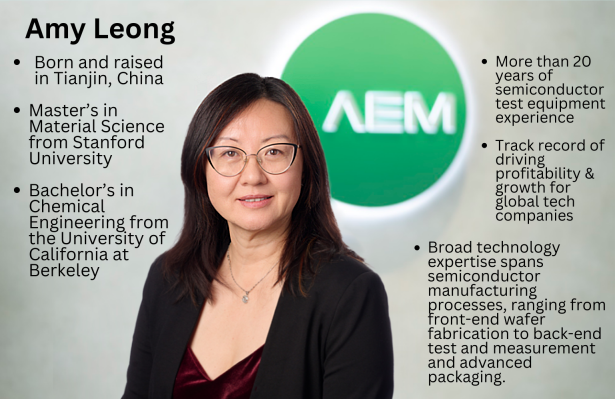

• Rare is the woman CEO among Singapore listed companies. Amy Leong is set to be an unusual addition, which will be all the more striking because she has been appointed to be CEO of a tech company with a global reach -- AEM Holdings. • Born and raised in China before moving with her family to the US, Amy has chalked up more than 20 years of experience working for various tech companies, the last being FormFactor. Her 18-year experience at Nasdaq-listed FormFactor (market cap: US$4.2 billion) looks to be of special value to AEM (market cap: S$620 million).  For this article interviewing Amy on her background and career, click here.• FormFactor provides essential test and measurement services and equipment to Intel, covering the entire IC (integrated circuit) life cycle. For this article interviewing Amy on her background and career, click here.• FormFactor provides essential test and measurement services and equipment to Intel, covering the entire IC (integrated circuit) life cycle.FormFactor has roles that dovetail into that of AEM, which focuses on back-end testing equipment for chips. AEM's key customer is, of course, Intel. • FormFactor is no ordinary partner of Intel. FormFactor is one of a handful of suppliers out of thousands in Intel's supply chain which has won numerous top supplier awards over multiple years. As Amy -- whose roles at FormFactor included Senior Vice President, Chief Commercial Officer, Mergers and Acquisitions, General Manager, and Chief Marketing Officer -- posted on LinkedIn a while back (see below):  • CGS International, in a report yesterday (11 June), briefly described her career. Strikingly, it spelt out some of the things it wished she would do when connecting with analysts. (Sounds like some analysts had tried the same with the outgoing CEO but didn't get their way). Read excerpts of CGS's report below ..... |

Excerpts from CGS International report

Analyst: William Tng, CFA

AEM Holdings Ltd

New CEO from 1 July 2024

■■ We hosted AEM for a CEO transition chat with our clients on 7 Jun 2024. Both incoming and departing CEOs joined the virtual call.

■ We adjust our model for AEM’s 1-for-100 share bonus issue, which reduces our TP to S$1.82; reiterate Reduce till better earnings visibility emerges. |

||||

| AEM introduces new CEO |

AEM’s current CEO, Chandran Nair, has resigned. Amy Leong joined AEM as its Deputy CEO on 30 May 2024 and will assume the CEO role effective 1 July 2024.

Born and raised in Tianjin, China, Amy came to the United States with her family when she was 16 years old.

She has a Master’s in Material Science from Stanford University and a Bachelor’s in Chemical Engineering from the University of California at Berkeley as well as over 25 years of semiconductor test and measurement experience, according to AEM’s press release.

Amy has been with FormFactor (FORM US, NR, CP: US$53.47) since October 2012.

Before this, she was the VP of Marketing at MicroProbe (acquired by FormFactor) over Apr 2010-Oct 2012.

Prior to joining MicroProbe, Amy worked at Gartner Inc (IT US, NR, CP: US$434.44) as a Research Director from 2008 to 2010 covering the system-on-chip and microcontroller markets.

| What can Amy do differently? |

We understand AEM’s customers are familiar with Amy given her long career in the semicon industry.

|

More disclosure please ... |

|

“We would like to see Amy work with the AEM board to explore higher standards of investor disclosure, such as target financial models (revenue, margin goals that the company hopes to achieve) and quarterly revenue, margin and EPS guidance.” |

In our view, as the new CEO comes on board, AEM will also fill its CFO vacancy.

As Taiwan’s importance in the AI supply chain grows, we think AEM may need to expand its presence there.

We would also like to see Amy work with the AEM board to explore higher standards of investor disclosure, such as target financial models (revenue, margin goals that the company hopes to achieve) and quarterly revenue, margin and EPS guidance.

As AEM competes with global players, the CEO and the board should also consider if AEM can attain a better valuation in other financial markets, which would help the company in its M&A strategy.

|

Full report here