Jason Wee, CFA, (photo) a Best World shareholder and a former head of equity research at CLSA, contributed this article to various media. (His previous article was BEST WORLD: Investor gives his take on BT article)

Jason Wee, CFA, (photo) a Best World shareholder and a former head of equity research at CLSA, contributed this article to various media. (His previous article was BEST WORLD: Investor gives his take on BT article)

| On Best World International, SGX, Business Times and the long road ahead On 23 Jul 2020, PWC issued its final audit report on Best World International (BWI). This was swiftly followed by Marissa Lee’s article on 30 Jul 2020, which referenced two of the most incendiary terms in financial literature, namely Enron and Fraud, before assembling selective facts and concluding that BWI’s founders should assist minority investors by offering to buy them out. After much thought, I decided to take this opportunity to discuss matters from a broader perspective, instead of just focusing on this rather narrow-minded and misguided article. My aim is to share my evolving thoughts on various dimensions and go through BWI, SGX and finally the Business Times (BT) in turn. |

| On BWI: My personal journey |

To put this entire article into context, I thought it would be best to share my personal journey and various interactions with and thoughts on BWI over the last 15 years.

It was late 2005 when BWI first came to my attention. I was then the head of small caps research across Asia for a global investment bank.

BWI popped up as I was scanning Asia for companies exhibiting high capital efficiencies, robust balance sheets and a significant revenue exposure to the Asian consumer.

At the time, BWI fit all three criteria: the ROE was comfortably above 30%, the balance sheet was cashed up post its recent IPO and it was a direct consumer play into the Singapore and Malaysian markets.

Two issues restrained my enthusiasm : First, it was a micro-cap (sub-US$100m market cap) and hence, too small for most of our clients, and

Second, it was in the Direct Selling business, an industry that was too similar to Multi-Level Marketing (MLM) and thereby tarnished by all the associated negative fly-by-night, hard-sell tactics imagery.

| "I decided to become a member of BWI and a couple of its competitors in order to better understand the business model and challenge my own negative bias." |

After a few weeks, I quickly realized that while the seminars organized by these companies were, indeed, mostly hard-sell product/sales talks, there were various other events which helped members learn more about the fine art of selling – a skill that many Singaporeans sorely lack.

They also helped many learn about business planning, team-building and other people skills.

These made me see another side of this industry. Reading deeper, I realized that most of the issues with MLM businesses involved excessive compensation given to the acquiring of members (eg forcing new members to pay a huge deposit or make a large purchase) instead of simply getting commissions from product sales.

After waiting the requisite cooling-off period post my initial recommendations, I decided to acquire a small stake.

Gradually, my small stake grew, and finally peaked at almost 1.3% in early 2010, actually nudging me into the top 20 shareholders list.

By then, I had retired from the financial world, but continued to diligently attend quarterly briefings with management.

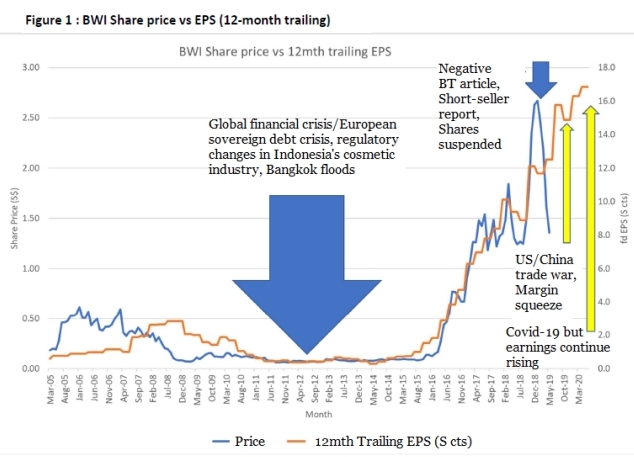

Unfortunately, almost immediately after this, BWI’s fortunes succumbed to various challenges. There were the lingering effects of the global financial crisis/European sovereign debt crises, regulatory changes in the cosmetics industry in Indonesia, unexpected Bangkok floods, etc.

Healthy earnings reversed into losses for BWI by 2Q/3Q2010.

Healthy gains in my BWI stake quickly turned into massive losses. I had held on in the belief that management would ultimately gain headway into the massive China market.

