Excerpts from RHB Research report

Analyst: Jarick Seet

• BUY, new SGD0.54 TP from SGD0.73, 42% upside plus c.8% FY20F yield. We cut FY20-22F earnings by 21%,14%, and 7%, and switch our valuation method to P/E in light of the current environment. Our TP is at +1SD from the last 12 months’ average forward FY20 P/E.

As such, revenue recognition could decelerate on project delays and a lower order intake. |

||||

• 1Q20 results preview. CSE’s FY19 revenue breakdown by geography is as such: 61.8% from the Americas, 36.5% from Asia-Pacific, 1.6% from Europe, the Middle East and Africa. In terms of customer segment, 65.1% came from oil & gas, 25.5% from infrastructure, and 9.4% from mining and minerals. MD Lim Boon Kheng. NextInsight file photo Its 1Q20F results should be relatively decent, with a minimal impact from the COVID-19 pandemic (due to the timeline of the outbreaks), and as the oil price war did not occur until early March.

MD Lim Boon Kheng. NextInsight file photo Its 1Q20F results should be relatively decent, with a minimal impact from the COVID-19 pandemic (due to the timeline of the outbreaks), and as the oil price war did not occur until early March.

Oil prices fell further, as the global pandemic severely dented the demand for oil. The WTI Crude price hit a 18- year low of c.USD20.00/bbl, before recovering slightly, after hints surfaced that Saudi Arabia and Russia were approaching a deal on the price war.

As a service provider, CSE handles mission-critical tasks, and approximately 90% of revenue is recurring in nature. Hence, a temporary drop in oil prices would not have impacted its workflow.

Work has also started at two large oil & gas projects worth SGD103m. It was not until 12 Mar that the World Health Organization declared COVID-19 a global pandemic.

Only after then did the US step up measures to curb the spread of the virus. As such, we think CSE’s 1Q20 results should still be relatively decent.

|

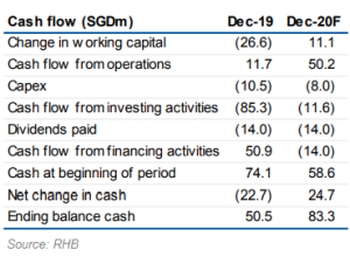

Healthy cash flow |

|

|

• 2Q20F outlook and earnings estimates toned down. In our view, 2Q20 will be a crucial period, depending on how the COVID-19 situation pans out.

We remain cautiously optimistic in our outlook, but cut FY20-22F revenue by 15%, 10% and 5%.

This is because we expect slower revenue recognition as a result of the delays in project execution due to the COVID-19 pandemic, lower capex in the oil & gas sector, and a slower flow of orders.

We also trim our FY20-22 net margin assumptions from 5.5% to 5.1%, 5.3%, and 5.4%.

Jarick Seet, analyst, RHBStay BUY. Our forecasts are based on a short-term drop in oil prices and the assumption that the COVID-19 pandemic may likely taper down in 2H20. Jarick Seet, analyst, RHBStay BUY. Our forecasts are based on a short-term drop in oil prices and the assumption that the COVID-19 pandemic may likely taper down in 2H20.After that, work orders should start to ramp up and flow over to FY21. Our outlook may worsen if the pandemic is prolonged, and oil prices remain extremely depressed. Our TP of SGD0.54 implies a 10.5x FY21 P/E, which is slightly below the last 12 months’ average forward P/E. |

Full report here.