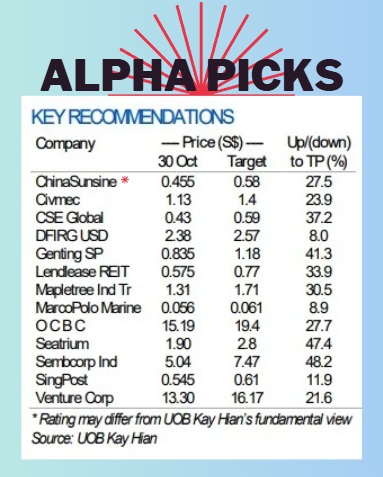

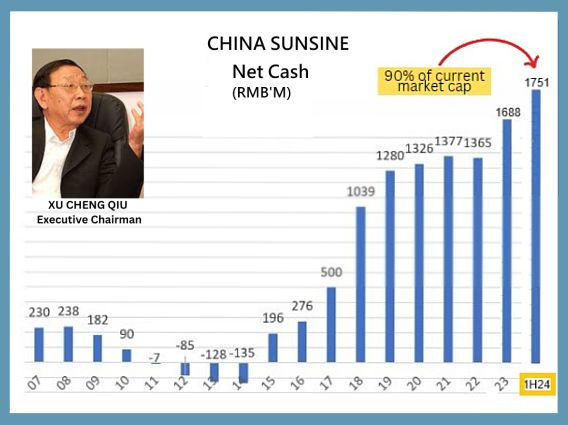

• UOB Kay Hian's alpha picks portfolio has consistently done well. Its top performers in Oct 24 were Singapore Post (+17.2% mom), Civmec (+16.0% mom) and DFI Retail Group (+9.7% mom).  Singapore Post surged on the back of news flow regarding the potential sale of its Australian assets while Civmec rose on its successful change of domicile and positive outlook. Singapore Post surged on the back of news flow regarding the potential sale of its Australian assets while Civmec rose on its successful change of domicile and positive outlook. DFI Retail Group benefited from positive sentiment on the back of its exit from its China supermarket exposure. On the negative side, Frencken (-13.9% mom) was hit by by weakness in results of its major customers in the semiconductor and life science sectors. CapitaLand Investment (-9.9% mom) fell as bullishness from the China stimulus and US Fed rate cut faded while Sembcorp Industries (-9.0% mom) saw profit taking in the wake of its share price having risen 24% in Aug-Sep 24. • What are its stock picks for Nov? See table. An addition from 1 Oct 2024 is China Sunsine, which was down 4.2% in that month. • UOB KH, which is expected to join an investor/analyst trip to China Sunsine's operations in China soon, says the stock trades at just 2x CY24F ex-cash PE. The cashpile has indeed been growing and growing (see chart).  * Chart as at 1H2024 when the stock traded at 40 cents. * Chart as at 1H2024 when the stock traded at 40 cents.Does China Sunsine have the fundamentals to help sustain UOB KH's alpha portfolio's winning run? Read more about this stock, which was listed on SGX a good 17 years ago, below .... |

Excerpts from UOB KH report

• Solid beat. In contrast to the STI’s negative performance for Oct 24, our Alpha Picks portfolio rose 0.4% mom on an equal-weighted basis, beating the STI by 1.1ppt.

Our Alpha Picks portfolio has now outperformed the STI in 12 out of the past 13 months.

• Trimming our portfolio. For Nov 24, we add Marco Polo Marine into our Alpha Picks portfolio as we reckon that the company would benefit from higher charter rates and limited vessel supply.

We take profit on SATS post its strong performance in Oct 24 while removing Frencken and CapitaLand Investment Limited as they face headwinds in the near term, in our view

| China Sunsine |

Analysts: Heidi Mo & John Cheong

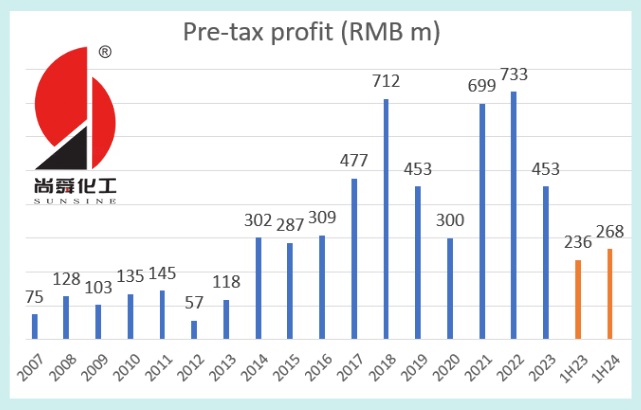

• Potential improvement in demand and ASPs from stronger Chinese economy. China’s latest stimulus measures have improved investor sentiment and may boost consumer confidence.

In turn, Sunsine’s demand and ASPs could see an uptick in the coming months. |

||||

• Good dividend yield of around 5% backed by strong balance sheet. Sunsine provides an attractive yield of around 5%, supported by its robust cash balance of Rmb1,751m (+4% hoh) as of 1H24.

This translates to Rmb1.82/share (S$0.34/share) or around 70% of its market cap.

This provides ample room for Sunsine to potentially raise its dividend and continue to perform share buybacks.

Sunsine has bought back 3.8m shares for 2024 since the start of its 2024 share buyback plan on 26 Apr 24.

• Expect steady volume growth from strong demand. Sunsine achieved stronger rubber chemical sales volume (+6% yoy) in 1H24.

This was backed by better capacity utilisation rates for tyre manufacturers based in Southeast Asia, partially offset by lower domestic demand.

As more Chinese tyre manufacturers look to Southeast Asia to set up factories or beef up production, we expect international sales volume to grow further.

Moreover, automakers reported 6% yoy higher auto sales in China, while New Energy Vehicles saw a 32% yoy surge in 1H24.

We therefore expect sales volume growth to remain steady moving forward.

| • Maintain BUY. Our target price of S$0.58 is pegged to 7.5x 2025F PE or +1SD above historical mean PE. Sunsine is trading at an undemanding 2x CY24F ex-cash PE, and we expect Sunsine to capture the potential demand recovery in 2025. SHARE PRICE CATALYSTS • Events:

• Timeline: 3-6 months. |

Full report here