Alas, it continued to prove challenging. So, even as management affirmed that they were continuing to develop the groundwork there, I decided it was time for me to move on.

I sold off my entire stake at 6-digit losses. I did not blame management. This is part and parcel of the risk one takes when investing in the world of micro-caps.

Throughout our many meetings over the previous five years, management was always very candid, despite being annoyingly long-winded at times, and not always giving me all the answers I wanted (due to limitations on what they were allowed to disclose).

Despite management’s best efforts, industry headwinds, I thought, will overwhelm the company.

Sometime in April 2015, BWI was brought back to my attention. A student from my investment class submitted his analysis on BWI for my vetting, and explained that BWI was making headway into the China market.

Upon further analysis, it was clear that China’s revenue contribution was starting to make an impact. This massive opportunity, that I had previously written off, was finally coming through.

I decided to become a shareholder again, at prices many times above my exit price.

| On the recent challenges |

In early 2019, BWI suddenly faced a credibility challenge from two sources. First, on 18 Feb, the BT published a report entitled “Sales of DR's Secret in China: Best World's best-kept secret?”.

The article essentially questioned the existence and/or actual size of BWI’s China business. This was followed a few weeks later, by a short-sell report from Bonitas Research (BR) arguing the same thesis, albeit using more credible and coherent analysis.

This attack on the credibility of BWI’s strongest growth engine had the expected impact of denting BWI’s then stratospheric share price trajectory.

A trading suspension was followed by an independent review exercise by the company, which was later expanded beyond the original allegations.

| The final independent audit report was released on 23 July 2020, and directly addressed the main allegation against BWI in addition to looking deeply into the relationships of all parties involved in the China business. |

Essentially, the auditors were able to “independently trace such sales from BWI to Qingdao Beihui and Changsha Best during the period from FY2015 to FY2018 to BWI’sunderlying supporting documents … as well as trace these sales to cash receipts based on the Company’s bank statements. The Independent Accountant noted that the Company’s sales to the two import agents appear to be valid and supported by sales and delivery documents.” [Item 1.1 of Key Findings].

This single point alone repudiates BT’s 18 Feb 2019 report.

The second major allegation related to the legality of BWI’s Franchise Model. This is addressed in Item 4 of the Key Findings.

The legal opinion obtained essentially says that “the Franchise Model is in compliance with applicable franchise related laws and regulations in China, but that certain features of the Franchise Model may pose potential risks under other laws in China.”

Therefore, the Board has decided to transition to Direct selling in China and work with legal advisers to mitigate all risks to the Group’s China business.

Interestingly, BT followed up this final audit report issuance with another scandalous report, entitled “Best World founders should make exit offer to minority shareholders”.

In the report, Marissa argues that Changsha Best, an entity majority-owned by the brother-in-law of a BWI founder, should be considered a subsidiary.

| (If Changsha Best is NOT a subsidiary, every element under Marissa’s long winded musings on what BWI should control or not control, should know or not know, falls apart). |

Yet, the reality is that an entity owned by a brother-in-law does not constitute control. Has anyone ever tried to insist that they have control over their brother-in-law’s business? The idea sounds ludicrous.

Even on the concept of related party transactions, the truth is that while the layperson would consider a brother-in-law a related party, the law does NOT.

Marissa appears to be on the wrong side of logic and the law on her musings on this aspect.

Stepping back from the micro-arguments and allegations, the final paragraphs which appear like an attempt to shame the founders into privatising the company ring hollow.

As a shareholder, the current suspended trading status for BWI is a little annoying, but not a major issue, as long as one takes a long-term view, of course.

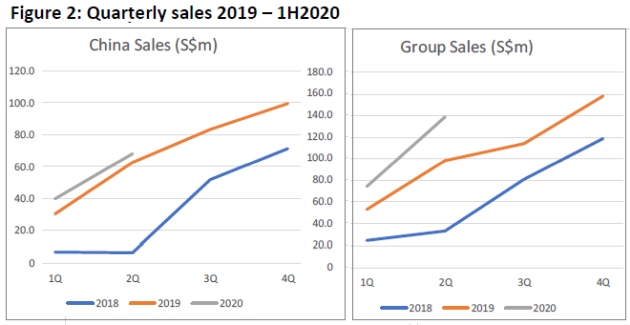

BWI has continued to provide updates to shareholders. Also, despite having to redirect resources to assist in review and the twin challenges of the US/China trade tensions (which has raised tariffs on BWI’s made-in-America products) and Covid-19 pandemic, BWI has actually been growing from strength to strength.

