This is Part 2. Part 1 is here.

| BUYING BEFORE THE STARS ALIGN |

“You pay a very high price in the stock market for a cheery consensus.” -- Warren Buffet

As investors, our metric is risk-adjusted returns and the above studies indicate an excellent probability that NR has powerful therapeutic actions.

The relatively consistent, significant and mechanistically plausible effects shown by Tru Niagen means the risk adjusted return is stacked in investors' favour. Indeed, the whole of Chromadex ($300m) is worth <10% of the average value of a company with just one approved drug treatment ($4.5b).

CHROMADEX STRATEGY: STEADY, STEALTHY & SUPERB

“If you don't know where you are going, you'll end up someplace else.” -- Yogi Berra

A lot of retail investors in Chromadex are Tru Niagen early adopters. The stock has badly lagged a surging market, and a constant refrain from these investors is that management should be doing more. This is particularly true as most investors think the patents end 2026, rather than our base case of 2036. (See Section: Risks; and Section: Patents for more on this)

This view is misguided. Chromadex works in the most highly regulated industry in the world, with limited resources and no small numbers of competitors that would like to see it fail and its patents up for grabs.

Activity is not the same as progress. Unfocused activity is a bad idea when the road ahead is full of traffic cops and landmines.

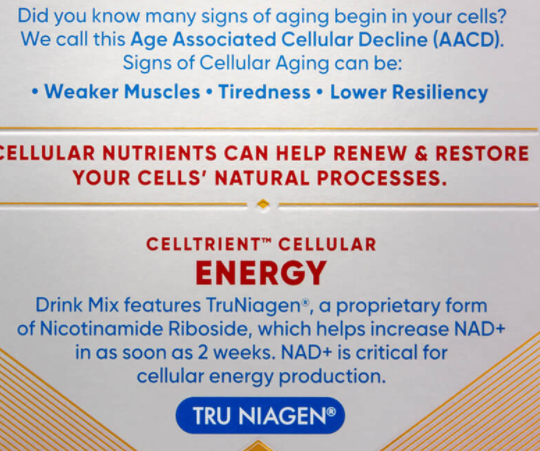

Chromadex is actually two parallel organisations. The inverted pyramid on the left is what most investors are focused on, and why the calls to crank up sales and promotion are so loud.

Source: Analyst

There are two reasons why the science driven approach (i.e. diagram on right) is what investors should focus on to drive shareholder value:

The Snowball: The consumer route is pushing snow uphill. The science route is rolling a snowball down a mountain and watching it turn into an unstoppable frozen boulder.

Strong research results will allow Chromadex to make big claims which the media can blow up. People will recommend it to friends and family on social media, and doctors will also recommend it to patients. This route is much more profitable in the long term. It vastly expands the Total Available Market, cuts customer acquisition costs enormously, and is infinitely more sustainable.

