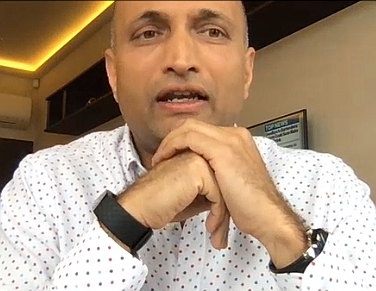

Times were supposed to get bleaker in 2Q for Food Empire, and the company braced itself for the impact from Covid lockdowns. CEO Sudeep Nair in a video conference from Moscow with analysts and investors in Singapore.Instead, the Food Empire brands of instant coffee proved to be resilient and consumer consumption of the beverage hardly altered. CEO Sudeep Nair in a video conference from Moscow with analysts and investors in Singapore.Instead, the Food Empire brands of instant coffee proved to be resilient and consumer consumption of the beverage hardly altered.That's how CEO Sudeep Nair characterised the stronger-than-expected 2Q results of Food Empire in a video conference with analysts and investors. "We thought there would be a very severe impact. Instead the brand which we have is very strong, people's consumption changed only a little bit here and there." (The profit comparison is not straight forward as there was a forex loss of US$2.9 million due to a fall in the Russian ruble in 1Q. But the loss in 1H20 narrowed to US$1.1 million as the ruble recovered some ground in 2Q). Compared to 1H19, Food Empire's net profit grew 1.1% in 1H20. |

Some offerings of Food Empire

Some offerings of Food Empire

Food Empire, as in the past when the ruble devalued, has started increasing the selling prices of its lower-priced SKUs in Russia. The increases will continue in gradual fashion.

Food Empire is giving discounts for certain higher-priced SKUs, according to Mr Nair.

Group revenue in 1H2020 was US$132.9 million (-4.0% y-o-y) on lower sales in Food Empire's No.1 market (Russia was especially affected by a prolonged lockdown) and South Asia.

"It's mainly because of the disruptions of logistics reaching the shops, and regions being cut off," said Mr Nair.

There was no contribution from Myanmar as Food Empire had exited the market at the end of 2019.

This was partially offset by higher revenue from Kazakhstan and Vietnam.

Notably, general and administrative expenses dropped by US$2.0 million to US$16.9 million.

The Covid lockdowns had resulted in lower transportation, travelling and manpower costs.

Other metrics:

|

|

1H2020 |

Change (y-o-y) |

|

Gross profit margin |

39.9% |

+0.9 percentage point |

|

Net margin |

9.9% |

+0.5 percentage point |

|

Net operating cash flow |

US$14.1 m |

+US$0.8 m |

|

Cash and cash equivalents |

US$46.6 m |

+US$8.1 m |

Food Empire could well enjoy a stronger 2H as sales have already recovered to nearly pre-Covid levels in some of its markets such as Russia.

| "Looking ahead, the prospect of intermittent lockdowns, rising unemployment and volatile currency conditions is likely to persist, which may have a negative impact to the Group in the form of lower sales volume. Nonetheless, the Board is confident that the Group’s businesses will remain sustainable, backed by strong brands, experienced management team and a strong balance sheet." -- Food Empire press release |

| See also RHB report: More Resilient Than Expected; Maintain BUY UOB KH report: FOOD EMPIRE: Better Quarters Ahead, Target Now 85 cents |