Investors with a shorter-term time frame have clearly been inconvenienced by the long suspension period.

Short sellers are probably the most impacted given the extended holding period for their negative bet.

As a long-term investor, I am rather concerned that BWI might actually pursue privatisation. This concern has nothing to do with Marissa’s article.

It stems from the fact that if I were still an investment banker, I would be making a robust case to BWI’s directors to privatise the firm, and relist on another exchange where analysts, journalists and investors are comfortable with consumer business models in China and therefore, more generous on their valuations.

After all, based on the last four quarters, BWI generated free cashflow of approximately S$73m.

Using the closing share price of S$1.36, the minority shareholdings would be worth some S$393.9m.

Given net cash S$228m on the balance sheet, management just needs another S$165m to fund a privatisation.

This can be easily paid back within 2 plus years (S$165m / S$73m) from the free cashflow, and that’s assuming no growth.

Of course, the actual numbers will depend on whether negative views from journalists and analysts will suppress BWI’s post suspension share price and make a potential buyout exercise even cheaper and easier.

| Looking ahead |

Looking ahead, BWI management should still be wary of short sellers, lest there be a repeat of the one-two punch from BT’s Marissa Lee and short seller Bonitas Research.

The other challenges remain the same as it has always since BWI’s beginnings in 1990:

| • Product: Continue to enhance current products and brand image and broadening the product range beyond the Dr Secret’s range. • People: Strengthen and deepen the core sales leadership teams and expand/extend their reach into the various geographies • Systems: Improve the controls and efficiencies across the entire network by leveraging new communications and information technologies, payment systems and team management tools. |

I sincerely hope that BWI will stay listed, and/or, allow those who share in BWI’s vision to remain vested even if BWI chooses to privatise.

After all, the same three criteria that brought BWI to my attention in 2005 are now evident again, specifically, a high capital efficiency (38+% based on last 4quarters), a robust balance sheet (S$228m net cash!!!) and an exposure into the growing Asian consumer (Note: most recent quarters actually saw growth across all major markets despite theCovid-19 pandemic, with Indonesia being the notable exception).

Given these characteristics, the trailing PE multiple of 8.2x (using closing price of S$1.36) is simply too attractive for me.

| On SGX: |

On 9 May 2019, the SGX suspended the trading of BWI shares, and thereafter took charge of the review to look into allegations of wrong-doing made against the company.

The scope of the review was expanded and the final report has just been issued some 15 months after this suspension.

Hopefully, this extreme vigilance taken by the SGX will pre-empt another attack by short seller Bonitas Research.

But then we already have BT’s Marissa launch her first assault post this final report. It might well be that BR is just waiting in the wings for their turn.

So, how do short sellers work? First, they are no charitable organization grounded on principles of truth and morality.

They are simply another capitalist construct created to make money from declines in the share price of their targeted companies.

There is no doubt that they can be healthy for a properly functioning stock market by providing a strong check against companies behaving badly.

But they don’t always get it right, and in some jurisdictions, companies and shareholders have pushed back against these attacks with some success.

The following are some criteria whereby short-sellers decide on potential targets:

