Excerpts from UOB KH report

Analysts: John Cheong & Clement Ho

| 1Q21: Results In Line; Robust Growth In Southeast Asia FEH’s 1Q21 net profit of US$6.8m (+3.9% yoy) forms 22% of our full-year estimates.

While gross margin fell, net margin remained stable. We expect revenue recovery, better scale in Vietnam and stable net margins to drive earnings in 2021. Also, the logistical challenges should ease in the coming quarters. Maintain BUY and target price of S$1.30, based on 16.6x 2021F PE. |

||||

RESULTS

• Results within expectations. Food Empire Holdings (FEH) reported net profit of US$6.8m (+3.9% yoy) for 1Q21, which accounts 22% of our full-year forecast, in line with expectations.

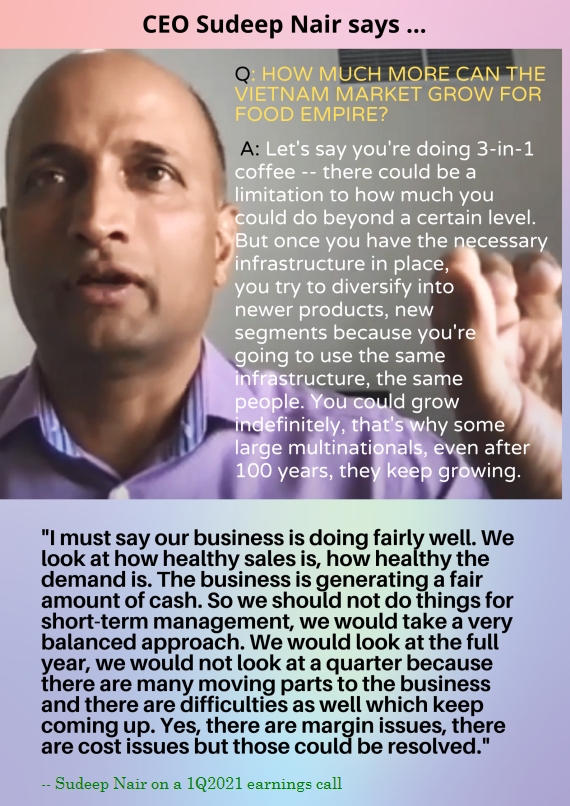

• Higher revenue from robust growth in Southeast Asia market. Revenue rose 3.4% yoy to US$76.8m in 1Q21, translating to a sequential recovery at 10.1% qoq, which is largely within our expectations. Cafe Pho is Food Empire's leading coffee product in Vietnam. Photo: Company Revenue from Russia fell 2.4% yoy while revenue from the group’s Ukraine, Kazakhstan and CIS markets registered a steeper decline of 8.6% yoy.

Cafe Pho is Food Empire's leading coffee product in Vietnam. Photo: Company Revenue from Russia fell 2.4% yoy while revenue from the group’s Ukraine, Kazakhstan and CIS markets registered a steeper decline of 8.6% yoy.

The drop in sales in these markets was largely related to logistical and supply chain delays at ports of discharge due to the lack of shipping containers worldwide.

The decline in the group’s CIS and Russia markets were largely offset by higher sales contribution from its Southeast Asia which saw a 22.2% yoy jump in sales to US$24.1m, driven by robust growth in Vietnam and Malaysia.

South Asia’s revenue also held steady at US$2.5m, compared to US$2.1m in 1Q20. We expect the logistical challenges to ease gradually in the coming quarter.

• Stable net margins as lower gross margin was offset by lower operating expense. Selling and marketing expense declined 9.0% yoy while administrative expense fell 9.3% yoy.

On the flip side, higher commodity prices and freight related expenses lead to a lower gross profit margin of 33.6%, down 6.8ppt compared with 40.4% in 1Q20. With that, net profit margin was largely unchanged at 8.9% in 1Q21.

STOCK IMPACT

• Recovery in top-line and stable margins to lift earnings in 2021. With the gradual reopening of economies on the back of global efforts to increase vaccine adoption rates, our forecast incorporates a 9.4% increase in revenue.

Furthermore, FEH’s increasing scale in Vietnam, efforts to streamline its operations, exit from its loss-making Myanmar business and ability to raise ASP during core market currency weakness have improved its overall margins over the years, while maintaining stable revenue. We expect stable net margin going forward, albeit 0.3ppt lower in 2021 to account for depreciation of the second India plant.

• Resilient product offerings and strong brand equity. Despite challenges in 2020 including currency devaluation in core markets and national lockdowns, the group has managed to generate a record level of profits.

We believe this is a testament to its strong brand equity and experience in navigating volatile currencies. Furthermore, given the low price point and consumer staple nature of its products, the products are relatively price inelastic. As such, sales volumes more sheltered from an economic slowdown, in our view.

| • Compelling valuation; potential takeover target. FEH currently trades at 11.2x 2021F PE vs peers’ average of 25x. In view of its resilient core earnings amid a challenging environment, its leading position in its core markets in Eastern Europe and growing presence in its second largest market Vietnam, we believe the valuation gap with its peers will narrow. Furthermore, given the depressed valuation, we do not rule out the possibility of a takeover offer or privatisation. Besides, in the past, SGX-listed peers including Super Group and Viz Branz were acquired and privatised at significantly higher valuations of 30.0x and 16.4x respectively. EARNINGS REVISION/RISK • No change. VALUATION/RECOMMENDATION • Maintain BUY with an unchanged PE-based target price of S$1.30, based on 16.6x 2021F PE, or 1SD above its long-term historical average (excluding outliers). |

Full report here.