Relocating sophisticated equipment for the semicon industry, etc. Relocating sophisticated equipment for the semicon industry, etc. Photo: Company Chasen Holdings has reversed sharply from losses a year earlier to post a S$3.4 million profit in the financial year ended 31 March 2021.

The latter provides cross-border land transport for goods such as solar panels, semiconductor equipment, electrical and electronic parts, automotive parts and apparel. Land transport services provided by Chasen across the borders of China, Vietnam, Malaysia and Singapore has became more sought after by clients instead of air and sea transport whose rates have shot up. |

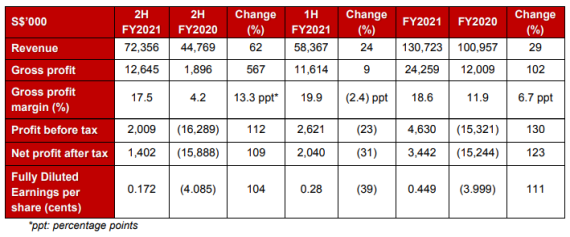

Chasen reported a 29% rise in total group revenue to S$130.7 million in FY2021.

Profit before tax stood at S$4.6 million (FY2020: loss of S$15.3 million) and net profit after tax, S$3.4 million (FY2020: loss of S$15.2 million).

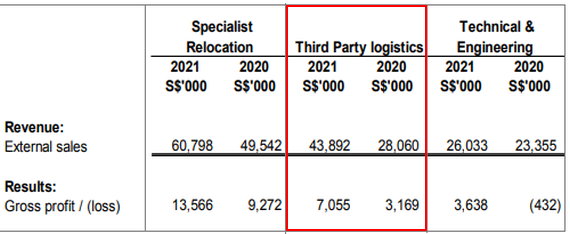

The higher revenue was driven by the resumption of backlogged and significant new contracts secured in Specialist Relocation projects in the PRC and the robust 3PL demand.

Specialist Relocation operations for electronics manufacturers in mainland China that were earlier backlogged by the lockdowns have resumed and continue to gain momentum in FY2021.

Chasen won new significant contracts in Changsha and Guangzhou in the second half of the year.

The 3PL segment continues to benefit from increased warehousing operations and cross-border land transportation order flows due to increased e-commerce and cross-border business activities particularly from its OEM customers in Southeast Asia and in the PRC. Third-party logistics segment shone in FY21: Gross margin jumped to 16.1% from 11.3%. Revenue jumped 56.4%

Third-party logistics segment shone in FY21: Gross margin jumped to 16.1% from 11.3%. Revenue jumped 56.4%

However, Chasen's Technical & Engineering (“T&E”) segment remains impacted by restrictions on foreign workers and on-site construction activity in Singapore due to the pandemic.

As a result, it experienced higher costs and delays in project completion as well as payments. This was largely offset by strong orders from the segment’s component and parts manufacturing operations located in Singapore and the PRC, with revenue rising 56% year-on-year.

| • Other operating income: Rose from $2.8 to $5.4 million owing mainly to the Singapore government's job support scheme during the pandemic. • Other operating expenses: Fell from $7.0 million to $1.8 million owing mainly to lower provision for doubtful debts. • Cash and cash equivalent: Stood at S$13.9 million as at 31 March 2021, an increase of S$8.1 million from S$5.8 million as at 31 March 2020. |

| Outlook |

| • Specialist Relocation segment: It is diversifying its customer base from the TFT LCD sector to semiconductor and fabless chip manufacturers, as well as the organic light-emitting diode (“OLED”) industry. The Group has already completed a project to relocate the production line for the world’s first 8.5G OLED plant for a South Korean manufacturer and has also secured another similar project in mainland China this year. • 3PL segment: The Group expects the Pan-Asian cross-border land transportation services to remain robust. Chasen intends to increase its fleet 15% - 20% by March 2022 from 120 as at 31 March 2021, while also introducing more fuel-efficient and environment-friendly vehicles.  The Group is also looking to target other key long-term customers to enhance the resilience and margins of its revenue streams. It to form a joint venture with an experienced local logistics partner in the PRC to tap the vast domestic 3PL and transportation market to service new customers with a focus on the electronics sector while securing more businesses from existing customers in the country. The Group is also looking to target other key long-term customers to enhance the resilience and margins of its revenue streams. It to form a joint venture with an experienced local logistics partner in the PRC to tap the vast domestic 3PL and transportation market to service new customers with a focus on the electronics sector while securing more businesses from existing customers in the country.The 3PL segment is working to implement ACTS (ASEAN Customs Transit System) to deliver a seamless cross-border land transportation service to customers. It has participated in pilot trials in Malaysia to destinations such as Thailand and Cambodia. Concurrently, it is exploring warehouse operations under the AEO (Authorized Economic Operator) System, where Customs check-cum-clearance will be carried out in-house. Once implemented, the Group’s competitive edge is expected to be enhanced. • T&E segment: Will continue to see suppressed revenue contribution amid manpower shortages due to COVID-related restrictions to entry, increasing costs as well as delayed project timelines and payments from customers. Nonetheless, the components and parts manufacturing capability within this segment will continue to capture opportunities in emerging core technologies such as 5G, Internet of Things and electric and autonomous vehicles. T&E business units have realigned strategies to tap opportunities in solar panel installation, and interior space and exterior façade cladding works using specialized industrial-grade glass and aluminium. |

“We have achieved a commendable FY2021 despite the challenges posed by the COVID-19 pandemic. Having restructured our cost structure in the first half of FY2021, we are now well poised to capture growth opportunities ahead, especially in the 3PL and Specialist Relocation segments. We look forward to continue delivering a strong performance in the coming quarters.” “We have achieved a commendable FY2021 despite the challenges posed by the COVID-19 pandemic. Having restructured our cost structure in the first half of FY2021, we are now well poised to capture growth opportunities ahead, especially in the 3PL and Specialist Relocation segments. We look forward to continue delivering a strong performance in the coming quarters.”-- Mr Low Weng Fatt, Chasen’s Managing Director and CEO. |

Chasen's full financial statement is here.