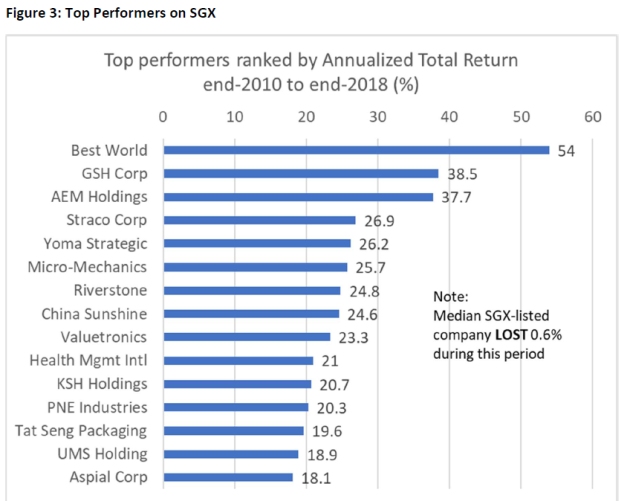

| 1. Find shares which have been rising sharply, and possibly over-reaching. BWI definitely comes up on this screen. After all, BWI was the best performing stock in Singapore in this decade! From end-2010 to end-2018, BWI delivered a total annual return of 54% to shareholders,well above the 38.5% delivered by GSH and far above the median decline of 0.6% delivered by all 513 stocks listed on the SGX during this period (See Figure 3) |

| 2. Next, find a vulnerability. It could be a misunderstood or questionable business model. It could be high gearing. Most importantly, this vulnerability should be sufficiently significant to derail investor confidence. In most cases, the company is highly indebted, and therefore any controversy over the actual business model will shake the confidence of bankers and thereby derail the entire business, regardless of whether the business was actually viable –much like how bad rumours can spur a bank run and bring down a properly run bank. This almost happened to Olam, except that deep-pocketed and long-time shareholder Temasek was able to see through the smoke and mirrors and help Olam regain its footing. In BWI’scase, it was the China business, where the evolving legal framework in China and generally negative bias towards direct selling business models (and fear of MLMs) made for fertile ground to create uncertainty. 3. Next, find the evidence. Use photographs taken at the worse possible moment to accentuate the negative image. Raw scans of official statements with official-looking stamps are helpful. Unfortunately, while this might look easy, it is actually rather tricky to execute correctly and accurately. When I was an analyst, I have only used this technique once: to confirm newsprint expense estimates for Singapore Press Holdings. Even then, while the numbers were directionally correct and generally in the ball-park, it did not give me a dollar-for-dollar match. There can be many legitimate reasons for these differences, and they include timing of bookings or classification issues or additional transport costs or embedded discounts. For the short-seller, however, any difference can be used to highlight potential fraud. 4. Next, make everything sound bad. It is quite strange that even positives can be considered negatives when they are seen in a short-seller report. For example, in BR’s report, BWI actually rewarded shareholders with hefty dividends, which therefore bulked up the total cash payout to the founders. BR artfully highlighted the huge payout to the founders and provided the computations in a numbers-rich table. Also, on page 25 of BR’s24 April 2019 report, they exclaimed that “… Best World exited 2018 with its trade and payables balance at an all-time high of S$95m and its receivables touching all-time lows atS$5.2m.” Any businessman will tell you that a high trade payables and low receivables is a wonderful thing, because it improves your cashflow. Only in a short seller report can this be considered a negative, it seems. |

| Given the above list, BWI was an easy target. What is clear now, however, is that independent auditors given open access to the internal documents have found nothing substantively wrong. |

As an investor, my main concern on the legality of BWI’s China business has been cleared up by the independent legal opinions. Of significantly lesser concern are the inner workings of the China business and how the sales proceeds moved from point to point.

The bigger picture is that BWI has actually been generating cash throughout this period.

During this entire 2015 to 2018, the founder’s brother-in-law actually risked his own funds (S$100k) in the venture.

Now, in 2019, BWI shareholders get to enjoy a revenue contribution of S$275.6m from China, up from S$13m in 2014.

One can quibble over who did what and how. The bottom-line is that if things had gone wrong (knock-on-wood), founder Dora’s brother-in-law could have lost his S$100k. Shareholders did not need to invest heavily, money-wise, to get the China business to where it is today. As to the BT’s headline suggestion that BWI should be privatised, that just adds insult to injury.