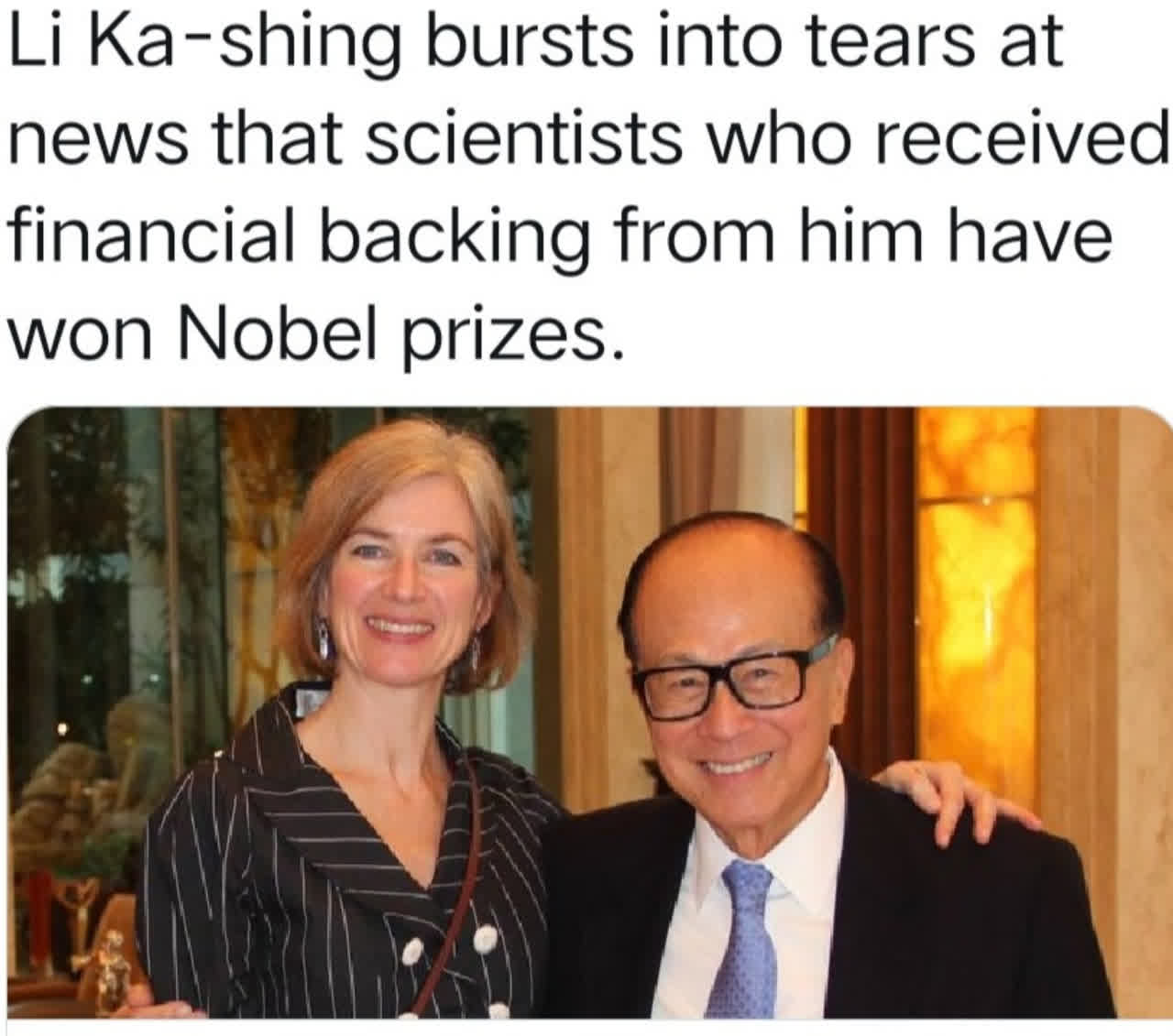

The Bullseye: The second reason is purely pragmatic. Chromadex’s management team has come together to make Tru Niagen big (eyeballing their bios, all of them could get well paid elsewhere). Li Ka Shing (see FAQ: Cast) made $15b on Zoom at the age of 92 and wants world impact. There are no known reports of him getting particularly emotional over retail sales.

Source: Twitter. October 2020.

The inverted pyramid on the right (“Science Route”) has the “Own the science” section drawn with a greater height than “Build the Brand” because through ownership of the science, building the brand becomes much easier. The “Focus on Fundamentals” slab should be drawn as a parallel process, but this shrinks the diagram and makes the text hard to read.

As can be seen from above, the real value of Chromadex will take several years to come to fruition, as it’s based on building a substantial body of clinical research.

NESTLE

“Our Health Science unit has been on a tear even before the pandemic. A few years back this was a CHF2bn (US$2.2bn) business. We expect this to double to CHF4bn (US$4.5b) by the end of the [2020] year… [there’s] very strong organic growth, especially in vitamins, minerals and supplements.

“Personalized vitamins, minerals, and supplements are going to be the next frontier. You are moving away from just straightforward supplements, like what I call the vitamin alphabet -- A, B, C or D -- and you are going to what the certain individual requires.” -- Mark Schneider, CEO Nestle

"We are proud to be in partnership with the pioneers at Chromadex who are unveiling the full potential of NAD+ through their research." -- Nestlé Health Science CEO Greg Behar.

“Tru Niagen is supported by published clinical studies and manufactured with the highest standard of safety and quality, which fits in nicely with our current portfolio of top-of-the-line nutritional supplements.” -- Jason Brown, CEO, Persona, a Nestle unit

Nestle is making a big push into health and high-end high nutrition, and has invested billions of dollars in acquisitions such as Aimmune, Vital Proteins and Zenpep as well as two more discussed below.

Nestle has the potential to be a game changer for Chromadex. The impact may not be immediate due to limited marketing, but the long term potential is huge.

There are two Nestle products using Tru Niagen, the first is Celltrient, a line of supplements for cellular energy, and Persona, a personalised vitamin delivery service.

Nestle takes a “family of brands” branding strategy and their brand is not obvious on the either website. There’s a certain pastel wholesomeness that is recognisably Nestle though.

