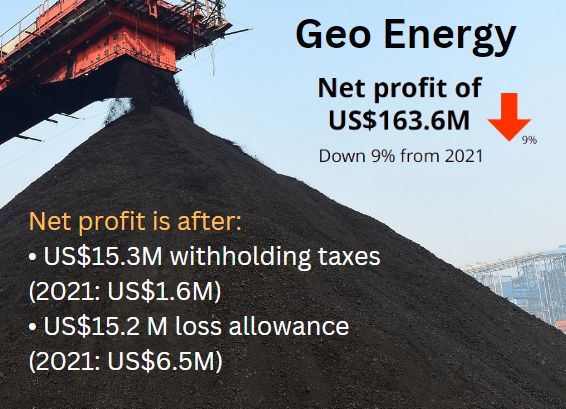

Geo Energy’s shareholders and the Securities Investors Association (Singapore) (“SIAS”) sent in questions in advance of the Company’s Annual General Meeting this week:

Questions received from the Company’s shareholder(s)

| 1. Does the Company intend to continue paying dividends on a quarterly basis for FY2023? |

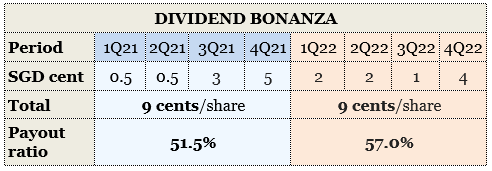

Answer: The Company remains committed to its dividend policy to declare dividends of at least 30% of the Group’s net profit attributable to owners of the Company, subject to debt covenants and capital requirements needed to support growth and investments.

The Company has previously paid dividends on a quarterly basis as part of our commitment to deliver value to our shareholders. The Company will consider continuing quarterly dividends, subject to cash flow requirements to support its growth and investment.

| 2. There was a recent Reuters report about China ramping up its coal imports in Q1. Has the company also seen strong export volumes to China in the last few months? |

Answer: Coal produced by the Group is sold to various geographical markets. China remains the biggest market for the Group and there has been stronger demand from China in the last few months.

The Group’s export sales are made to offtakers, Macquarie Bank (for TBR coal) and Trafigura (for SDJ coal), and thus the Group does not face any significant volume or counterparty risk.

| 3. Please explain why Geo Energy had applied for the "RKAB" production quota of only 8 million tonnes despite expecting a strong coal market in the year ahead. |

Answer: The RKAB production quota is applied based on our mining plan and it is possible to apply for an increase in the RKAB production quota. As previously shared in the Company’s 4Q2022 Results Announcement and other announcements, the Group’s SDJ and TBR coal mines have a higher strip ratio (which refers to the amount of waste to be removed/mined per unit of coal) going forward, due to the geology of the mines.

Given the higher strip ratio, the production is expected to be lower. Please also refer to the Independent Qualified Person’s Report 2022. The Group continues to assess and optimise its mining plan. If the coal market remains strong and weather conditions permit, the Company may consider applying for an increase in RKAB to 10 million tonnes.

| 4. Based on the latest Independent Qualified Person's Report, what is the estimated value of Geo Energy's coal assets? Is there any significant difference with the value provided at the end of FY2021? |

|

Stock price |

33.5 c |

|

52-wk range |

28 – 57 c |

|

PE |

2 |

|

Market cap |

$468 m |

|

Shares outstanding |

1.41 b |

|

Dividend |

27 % |

|

1-yr change |

-38% |

|

P/B |

0.9 |

|

Source: Yahoo! |

|

Answer: As set out in the Independent Qualified Person’s Report 2022, the discounted cash flow for SDJ and TBR is around USD565 million.

There is no significant difference with the discounted cash flow value in Independent Qualified Person’s Report 2021.

The above coal assets have been recorded at historical cost less any accumulated depreciation (based on production volume).

The above discounted cash flow is not reflected in the Group’s balance sheet.

Can the board elaborate further on the search and investment criteria for acquisitions? Will the group continue investing in coal mines in Indonesia and if so, how does the group balance any such strategic investments with “social and environment considerations”? Answer: The Group’s investment criteria for acquisitions are as follows: a) Producing assets with immediate cash flow; b) Total reserves acquired and its mine life should allow the Group to achieve economies of scale while remaining nimble to market changes; and c) Adequate infrastructure options. As the Group’s expertise is in coal mining, the Group still intends to invest in coal assets, primarily in Indonesia. The Group recognises the importance of social and environmental considerations in our investment, and believes that the coal industry is fundamental to the well-being of many lives through the provision of affordable energy. The Group also targets eco coal with low ash and low sulphur to reduce environmental impact. Energy security is as important as energy transition. To find the right balance, the Group will also consider smaller diversification investments outside the coal industry as part of the Group’s long-term strategy. |

For the full Q&A, click here.