|

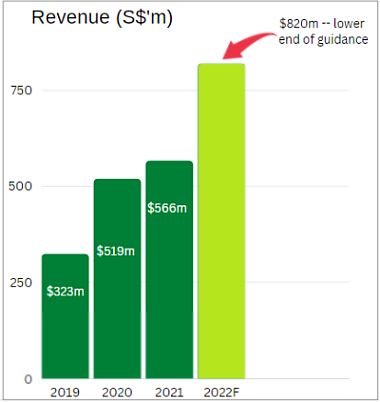

AEM Holdings has just upped its revenue guidance for this year, its third upward revision after a S$670-$720m guidance in January 2022. It's almost 3x in 3 years.

|

Singapore-listed AEM is a global leader in test innovation, providing comprehensive semiconductor and electronics test solutions based on the best-in-class technologies, processes, and customer support.

Despite the upward guidance, AEM's revenue in 2H2022 will be lower than in 1H2022 when it came in at S$540.5 million.

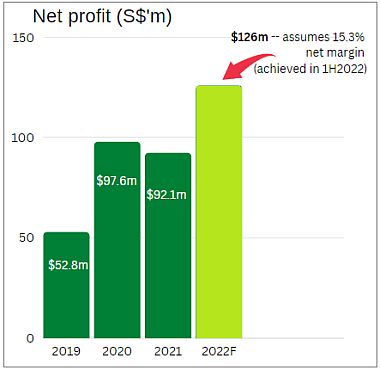

Assuming the 15.3% net margin AEM achieved in 1H2022, it can be estimated that net profit for the year will come in at a record S$126 million.

The actual profit will depend on factors such as the consumable-equipment mix.

Assuming $126 million net profit, the stock's PE ratio stands at about 7.9 based on the recent stock price of $3.18.

The stock has fallen from a recent high of $4.64 on 26 Aug 2022 following, among other things, news of its key customer Intel Corp's plans to cut workforce amid a downturn in the semiconductor industry.

The longer-term outlook for AEM remains robust.

As its 1H2022 financial statement said: "We believe that in the longer horizon that trends including 5G, edge computing, AI, and electric vehicles will drive the need for more semiconductors and the integrated testing solutions that AEM is pioneering."