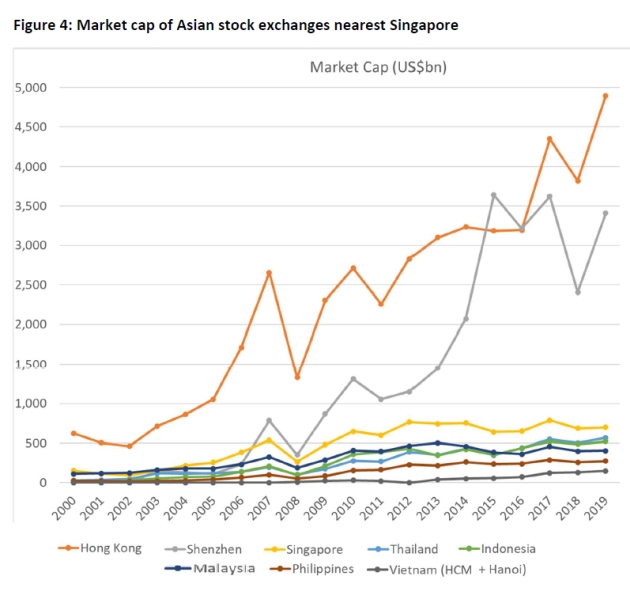

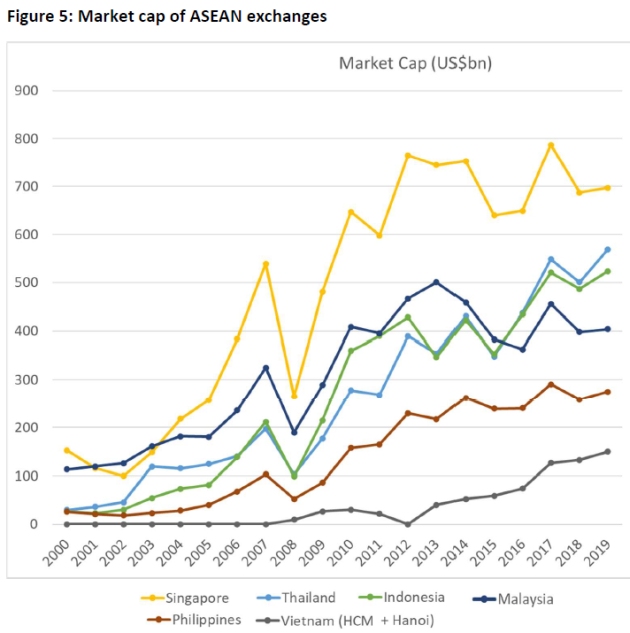

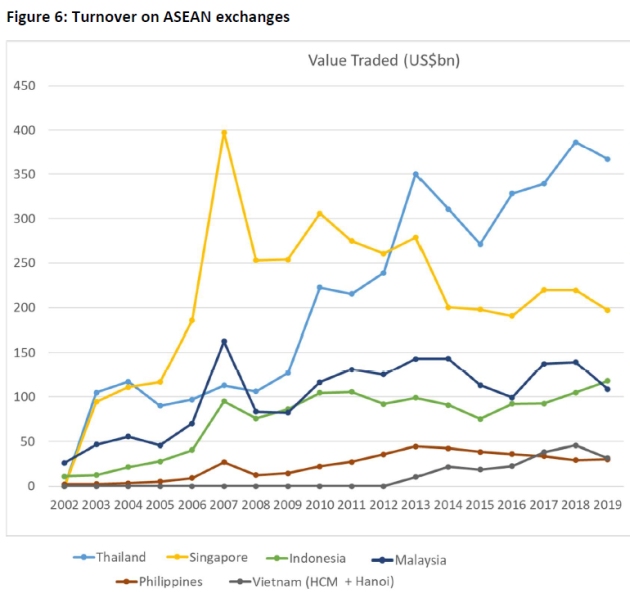

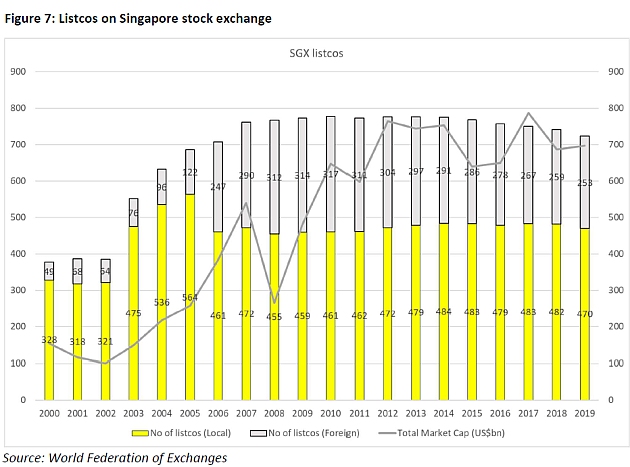

More so given what has been happening to the Singapore stock exchange. (See Figures 4 to 7) The total market capitalization of the Singapore stock market has been stagnating below US$800bn, with under 800 listed entities.

