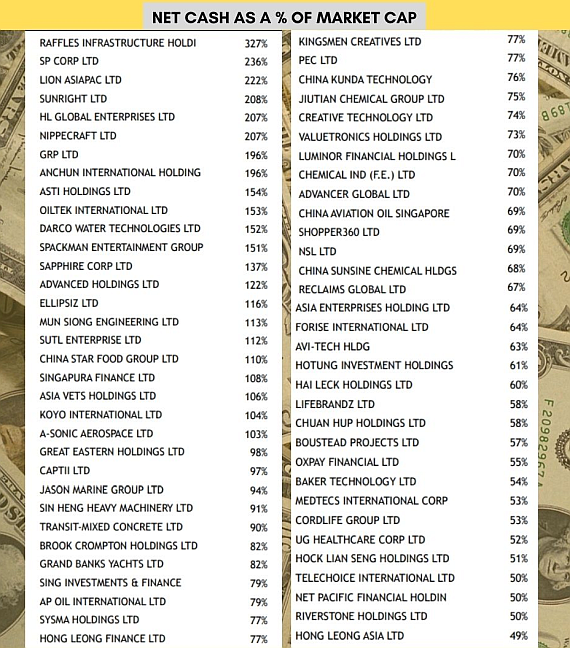

| Maybank Research says 43% of Singapore’s active listings have net cash balance sheets, with a sizable proportion of small and mid caps with cash exceeding their market caps. Notable corporates where cash is at least 10% of market cap include HRnetGroup, Aztech, Credit Bureau Asia, ComfortDelGro, AEM and Venture Corp. The broker's report titled "Fishing in Troubled Waters" sought to identify stock picks that would continue to do well in a challenging macro environment ahead. |

Source: Bloomberg

Source: Bloomberg

The broker also noted strong consensus 3-year dividend growth CAGR expectations for Genting Singapore, Singapore Post, Lendlease Global Commercial REIT, ComfortDelGro, SingTel, and AEM.

Separately, it noted rising share buybacks from Keppel Corp, AEM, Wilmar, Nanofilm, Yangzijiang Shipbuilding that have YTD purchased more than a third of what was bought in 2021.

Furthermore, significant insider buying activity is observed across sectors particularly Vertex Technology, Chip Eng Seng, and Propnex.

Overall, this data notably overlaps with the broker’s key conviction picks including ComfortDelGro, SingTel and Venture.

"For completeness, our other top picks include: Bumitama, CapitaLand Integrated Commercial Trust, CDL Hospitality Trusts, CapitaLand Investments, DBS, OCBC, SGX which balance between defense and structural growth."

Full report here.