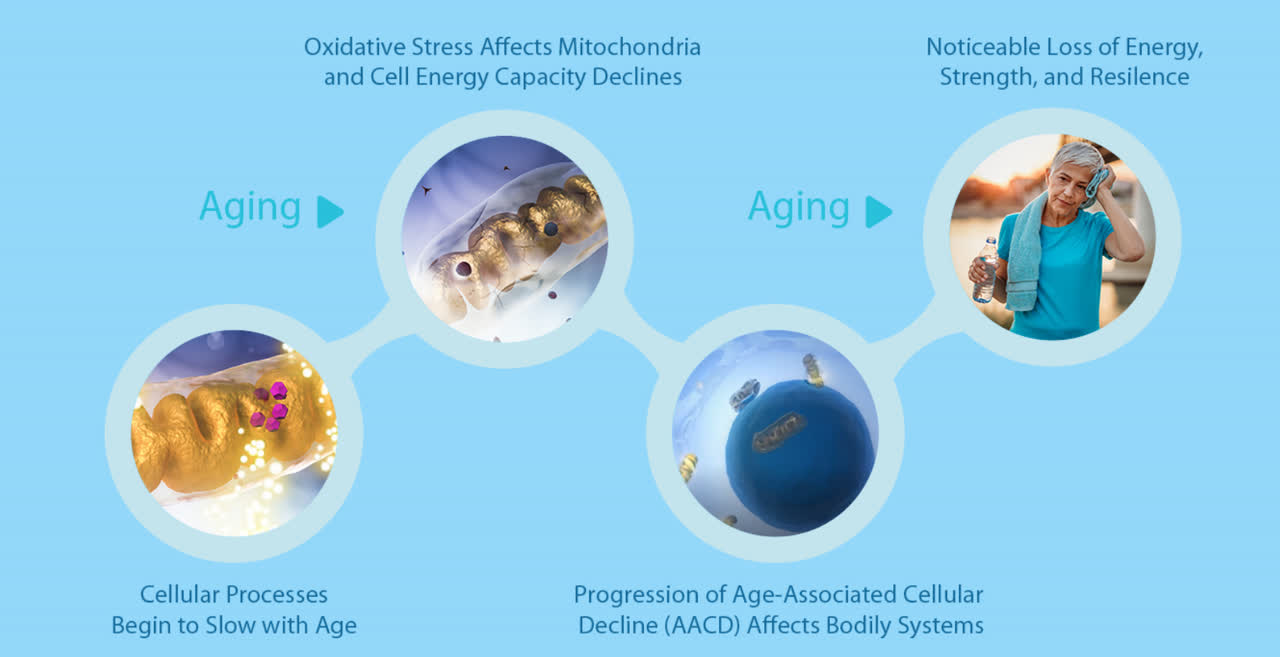

WHAT IS AGE-ASSOCIATED CELLULAR DECLINE

Nestlé’s push into healthcare is so large they have identified a treatable disorder that you might not suspect you could have: Age Associated Cellular Disorder ( AACD).

From website, owned by Nestle.

The good folk at Nestle have not only been kind enough to identify AACD as a disorder, but also how to treat it.

Spoiler: It starts with “ Cell-” and ends with “-trient”.

CELLTRIENT SUPPLEMENT LINE

Source: Celltrient website

Celltrient is a new direct-to-consumer line from Nestle, comprising of three products priced at roughly $30/box.

A Celltrient blog on AACD well worth reading is here.

Energy, Strength & Protection: Choose, or take all three

|

CELLULAR NUTRITION PRODUCT |

MARKETING COPY |

|

Energy

|

As we get older, our energy levels can begin to decline. While this may partly be due to a busy schedule or lack of sleep, it can also be related to what’s happening inside your cells. NAD+ plays a key role in energy production within our cells. However, our NAD+ levels start to decline as we age, which can lead to you feeling tired, as your cells are not producing optimal levels of energy. NR is a form of vitamin B3 that’s a precursor for NAD+, and you’ll find this in our Celltrient Cellular Energy Drink Mix. |

|

Strength

|

How strong you feel and how much stamina you have are integral factors to feeling your best as you age. Healthy function of the mitochondria, the power houses of our cells, is important for maintaining muscle strength as we age. As we get older, our cells have reduced ability to activate mitophagy, a quality control process cells use to remove damaged mitochondria. Celltrient Cellular Strength products contain cellular nutrient Urolithin A ( UA), which can help to activate mitophagy and support mitochondrial health. (UA is made by Amazentis, a company invested into by Nestle. They also have exclusive rights to UA) |

|

Protection

|

Glutathione is a powerful antioxidant that plays a crucial role in the body’s defence against oxidative stress. Glutathione can also help to support immune cells. Celltrient Protect dietary supplements help to replenish amino acids important for making glutathione when you need it. (Nestle used to sell a branded version of glutathione called Pruvin and knows this supplement well. Unlike NR and UA , Nestle has no exclusivity on the supplement. |

Tru Niagen and Urolithin A are the cornerstones of the Celltrient range with Nestle having some exclusive rights on these two products. Nestle owns a stake in the company that makes Urolithin A and Chromadex has given Nestle limited exclusivity to the medical nutrition category.

The Celltrient Strength (Urolithin A) and Protection (Glutathione) are in pill form but the Energy product (i.e. Tru Niagen) is in sachet. This is a good strategy to avoid cannibalizing Tru Niagen sales.

At this time, Chromadex only provides Tru Niagen as an ingredient to two companies besides Nestle, being Thorne and Life Extension. These are gold plated brands in the supplements industry, and used by medical practitioners, professional athletes and their trainers. As with Persona, such brands are expected to create new net demand by using unique channels to reach untapped customer bases.

The Nestle Deal: Fairly Incredible

Celltrient is an initial product, and part of a larger Nestle deal that looks fairly incredible for Chromadex. The sales agreement with Nestle delivers everything a smaller company would wish for - sales, co-marketing, access to a new and controlled distribution channel, and the endorsement of a company trusted enough that it sells billions of tins of baby formula.

This is not the reason why I call the deal “fairly incredible”. The reason is that the terms of the Nestle/Celltrient deal are remarkable for a company with 0.1% of the market value of its counter party:

- Branding: Nestle will use the Tru Niagen branding, which is reminiscent of the wildly successful “Intel Inside” campaign that put this NASDAQ bellwether in the spotlight for the first time.

- Share of Gross: Nestle buys Tru Niagen at a fixed price, and pays a percentage (“low teens to high single digits”) on sales. The contract might have CEO Rob Fried's fingerprints on it as his movie producer past would surely have given him a keen appreciation of the value of gross.

- Halo: The exclusivity granted to Nestle might not even be 5% of the total available market, being limited to Medical Nutrition. The halo of the Nestle endorsement of Tru Niagen will extend to every market segment though.

- Sales: Nestle cannot under dose the product, the agreements specifies a minimum use per serve. The Celltrient product has 250mg per serve, which is close to the Tru Niagen bottle recommendation.

This is an excellent agreement for Chromadex but still a good deal for Nestle. They have secured access to a second proprietary and highly promising compound, and thus have built a decent moat against copycat products. This allows them to invest with more confidence in building a large new business.

A summary of the Nestle-Chromadex relationship is available in this investor presentation on p39.

