Excerpts from UOB Kay Hian report

Analyst: Clement Ho

Initiate coverage with BUY and target price of S$1.15. |

|||||

• Revenue stream from multiple industries. Frencken Group (Frencken) serves leading corporations across multiple industries, a wide range of end-user markets and different geographical regions.

Top- (+5.6%) and bottom (+41.1%) lines delivered healthy performances amid tumultuous business conditions in 2019. For the year, we expect a slight revenue contraction of 6.4% as the healthy demand growth from the semiconductor business would be offset by the worsening dynamics in the automobile industry.

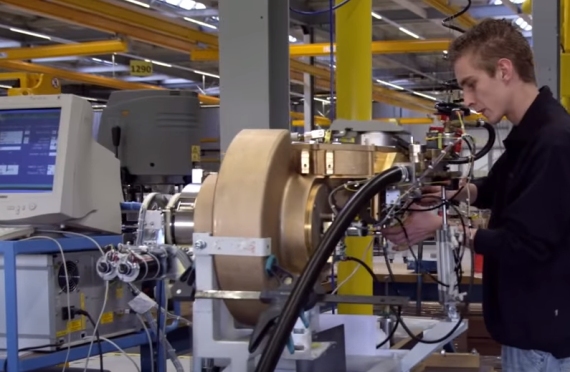

A resumption of orders in the company’s analytical and industrial automation subdivisions is expected to lift 2021-22 top-lines by 8.7% and 9.5% respectively. Frencken is a leader in the field of electro-mechanical assemblies and modules for electron optics and ion optics in applications like scanning electron microscopes (SEMs) and mass spectroscopy.

Frencken is a leader in the field of electro-mechanical assemblies and modules for electron optics and ion optics in applications like scanning electron microscopes (SEMs) and mass spectroscopy.

• Longer-term beneficiary of positive tech sector trends. Frencken is in a good position to ride the positive market trends in 5G, Internet of Things and artificial intelligence.

As a component supplier and provider of modular parts for companies in industries such as analytical & life sciences, healthcare and industrial automation, the group will benefit from higher demand for parts as the technology trends evolve towards mass consumption.

|

Solid recovery in 2021 |

|

“Short-term weakness in net profit. Amid order push backs and supply chain disruptions due to the Covid-19 pandemic, Frencken’s 2020 net profit is expected to fall 8.3% to S$38.8m. However, the favourable business mix would position the group for a solid recovery in 2021-22, with bottom line growth of 5.7% and 25% respectively on improved operating leverage." -- UOB KH report |

• Taking operational efficiency to the next level. Despite expected lower sales in 2020, operating margin should normalise above the 11% range, compared with the sub-9% region in 2014-17, due to cost-cutting measures and efficiency improvements.

Management is still making investments to upgrade its equipment and facilities.

• Supportive balance sheet to weather volatile conditions. As at end-1Q20, its net cash pile of S$92.9m, or 25% of market cap, should help weather any uncertainties in the current demand environment due to the Covid-19 outbreak.

Past the volatile period, we believe Frencken would emerge with a leaner cost structure, which translates into greater operating leverage as revenue normalises.

Shareholders should be rewarded with a consistent dividend payout ratio of >30% of net income, which Frencken has made ever since its listing in May 05.

| • Initiate coverage with BUY and target price of S$1.15, pegged to 12.6x 2020F PE, in line with that of SGX-listed peers, and implies 5.7x EV/EBITDA. We believe current valuations are attractive, given the exposure Frencken has to favourable market trends in the technology sector. Assuming a 30% payout ratio, the anticipated 2020F/21F DPS of S$0.0275 and S$0.029 would translate to yields of 3.2% and 3.4%, respectively. Frencken currently trades at 9.4x 2020F PE and 4x EV/EBITDA |

Full report here.