Excerpts from DBS report

Analysts: Malaysian Research Team, Siti Ruzanna Mohd Faruk, Lee Keng LING

| Extraordinary demand uplift • Escalating global COVID-19 cases support demand surge; industry shortage has led to uptrend in pricing • On course for extraordinary profit growth rates as players ramp up utilization rates and lock-in higher margins • Catalysts: earnings surprises, ASPs increases, increased usage leading to “new normal” demand • BUYs: Top Glove, Hartalega, Kossan, Riverstone  |

Ramping up the utilisation; order backlog extended.

Rubber glove manufacturers are seeing robust demand leading to industry shortages and uptrend in pricing, as global Covid-19 infection rates have stayed high.

We gather the rubber gloves producers are running at utilisation rate of above 90% with the order backlog at 1 year compared to usual 1-2 months.

We raise our sales volume and ASP assumptions for rubber glove companies and forecast stronger earnings growth of 85% for the sector in 2020 (compared to average of 16% over the last three years), as manufacturers ramp up their utilisation in view of the surging demand.

Rubber glove producers under our coverage are on course for record profits.

Expect strong earnings delivery.

|

Riverstone 41% discount |

|

-- DBS report |

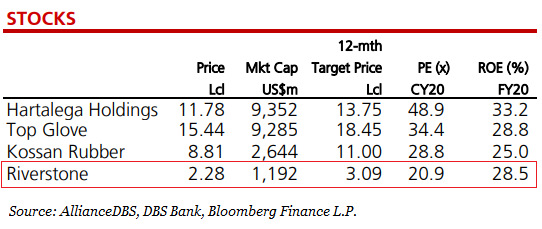

We upgrade Top Glove Corp and Hartalega to BUY in view of the stronger earnings outlook. Near-term share price catalysts include earnings surprises driven by escalating prices and margins.

Every 1% improvement in net margin will increase these companies’ net profit by 5-9% and TPs by 5-9%. We also like Singapore-listed Riverstone Holdings (RSTON) and Kossan Rubber Industries (KRI) for their relatively attractive valuations.

RSTON’s CY21 price-to-earnings (PE) of 20.0x is at a 41% discount to its peers’ average. The stock is supported by a strong balance sheet with net cash position.

| Margin uplift to be earnings kicker and share price catalyst. We expect higher ASPs to be reflected in sequentially stronger 2QCY20 profit. In addition, 2H20 should see a meaningful step up in sales volume and margins compared to 1H20. A second wave of infections from the gradual easing of lockdowns could see glove demand sustained at high levels. Over the longer term, even as infection rates ease, we expect the Covid-19 experience to drive increased usage of gloves globally, sustaining a “new normal” of demand. |

Full report here.