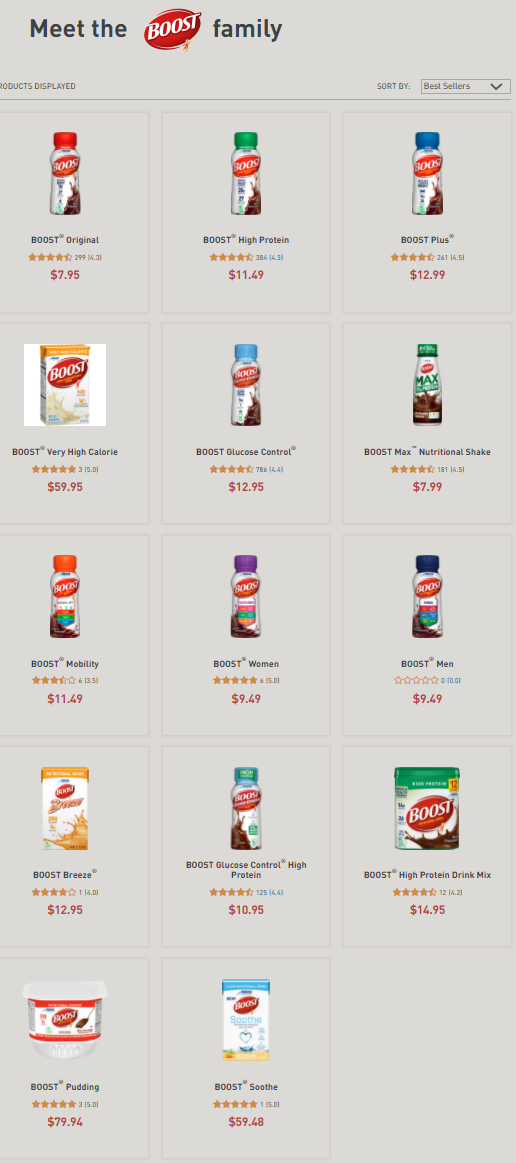

PERSONA VITAMIN SUBSCRIPTION

Persona is a Nestle-owned vertically integrated vitamin service. An enterprising investment bank might try to pitch as a VAAS (Vitamins as a Service TM).

Persona has its own medical panel to evaluate supplements, as well as a dedicated portal for medical practitioners. It uses an online, direct to consumer model based on a slickly designed heath assessment survey, which asks questions on age, conditions, complaints, medications and so on. You can look at, or even complete, this 5-minute survey here.

Supplement recommendations are based on responses. Tru Niagen is one of the vitamin recommendations that can come up.

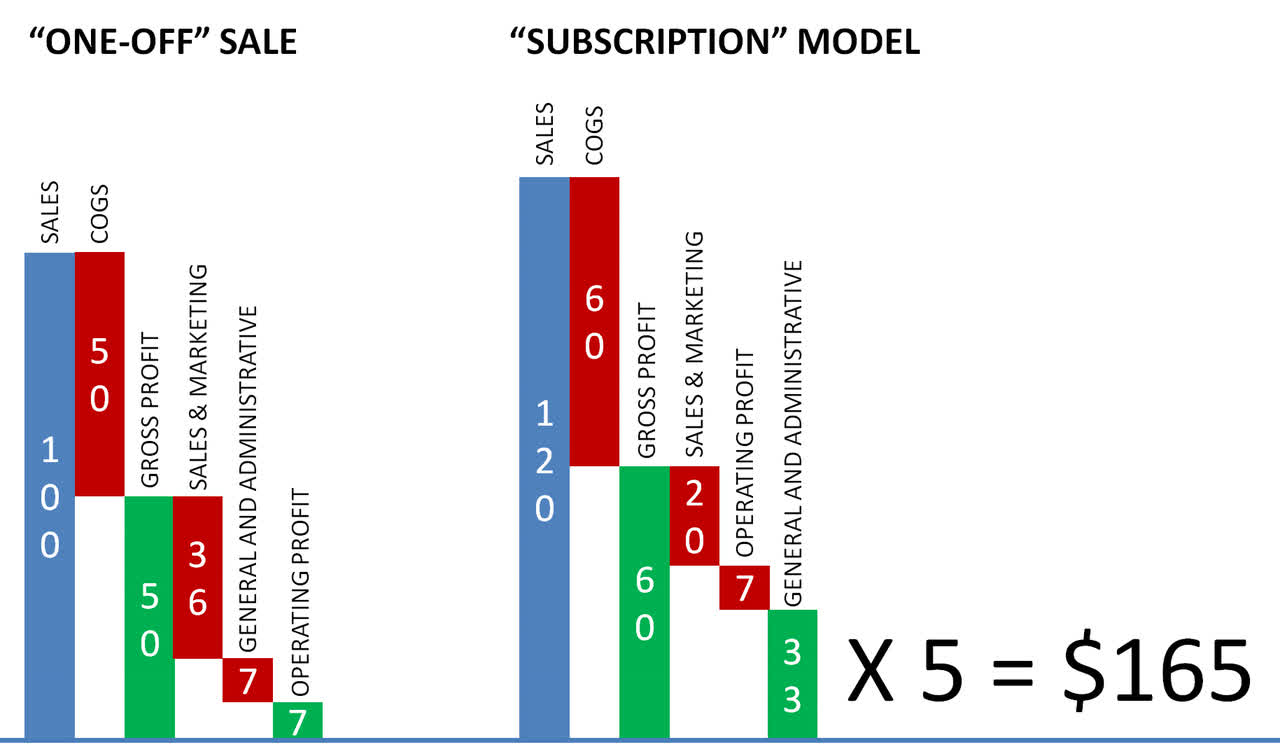

Nestle, a master of the strategic, built Persona by combining its $2.3b acquisition of Canadian vitamin manufacturer Atrium in 2017 and last year’s purchase of a Washington based start-up of the same name. Combining these two businesses ingeniously build a cashflow generating machine from a business in an industry where high sales and marketing costs wash out the benefits of high gross margin (~50% on average for both items).

