, Lendlease’s share price has weakened to a low of around $0.645 on 8 – 13 Jun 2023. This is likely due to concerns on potential equity fund raising.

If I draw reference from how Lendlease executed their acquisition of Jem, Lendlease first made a maiden acquisition in Jem through a 5% interest in Lendlease Asian Retail Investment Fund 3 on 1 Oct 2020. Since 1 Oct 2020 to 14 Feb 2022, Lendlease made a few announcements as it gradually increases its stake in Jem in tranches with the announcement on 14 Feb 2022 stating that it intends to acquire the remaining interest in Jem.

It also mentioned on 14 Feb 2022 that it may propose an equity fund raising, which may comprise a private placement of new Lendlease units to institutional and other investors and/or a non-renounceable preferential offering of new units to the existing Unitholders on a pro rata basis. Based on this example, it may arguably take more than a year before Lendlease does any equity fund raising, subject to market conditions and how Parkway Parade performs.

| E) Sharper than expected interest rate hike |

Generally speaking, although Lendlease has 61% of its loans hedged to fixed rates, a sharper than expected increase in interest rates may still have an adverse impact on Lendlease’s DPU.

Some market watchers are worried on their upcoming EUR loan drawdown. Based on a Reuters' article dated 27 Jun 2023 (click HERE ), most ECB policymakers expect to increase borrowing costs again at both its July and September meetings, bringing the deposit rate to 4.0%. Although Lendlease has obtained a EUR300m unsecured 5-year sustainability linked loan facility to refinance its Euro loan due in FY2024, it has not drawn down the loan yet. As a result, the interest rate is not fixed yet but Lendlease has already locked in the spread.

[Just to elaborate, banks typically charge a base rate (rate to be decided nearer to drawdown date) + a spread which Lendlease has already locked.]

Notwithstanding the above, it is noteworthy that the EUR300m is a sustainability linked loan facility and the interest rate charged to Lendlease may arguably be lower than a normal loan.

|

For a more complete picture, it is advisable to refer to Lendlease’s analyst reports (Click HERE ); SGX website (Click HERE ) and Lendlease’s corporate website (Click HERE ).

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com . However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

P.S: I am vested in Lendlease.

Please refer to the disclaimer HERE