Company Overview

Link to StockFacts company page |

||||||||||||||||||||

1. Describe Don Agro’s recent financial performance.

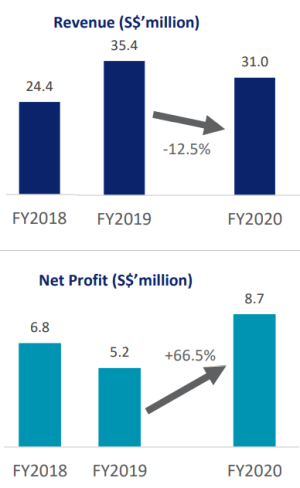

• Don Agro posted a 66.5% year-on-year (yoy) increase in net profit, to an all-time high of $8.7 million, for FY2020 (ended 31 December 2020) despite challenging operating conditions amid the COVID-19 pandemic.

• Revenue for FY2020 declined 12.5% yoy to S$31.0 million. This was mainly attributable to a relative decline in the sales of crops compared to FY2019, as a significant yield of sunflowers harvested in FY2018 was shifted for sale in FY2019 instead. Correspondingly, cost of sales decreased 23.3% yoy to S$25.6 million for FY2020.

• Revenue for FY2020 declined 12.5% yoy to S$31.0 million. This was mainly attributable to a relative decline in the sales of crops compared to FY2019, as a significant yield of sunflowers harvested in FY2018 was shifted for sale in FY2019 instead. Correspondingly, cost of sales decreased 23.3% yoy to S$25.6 million for FY2020.

• Notwithstanding the above, the Group has been a beneficiary of rising global prices of agricultural produce, with gross profit rising 70.3% yoy to S$14.6 million for FY2020. This was mainly driven by a 41.5% yoy increase in gain from change in fair value of biological assets and agricultural products to S$9.2 million for FY2020.

2. What is the rationale for the recent acquisition of Volgo-Agro? How was the acquisition funded and how will it add to the firm’s growth plans?

• Volgo-Agro is an agricultural company that operates a land bank of approximately 10,040 hectares in the Volgograd region of Russia, an area that provides favourable levels of precipitation and quality of soil that is highly suited for winter wheat production.

• In line with our IPO plans to expand our arable land bank, we now harness an enlarged land bank of approximately 63,240 hectares in total after the acquisition, representing an 18.9% growth rate. This new land capacity will accelerate growth for winter wheat production and allow us to expand our income stream by diversifying our range of offerings through crop rotation.

• The acquisition has also enabled us to gain important assets including a grain cleaning machine and existing storage facilities of 10,000 tonnes, allowing us to store more winter wheat for sale during peak pricing periods.

3. What is the Group’s dividend policy (if any)?

• While the Group does not currently have a fixed dividend policy, the Board of Directors intends to recommend and distribute regular dividends of up to 20.0% of net profit to reward shareholders for participating in the Group’s growth.

• Since our listing on the Catalist board of the SGX in February 2020, the Board declared a maiden dividend of 0.7 Singapore cents per share on 30 March 2020, representing a payout ratio of 20.0% for FY2019 (ended 31 December 2019).

• For FY2020, the Board declared a final dividend of 1.2 Singapore cents per share, representing a payout ratio of 20.0%. This demonstrates the Board’s commitment to reward shareholders for embarking on Don Agro’s growth journey.

4. What are Don Agro’s competitive strengths in the agriculture industry?

• The Group has competitive strengths in two areas – our location and our people.

• Location - Our main land bank is located in the Rostov region, one of the most fertile regions in Russia with stable and predictable weather conditions, highly suitable for crop production. This region is approximately 220 km away from the Azov Sea and Don River international ports. This allows our customers, who are mainly traders and exporters, to save on transportation costs and, as a result, be able to offer higher prices for our crops. Our second operating division in the Volgograd region is also located close to key trading routes with the Middle East and Asia.

• People - Don Agro is headed by an experienced team of industry executives who have a clear long-term vision of the Group’s business objectives and growth plans. This is evident in our latest ventures which include branching out to produce organic produce as well as the acquisition of Volgo-Agro. The Board and management team are also supported by operational leaders who have extensive experience in the day-today operations of crop fields, dairy farms and all other aspects of the business. Success in crop and dairy farming may be attributed to experienced, structured and hands-on farm management practices to maximise yields and produce high quality crops and raw milk.

5. What are the key drivers of Don Agro’s growth over the medium to longer term?

• The Group’s business is dependent on the amount of arable land available. Through the acquisition of arable land banks and other agricultural companies, we have expanded our total land bank to approximately 63,240 hectares, of which 51,200 hectares are arable land. We are also looking to acquire land which is near to our current area of operations or closer to ports in the Rostov region for ease of transporting our produce.