In fact, recent years has seen delistings outpace new listings. Within the region, Hong Kong and the relatively younger market of Shenzhen have far outpaced Singapore.

Thankfully, Singapore remains the largest market within South-east Asia, but Thailand and Indonesia are catching up fast, and Thailand is already much larger in terms of trading volumes vs Singapore.

Given this, to suggest that a true-blue born-in Singapore business like BWI should be privatized deserves a strong push-back. No?

| On Business Times: |

On 1 March 2019, I sent a rebuttal to Marissa’s Feb 2019 article. I ended the note urging that “future journalistic articles are more balanced in content” and to “give our small-mid caps in Singapore some benefit of the doubt”.

The latest 30 July article by Marissa suggests that my earnest suggestions have been largely forgotten. Allow me to explain why this latest 30 July article is at best a mis-interpretation of the Final Audit on BWI, and at worst, a biased mis-representation of the entire review.

On Changsha Best

In her latest BWI article, Marissa explains why she feels that Changsha Best should be consolidated. She goes on to quote the Accounting Standards, which states that control is established “… when an investor has the power to run the business, is exposed to the investee’s variable returns, and has the ability to use its power to affect those returns.”

The operative word here is “AND”. There is nothing in the final audit that suggests the “power to run the business”. Tapping on resources of a larger supplier for accounting, legal or HR advice does NOT constitute control.

In fact, it is a very logical business practise when bigger firms help their younger suppliers in their early years. Instead of focusing on the legalese, perhaps one should understand WHY the Accounting Standards have been reframed thusly.

The question to ask is: “What happens to BWI should Changsha Best fail?” (knock on wood). Based on the shareholdings of Changsha Best and the cashflow and balance sheet reconciliations done, the answer seems to be “very little”.

Therefore, Marissa’s expressed concerns here seem misplaced.

Two additional points made by Marissa deserve some attention.

| 1. The lack of supporting documentation. This actually proves nothing. As long as there is reasonable logic on the cashflows and business operations, companies are actually entitled to the benefit of the doubt. Allow me to give an example. In 2004, I was literally dragged into a meeting to assess if we should support the IPO of a then-smallish company. I had resisted this for some six months because this company had net margins of 1.8%, a net gearing of almost 400% with core operations in the volatile commodities industry, mostly in faraway Africa. This company is Olam International. After my initial fact-finding meeting, which extended into a two-hourlong grilling session, then and current CEO Sunny Verghese managed to convince me that the business was very real and very viable. In the end, I agreed to be a lead analyst for the IPO, but not after requesting proof that the control measures that were explained to me were actually in place. The Muddy Waters attack happened long after I had departed the investment banking industry. In my opinion, the only real issue within the hefty short-sell report, was that Olam needed to reel back on its aggressive expansion plans and leverage. Most of the rest of the report suggesting corporate governance lapses felt more like smoke-and-mirrors to me – kind of real, but not really. The reason I bring up Olam is because the company has a sprawling business that sources direct from the smallest of farmers. Certainly, in 2004, this business required a lot of cash-based transactions, and even forward cash disbursements to farmers in order that they could afford the fertilizer and seed for the upcoming planting and harvesting season. If the independent auditors who were called-in post the Muddy Waters attack had to do the same detailed transaction-level assessment that has been imposed on BWI, the audit would probably have lasted many months longer. I also doubt they would have been able to find black-and-white supporting documentation on these cash-based transactions with sometimes illiterate small-scale farmers in Africa. In emerging markets and many trust-based societies, businesses are still conducted via oral agreements and a handshake. In fact, “oral contracts are valid and enforceable under the laws of China” (See Final Audit note 3.5). 2. Enron. Marissa displayed her knowledge of the Enron fraud by explaining how the company exploited an accounting loophole. Allow me to quote a longer explanation of this loophole from the authoritative case study “Enron and World Finance: A Case Study in Ethics” published by Palgrave Macmillan. These transactions, termed FAS 140 transactions “were used by Enron to monetize liquid assets on (and thus remove them from) its balance sheet, while in fact retaining control over them. This was achieved by the sale of the assets through a number of steps to an SPE not consolidated in its financial statements. The resources of the SPE consisted of borrowings and equity in the proportions of 97 per cent and 3 per cent, respectively. Enron’s continuing control over the assets (and thus also its continuing assumption of financial obligations linked to them) was typically achieved by a Total Return Swap, a credit derivative through which Enron retained most of the economic benefits and risks of ownership of the assets and committed itself to meeting the costs of theSPE’s borrowings. Thus transactions classified as sales were closer to financing and part of Enron’s debt. Enron also recognised as income the difference between the cash proceeds of the ‘sale’ and the carrying value of the assets in question.” Essentially, these transactions were created to hide the true gearing of Enron (not the case in BWI) and generate fake revenue streams (also not the case in BWI). According to this study, FAS140 transactions were just one of eight types of accounting tricks used by Enron to hide the true picture of the group’s finances. After reading the Final Audit report again, I cannot understand what Marissa Lee might be insinuating on what risks BWI might be trying to hide by bringing up Enron. |