In the simplified model below, based on the assumptions of an “up sell” (i.e. additional vitamin sales of 20%), dropping the sales and marketing costs though the consumer direct model and having repeat purchases boosts profits enormously ($165 vs $7).

Source: Analyst

Significance of Nestle

A look at the polished “MyAACD” website suggest that Nestle is willing to spend plenty to make this the foundation of a long term business. In firms of Nestle's size, you can be fired for bringing in “just” tens of millions of revenue in a new business.

Assuming Nestle Health Sciences wants at least 1% of its existing revenues (~$5b) for new brand, this implies $50m p.a. sales for Celltrient.

Brand Impact Larger than Financial impact

Nestle paid an upfront exclusivity fee of $4m which is amortised of over 3 years (presumably just over $100K/month from October 2020) and there are market launch fees amounting to a maximum of $2m, with milestones that might result in another $0.5m or so this year.

Assuming Celltrient Energy (i.e. the Tru Niagen product) accounts for a third of Celltrient’s sales, this is $17m of gross revenue, which works out to 8 million serves, at $2 a serve (retail price is $35 for 14 serves, but small discounts are available). A serve of Celltrient Energy has 250mg of Tru Niagen, so that is 2 million grams of Tru Niagen. (I’m rounding throughout as it’s nonsense to imply precision to rough estimates.)

The cheapest way to buy Tru Niagen is a six month subscription, which works out at $3.60/gram. With a gross margin of 55%, this implies a production cost of Tru Niagen of $1.60/ gram. This is for the packaged, shipped-to-doorstep retail product. As a bulk ingredient, the production cost is likely more like $0.80-$1.00 a gram. This number is also in the range implied by Court documents that show Chromadex’s bulk prices.

Assuming that Chromadex sells at a low-ish 25% gross margin to account for volume and the price to Nestle is $1.25/gram, 2 million grams would being in $2.5 million in sales (<3% of this year’s sales for Chromadex) and $0.6m in gross profit, with around another $0.8m in royalties at the assumed rate of 5% of Celltrient Energy sales. Adding these numbers to the exclusivity and launch fees still leaves us at about $2m of profit for a full year.

The impact on the last quarter of 2020 will be far less given sales are not at full scale, and these are annualised figures.

Why then is the Nestle deal so important? It’s because it makes each of the three pillars of our investment thesis sturdier:

- Independent Validation of the Science and Marketing: Nestle validates both the science and marketing story, and will help increase awareness of Tru Niagen with its marketing and distribution power.

- Independent Validation of the Safety: Nestle has its own highly capable scientists and doctors that have, doubtless, given a clean opinion on safety

- Independent Validation of the Patents: Adds to the due diligence on the IP portfolio which Horizon Ventures surely had done

The deal also brings the following benefits:

- Adds to sales and profit: Brings Chromadex one step closer to profitability, and would make it one of the vanishingly small number of small, high growth companies that is also profitable.

- Helps build economies of scale. Additional sales volume allows greater economies of scale that reduces the unit cost of making NR. Tru Niagen is expensive compared to many supplements and could be in a highly price elastic range where a smallish reduction in price could disproportionately increase sales.

- Reduce knock-off imports: Price reductions will also help fend off copycat products from sources such as Alibaba. It’s anyone’s guess which product there is safe, pure or even NR. Nonetheless it is intriguing that many of the listed NR products are not exactly dirt cheap, with many priced above our estimate cost for Tru Niagen, and some even priced above Tru Niagen’s retail price. Tru Niagen is of course a far safer choice, being US manufactured and quality checked.

Nestle will naturally ramp up marketing if the response to NR to Celltrient and Persona are good - it didn't get 30 brands that have over a billion dollars sales a year by chance. Illuma, a milk power with “Nutrisorb” for calcium absorption, is an interest example of how damn effective Nestle can be at selling products.

Nestle also has brand management nailed down to a fine art. They work with top agencies, using Wallace Church for the launch of Celltrient, and specialist consultants seem to have also have been brought in for test marketing.

These pedigrees show in the genius branding of “my AACD”. Using six letters, we subliminally admit to an illness we’ve never heard of, using an acronym that rips off the tongue. The similarity of the disorder with the first sounds we all learn (“A-B-C-D”, you know the rest) and subliminal association with an existing disorder – OCD – is superlative.

The marketing copy also has tweaked the result to “soon as two weeks”, a minor change from “as little as…” but it’s such attention to detail that makes the brands great.

Celltrient’s marketing collaterals are full of vivacious, glowing seniors (Kelly Ripa and proto silver foxs) and they have also chosen an old-school approach of packaging in foil packets, familiar to many older people. In Nestle-speak, these are rebranded as “tip-in dissolvable packets”.

Many of the target customers may have taken ulcer medication in a similar packaging, in the 1980's and 1990's. Barry Marshall who discovered the cause of ulcers, helped kill off much of the ulcer medication market. It’s interesting to note that his theory which led to a Nobel Prize was regarded far more sceptically that NAD today. As a small aside, I met him years ago, and he’s the laconic and tough minded guy that it helps to be when changing the world.

