Excerpts from KGI report

Analyst: Chen Guangzhi, CFA

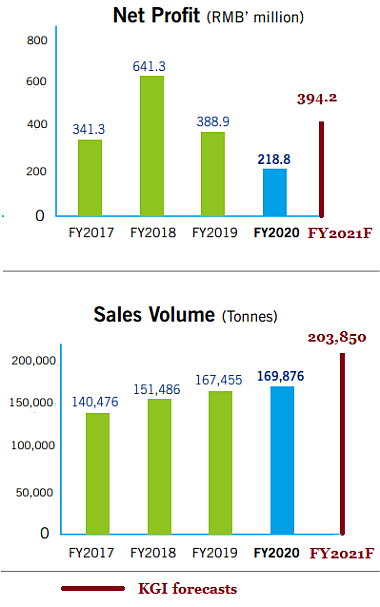

• China Sunsine’s profitability turnaround in FY21 is driven by the commodity upcycle and capacity ramp-up.

• However, the company’s production ramp-up in insoluble sulphur and anti-oxidant is expected to offset the potentially weaker price later this year. • We maintain OUTPERFORM with a higher TP of $0.68 due to the ASP upswing and increase in sales volume in FY21 and FY22. |

||||

Riding on economic recovery and commodity upcycle. While the COVID-19 pandemic continues to cause disruptions around the world, China is one of the few countries which successfully contained it and prevented a new wave of outbreak.  Benefiting from the normalisation of economic and business activities, China has been recording a consecutive 14-month of manufacturing PMI above 50 since March 2020.

Benefiting from the normalisation of economic and business activities, China has been recording a consecutive 14-month of manufacturing PMI above 50 since March 2020.

Meanwhile, global expansionary monetary policies have resulted in rising commodity prices. China Sunsine as the top rubber chemical producers is benefiting from both demandpull and cost-push commodity upcycle.

Rubber chemicals prices have turned around since October 2020. Selling prices have increased exponentially due to the low base last year. Most prices are approaching the levels of the peak in mid-2018.

The current price of chemicals like antioxidant A has reached new highs. However, the price of the main underlying feedstock aniline has also soared. Price spreads between end products and raw materials shows mixed performances as some have broken new highs while others are still depressed.

Great management vision. In addition to favourable selling prices and improving profit margins in 2H20, the well-timed ramp-up of capacity also helped buffered against the cyclical downturn.

Thanks to the commercial operation of 20,000 tonnes of TBBS in 2H20, the 13% YoY increase in sales volume propelled the performance turnaround. The capacity expansion during the downturn in 2019 was a correct strategic move and proves management’s foresight and vision.

Valuation & Action: We maintain our OUTPERFORM rating with a higher target price of $$0.68 due to the upswing in ASP and increase in sales volume in FY21 and FY22.

Risks: We expect the macro environment in 2H21 to be less favourable than 1H21. Global supply and demand dynamics will be more balanced as prevailing vaccination will gradually rein in infections.

China has tightened credit facilities since 4Q20, while the US could start tapering QE later this year. Therefore, the bull cycle in commodities could peak in 3Q/4Q21. Meanwhile, the 2022 Beijing Winter Olympics will be held in early February. Investors should be familiar with the seasonal winter haze in the northern part of China.

It is highly likely that authorities will release a suspension work order similar to what it did before and during the 2008 Beijing Summer Olympics for plants located in Shandong and Heibei province. Therefore, it is unknown whether 4Q21 production will be affected.

Commodity upcycle could peak in 2H21. There are two factors driving the current commodity upcycle: imbalanced supply and demand dynamics and loose monetary policies. We believe these two factors will start to taper off in 2H21.

The ongoing vaccination around the world is expected to gradually control infection cases. Hence, normalisation of production and business activities will result in supply slowly catching up with demand.

There is a strong lagging correlation between raw material prices and credit impulse. Generally, the credit cycle is 12 to 15 months ahead of the commodity cycle. China has tightened credit facilities since October 2020. Therefore, we forecast that the current bullish commodity cycle could peak in 3Q/4Q21.

New capacity will buffer the topping out of prices again. There are 30,000 tonnes of insoluble sulphur and 30,000 tonnes of anti-oxidant TMQ that are expected to commence commercial operation in 2H21. Chen GuangZhi, analystTo quantify, theoretical production volume of insoluble sulphur is expected to increase by 100% YoY in 2H21 and 50% YoY in FY21; production volume of anti-oxidant is expected to increase by 66.7% YoY in 2H21 and 33% YoY in FY21. Chen GuangZhi, analystTo quantify, theoretical production volume of insoluble sulphur is expected to increase by 100% YoY in 2H21 and 50% YoY in FY21; production volume of anti-oxidant is expected to increase by 66.7% YoY in 2H21 and 33% YoY in FY21. Meanwhile, we believe the ASP in 2H21 will be comparable to 1H21 on a conservative assumption. In a nutshell, Sunsine will deliver a better performance in FY21. |

Full report here.