This latest article by Marissa resorted to two of the most incendiary words in financial literature for effect: namely “fraud” and “Enron”.

As explained above, the relationship between these two nouns and BWI is tenuous at best and non-existent at worst.

Unfortunately, this article has forever linked BWI to the words “fraud” and “Enron” in the world of automated trading search engines.

One can only hope that the BT editor will be more vigilant in questioning articles which include such catch and incendiary words in the future.

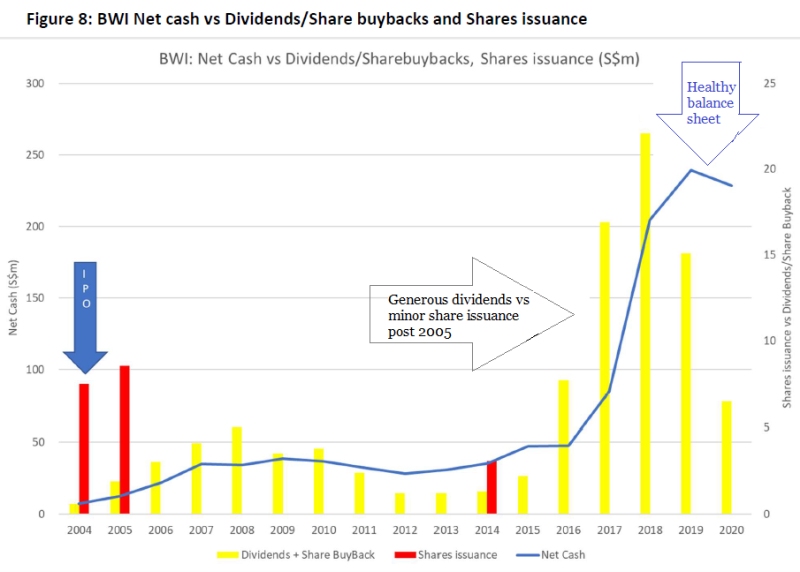

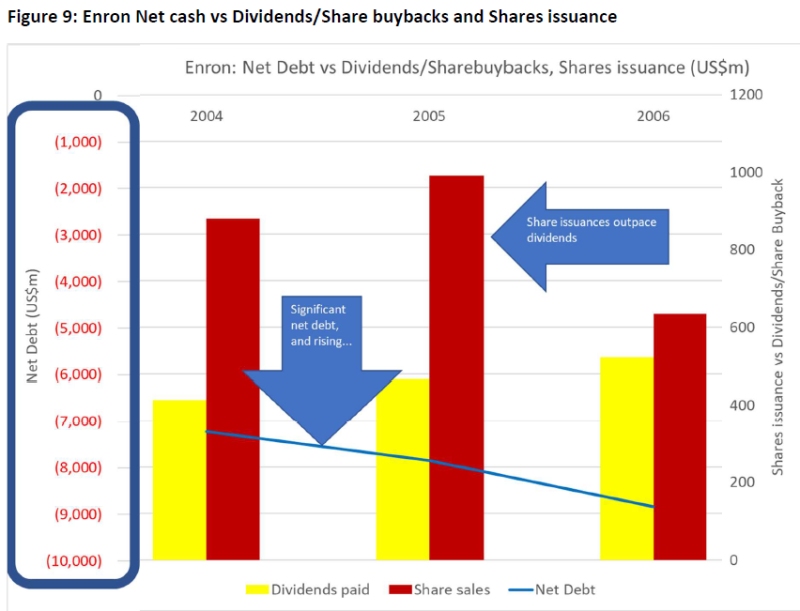

On the other hand, in the court of public opinion, one ungrounded accusation can easily cause distress to peoples or companies. Therefore, analysts and journalists, who can easily influence public opinion with their viewpoints, owe a duty of care to err on the side of caution and remain balanced in their critique. As an analyst, I have chanced across many questionable business models. Noble Group is just one example. After several meetings and casual industry checks, I quickly realized it was impossible for me to provide any type of forward forecasts. Hence I never published a view on the company. By the time the issues were blatantly obvious, to any who cared to analyze the financial statements carefully, I had already left the investment industry. In fact, there is only one case, in my 13-year career, that I publicly challenged one company on their finances, because that was the only time that I felt I could prove beyond reasonable doubt that something wasn’t quite right. B) Second, growing companies that are producing positive cashflows and distributing generous dividends, without the use of leverage, are very unlikely to be frauds. In the past, there have been cases where companies were able to disguise their true cash positions. But now, auditors have all wised up to these shenanigans and this is now much more difficult to execute undetected. Therefore, if you look at the financial flows of BWI (Figure 8), things actually look quite healthy. If one looks at the Enron case (Figure 9), the contrast becomes very clear - high gearing came with repeated debt and new share issuances. |

Source: Enron annual reports 2000, 1999

[Note: Actual debt levels likely worse than what is disclosed]