Celltrient as the First Product

Without speculating too much on the many future possibilities, Nestle has a patent on a mix of NR and a ketone precursor (MCT oil, a faction of coconut oil is the best known ketone precursor).

Preclinical trials have suggested that both products may be therapeutic for Alzheimer’s disease, and Rudy Tanzi, Chromadex Scientific Advisor and Mass General Vice Chair of Neurology, is conducting a clinical trial on this. He knows the Patriots quite well too. (BTW, anyone expecting the Patriots to endorse Tru Niagen for free is admirably optimistic about modern marketing.)

The combination of NR + MCT is plausible given the cellular energy effects of NR and the fact that ketosis (burning fat for energy) appears to have evolved to allow our bodies and brains to function when we are glucose depleted.

Indeed, this paper which just came out in PNAS, a leading journal, suggests that from as early as age 47, energetic crises disturb brain network stability and may be implicated in the dementia onset.

Nestle has also conducted fairly extensive studies, undoubtedly costing many millions of dollars into malnutrition of elderly hospital patients. In one study, it identified 20% of patients as malnourished and treated with proper nutrition to lower morbidity, reduce complications and result in superior treatment outcomes. This study suggested that for every 2,000 patients, 40 deaths and 25 complications could be avoided if the patients were properly nourished.

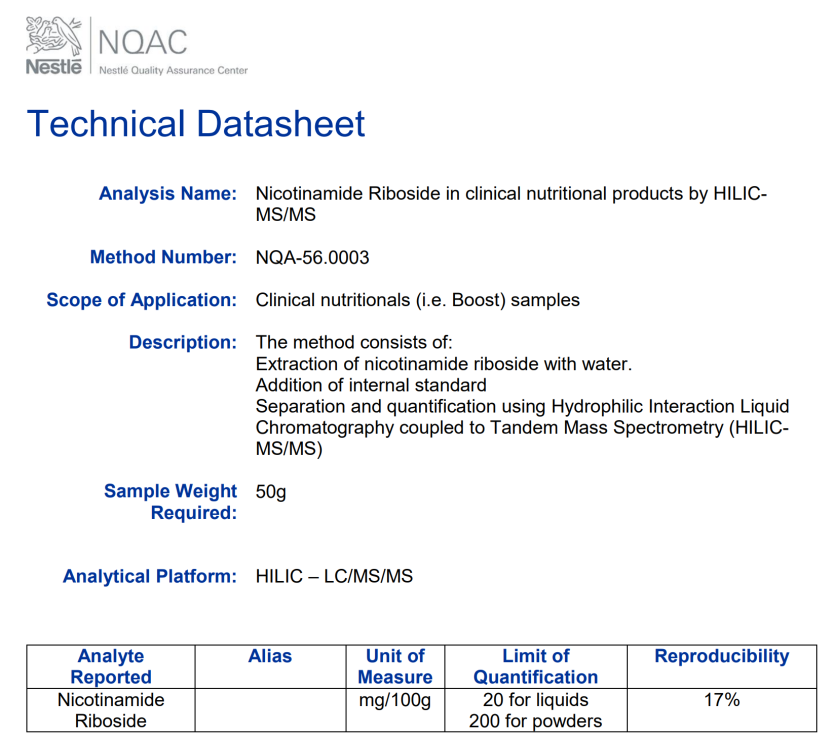

The first Nestle-Chromadex collaboration was intended to be a “Boost + NR” drink, but NR is not very shelf stable in liquids. This is being worked on and a patent has been filed for an encapsulation method, which appears to be a “proof of concept” rather than commercial ready solution. Until solved, the work-around is to sell Tru Niagen as a sachet dry powder to be added prior to drinking.

Nestle has dedicated teams to sell to hospitals, and it would not be surprising to see a Boost type product in the future for hospitals, hospices and home care, as well as general elder care.

|

Patent number |

Nestle-owned Patent |

|

WO2019242983 |

A composition can treat or prevent at least one physical state selected from the group consisting of oxidative stress, a condition associated with oxidative stress, a reduced level of glutathione, and a condition associated with a reduced level of glutathione, in particular neurodegenerative disease, depression, anxiety, decreased /low motivation, impaired cognitive function, mild cognitive impairment. The composition contains an effective amount of a combination of a Nicotinamide Adenine Dinucleotide (NAD+) precursor and at least one ketone or ketone precursor (emphasis added) |

Source: Nestle Websites

CHROMADEX: THE THREE PILLARS

OWN THE SCIENCE

Visitors to Yosemite (Fried and Brenner certainly amongst them – see FAQ: Cast) will have seen the many fallen sequoias trees, felled after thousands of years of growth. As mighty as these trees look, their root system is shallow and they are vulnerable to even a single storm.

Chromadex: Planning for a happier ending than this Redwood

Chromadex is executing in a way that shows it plans to avoid this type of fate by having roots deep enough to handle what’s thrown at it. In concrete terms, this means proving the benefits of Tru Niagen with research, having a strong brand and reputation, and making sure its patent position is strong.

Despite what investors believe, management of listed companies usually have limited influence on their share price. The best way to judge management is how well they execute on stated priorities. Investors that don't like the priorities a company decides to set may be happier in another stock.

Let’s look at the first slide in the investor pack, with shows nine management priorities, in three categories. We rate these according to how well they are doing.

CHROMADEX MANAGEMENT PRIORITIES

Source: Investor Presentation

THE GREAT

Chromadex has done the foundational things well, and should be applauded for this – doing the right thing in the right order, and generally doing them well.