• To ensure alignment with consumer trends, we will focus on products that are in high demand and more commercially viable such as wheat, sunflower and corn. The sale of wheat in the Russian domestic market has been strong due to the increased cost of imported agricultural produce as a result of the depreciation of the Russian Ruble. There is also a growing preference for wheat in Southeast Asia which has become the world’s top wheat importing region.

6. Which are your key geographic markets? Do you have active plans in place to expand your geographical reach?

• We currently serve the local market in Russia as well as customers in the Middle East and Southeast Asia. We have in place plans to expand both domestically and internationally. • Domestically, we intend to expand into high growth areas including other districts within the Rostov and Krasnodar regions.

• Internationally, we are constantly looking for new trade opportunities in Southeast Asia and the Middle East. We will be executing these expansion plans through mergers and acquisitions, joint ventures and strategic alliances with domestic and foreign partners.

7. How has the pandemic affected Don Agro’s facilities and productions? How did you deal with it?

• The Group’s business has been largely unaffected by the global pandemic as people continue to stock up on food supplies such as wheat, oil and other staples during periods of lockdown. Overall, the pandemic did not have a significant material impact on our business operations. Instead, we were able to record a 66.5% yoy increase in net profit to an all-time high in FY2020.

8. What are some of the key consumer trends you foresee and how will they hinder/drive the Group’s growth prospects?

• As consumers are becoming better informed and mindful about the ethical and environmental impact of their food choices, there is a shift towards sustainable consumption. These include opting for organic alternatives such as certified organic wheat products due to rising health concerns about the harmful effects caused by chemicals and pesticides in non-organic produce. According to Meticulous Research®, global organic food market has been forecast to reach S$272.2 billion by 2027 or expand at a CAGR of approximately 12.2%.

• In line with these trends, we recently launched a pilot project to cultivate organic wheat. We believe this is a step in the right direction as it will allow us to expand our suite of offerings, capture new market segments and ultimately generate new revenue streams.

• With expected higher margin and reduced used of fertilisers and pesticides, the sale of organic produce could improve our earnings resiliency and profitability over the longer term.

9. Globally, governments have been committing to green economy/net zero plans. What are some ways Don Agro is working towards supporting a sustainable economy?

• The sustainability of our Group’s operations is one of our key corporate priorities. As companies worldwide embark on the search for alternatives that are cleaner and greener, we have a key role to play in ensuring that our responsibilitiesto our shared environment are met.

• To lessen our environmental impact, we strive to improve efficiency, productivity, and crop yield by periodically replacing our equipment and machinery (e.g. seeders, tractors and harvesters).

• As an agricultural business, we are aware of how conventional farming practices may have adverse impact on the environment. To reduce this impact, we have been progressively expanding our adoption of “No-Till” farming practices since 2014. “No-Till” farming benefits the environment as it prevents the erosion of soil and restores its natural structure while requiring less use of machines and fuel overall. Today, “No-Till” fields make up approximately 7,418 hectares of our arable land bank and we intend to grow this figure in the years ahead to ensure our operationsremain environmentally sustainable.

• Our recent venture into organic wheat cultivation further demonstrates our commitment for sustainable farming practices. For our new organic wheat fields, only naturally occurring biological products will be utilised for the crop cultivation process in place of pesticides or herbicides. We expect these fields to be completely free of mineral fertilisers and pesticides by September 2021.

| 10. What is Don Agro’s value proposition to its shareholders and potential investors? • As the first Russian company to be listed on SGX, we believe that investors are presented with a unique opportunity to invest in the Russian agricultural sector which is of rising importance and has seen tremendous growth in recent years. In 2020, Russia was the world’s largest exporter of wheat, the second-largest producer of sunflower seeds and the fourth-largest producer of milk. Crucially, the Russian government views the agriculture sector as a strategic industry to further the country’s long-term growth and has introduced strategic and supportive government policies. • By choosing to focus on wheat, sunflower and corn which are products that have strong and growing demand, the Group is well-positioned to capture the burgeoning growth of the market. According to a report by the USDA in 2019, demand for wheat has been experiencing major growth. In particular, Southeast Asia has become the world’s top wheat importing region as a result of a shift in consumption habits. Insufficient local wheat production in the region (making up less than 1% of demand requirements) and a hike in consumption have driven import demand for wheat. Going forward, we are optimistic of our long-term growth trajectory as we continue to focus on such products that are in high demand. |

First published in 10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials. This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research.

For company information, visit http://donagroint.com/

Click here for FY2020 Financial Results