| C) Third, I always thought the investigative audit into BWI was to check the legality of BWI’s China business, and to allay concerns that there were financial shenanigans that hurt minority shareholders. On both accounts, things look fine. In fact, as management has pointed out, once BWI transitions fully into the direct selling model, many residual issues raised by the audit, will be addressed. I would also add that when all is said and done, the people and entities involved in spearheading BWI’s China business over the last few years, will have left shareholders a very important and growing cash-cow in the form of this China division. D) Fourthly, journalists, analysts and investors should know that BWI has been setting the groundwork in China since at least 2004! The only reason BWI’s China business suddenly grew rapidly in recent years is mostly a confluence of perseverance, experience, and a lucky break in getting the right people just as China evolves to allow more adventurous business models. E) Finally, even though BWI has managed to survive the Asian Financial crisis (pre-IPO), the Global financial crisis, and looks to be riding strong through this Covid-19 pandemic, the road ahead is far from certain. Trade wars, potential product/brand risk due to scandals, people risk due to bad apples misbehaving, poaching of star performers by competitors and changing legal frameworks are all risks that can be messy to deal with. |

Caveat Emptor.

Yours sincerely,

Jason Wee, CFA (Shareholder and retired analyst)

please do congratulate Jason Wee, on my behalf, on his balanced and informative article on Best World, which addresses a specific need for objective analysis,

As an Investor in ,and Believer in the intact prospects of Best World, here is my Feedback, for what it is worth:

1. The Competence and Integrity of the Founders Doreen Tan and Dora Hoan, deserve to be highlighted.

I assume that even Marissa Lee would acknowledge their professional qualities and personal integrity.

She is only suggesting that it might be in their interest to take BWI private, and then quote elsewhere,

( What would be the benefits? Wouldn`t this be opting out of Singapore? and a blow to SGX? and a win for "Muddy Waters"?, and an encouragement to them to repeat the exercise?).

2. What is the Status of the Civil Case against "Bonitas"? Is it still "live" and ongoing?

3. Do we know the number (if any?) of any shares sold short by"Bonitas and the price?

4. Does Jason Wee have a best guess as to if and when the Trading Halt will be lifted?

A successful and even handed conclusion of this incident by SGX ideally by Year End, would ,in my view, benefit the both the reputation of Singapore and of Best World.