• Build upon & protect our intellectual property

It’s probably no coincidence the first item is ensuring the IP is strong. CEO Robert Fried made his bones in Hollywood (see FAQ: Cast) and clearly understands IP. He has taken a strong approach to patents and their defence, invariably reaching for top shelf legal talent. This is a strategy consistent with establishing a position too strong to assail with impunity.

The pre-millennium movie “ The Untouchables” has a scene so talked about that almost everyone old enough remembers it. The scene dramatizes an actual event where Al Capone holds a banquet and dealing emphatically with a few rogues in his organisation (emphatically being an adjective for one of the ways a cranium can provide feedback to a baseball bat)

For people of an age who have only seen Robert De Niro when he’s yukking it up with Anne Hathaway or at Nobu, you can watch the scene here (warning: it’s definitely PG, and probably R rated).

I’m not suggesting for a moment that Fried, who has won a Christopher Award, is predisposed to violence. Nonetheless, a background in Hollywood presumably informs of the power of being emphatic, and of public deterrence.

Progress to goal:

20+ patents and patent pending on NR

A high powered General Counsel, along with Chairman Frank Jaksch, lobbying the FDA for tighter enforcement of existing rules in the supplements industry Engaged top tier legal talent to fight a patent infringement suit with Elysium ( see Section: Patents for more)

• Invest/partner for quality research

Progress to goal:

200+ research studies

Many top tier institutions

• Strong Global Partnerships

Progress to goal:

Exclusive supplier of NR to Nestle. WR Grace (NYSE: GRA) as exclusive supplier, Watsons/Superdrug distribution, a huge retail chain in Asia and Europe (see FAQ: Cast)

• Regulatory Approvals

Progress to goal:

Marketing approvals with the FDA and its equivalents in the world’s toughest markets – i.e. US, EU, Canada and Australia. Almost no-one is getting approvals in China, so this is still rated “great”, as you can only do what’s possible (see FAQ: China for more on this)

PENDING

New market launches and Brand awareness

New market launches have been impressive, though some have been delayed due to COVID-19, which has made negotiations with distributors and planning trickier. Regulators are presumably also being slowed by COVID-19 related matters. The brand awareness of Tru Niagen is low, mostly because Chromadex is saving its marketing dollars in advance of building its base of research to make claims upon. This is discussed in the Section: Why Don’t They Make Stronger Health Claims Tru Niagen’s “Blue Bottle” branding is distinctive and premium. Old school too, which may be a recurring theme with how Chromadex does things.

New Market launches: Progress to goal

Direct sales in US, Australia, NZ, HK, Singapore. Also started limited sales in UK this year, cross border sales in China, Japan, France, Germany, Spain, Italy Unannounced, but seems to be entering Latin America, based on this Celltrient website (Chromadex’s SVP of Sales Alberto Bottene seems to be an excellent guy to do this). Launch of Nestle Celltrient line.

Brand Awareness: Progress to goal

Some nicely targeted, but still low key marketing through channels like Fox, Bloomberg and Reader’s Digest (“geezer” market), some lifestyle sites like Goop, and endorsements from people like Dave Asprey (Bulletproof coffee/biohacker), Dr Drew (MD), Shannon Sharpe and Gabrielle Reece (world class athletes turned celebrities). Some signs of a widening envelope – pals of Joe Rogan as of the time of writing. Brand awareness is small due to conservative health claims and a strategy to take control and reduce distributors and sales outlets.

Build a fundamentals sound business operation

Chromadex’s core management team is very well qualified, with experience playing in the big league that is far greater than typical of a company of its size.

MANAGEMENT TEAM

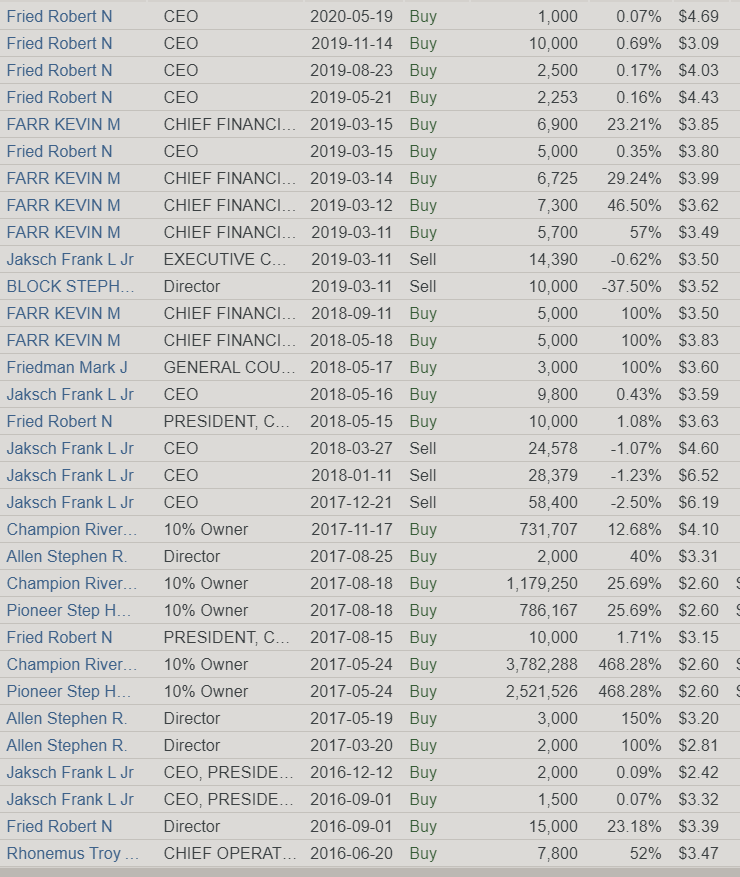

It's also nice to see relatively little insider activity. There have been some purchases from Robert Fried (CEO) , Kevin Farr (CFO) and Mark Friedman (General Counsel), and small amounts of selling by Frank Jaksch (Chairman) and Stephen Block (NED).

This suggests that management is focused on execution rather than short term objectives.

Source: https://fintel.io/n/us/cdxc

FINANCE AND OPERATIONS

Overall, nice:

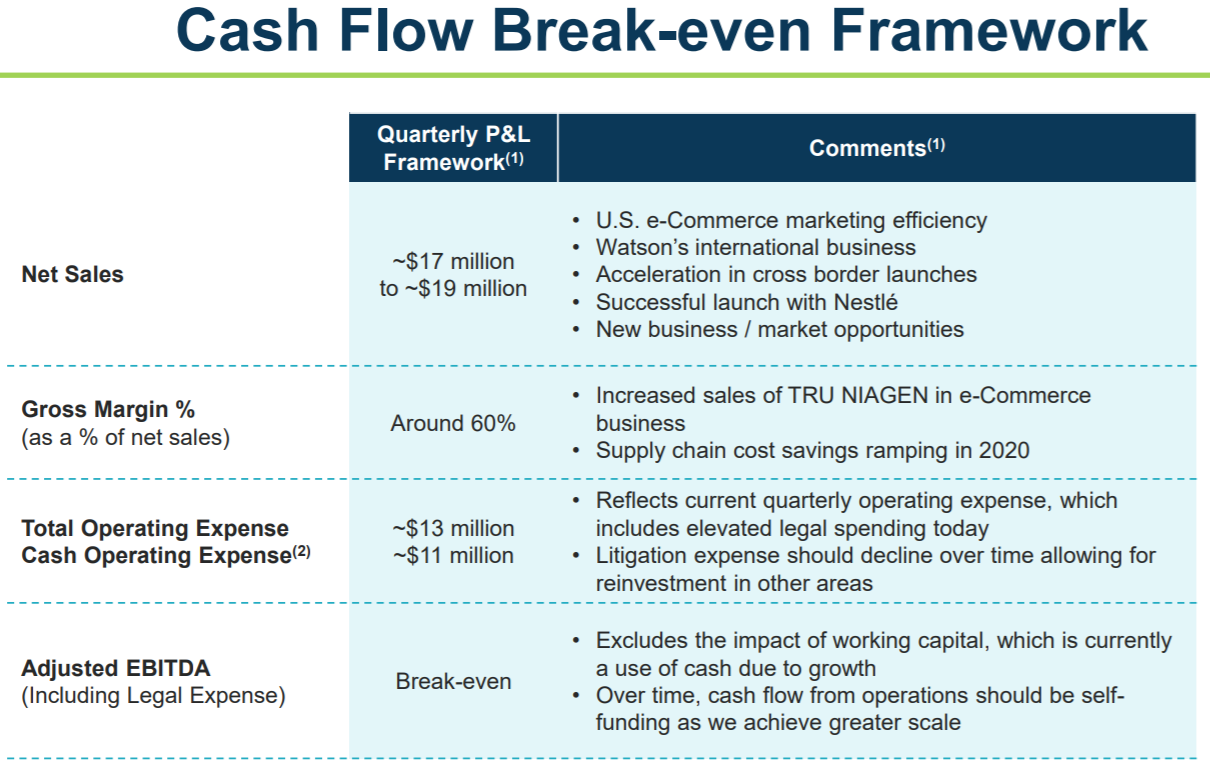

- Chromadex’s operations have been set up to easily scale and appear to be able to double or triple its revenue without adding much more overhead (calling it scalability in this day and age, risks being met with an “OK Boomer”).

- Achieved approximately operating cashflow breakeven and will likely have its first profitable quarter in 1H2022

- Decent balance sheet – no debt (i.e. its net cash), 2+ times current ratio

- Established a $50m “At the Market” Sales Agreement with B Riley FBR and Raymond James, which is untapped at the time of writing

- Boosted research on NR and saved many millions in research money through its Tru Niagen supply agreements to external research parties

Source: Chromadex

PENDING

The remaining items are lumped together as they all depend on solid science to take off.

Successful clinical studies will allow Chromadex to progressively make stronger health claims, and larger studies (say 300-400 patients) with positive results in any of their research areas would make a huge change to how aggressively they can market.

The liver fat study and the COVID-19 Phase 2/3 study are possibly the most important of the more imminent studies. Dr Brenner tweeted in October he is reviewing promising early results on fatty liver improvements.

Educate Consumers on health benefits of Tru Niagen

Progress to goal

There is no hard data available, but awareness of NR seems to be less than 1% of the general public and even for medical professionals probably less than 3%. Successful clinical trials will change this (mice studies don’t make for good clickbait). That said, NMN – another NAD booster which has many times the awareness than NR, something that seems to be entirely due to one man (see Cast: David Sinclair)

Increase focus on earned media

Progress to goal

There are some podcasts and news stories, but mostly no truly mass media. This might be due to conserving gunpowder for when there's a strong story to tell.

Source: Chromadex

Lead by example – innovation, science and safety

Progress to Goal

Chromadex places a premium on safety (e.g. recommended dosages are far from aggressive) and makes only science-backed claims. Also lobbied FDA for greater enforcement of its own rules for supplements.