It's been a while since we covered Cordlife Group, the No.1 private cord blood banking group in Singapore.  A cryovial containing processed umbilical cord lining segments. Photo: CompanyCordlife has re-appeared on some investors' radar because it could become a really big player in Asia if a proposed merger with a Chinese peer materialises. A cryovial containing processed umbilical cord lining segments. Photo: CompanyCordlife has re-appeared on some investors' radar because it could become a really big player in Asia if a proposed merger with a Chinese peer materialises. Cordlife on 4 June 2019 announced a proposal for a merger, via a share swap, with Global Cord Blood Corporation (GCBC). Negotiations are still ongoing. Some salient facts available in the public domain about GCBC, foremost of which is that it shares the same Chinese controlling shareholder (Sanpower Group) as Cordlife, include:

(See: CORDLIFE: A Giant Leap into China) |

Here are 6 things to note to get up to speed about Cordlife:

1. Market presence: Cordlife has roughly a 70% market share in its home ground (Singapore) where it has been established for 18 years.

The 70% market share figure is anything but precise: It is based on Cordlife's "market intelligence".

In its 1H2019 presentation material, Cordlife said it is N0.1 not only in Singapore but also Hong Kong, the Philippines, and Indonesia.

It is No. 2 in Malaysia and No.3 in India. The Group is thus one of the leading providers of cord blood, cord lining and cord tissue banking services in the region.

2. More on market presence: In Singapore, the players (ie Cordlife, Cryoviva and Stemcord) have, collectively, a penetration rate of about 20% in private hospitals.

CEO Tan Poh Lan owns 205,440 shares of Cordlife. Photo: CompanyThat suggests there is room for growth as consumers become more aware of Cordlife's services. The growth potential is even more stark in overseas markets with larger populations.

CEO Tan Poh Lan owns 205,440 shares of Cordlife. Photo: CompanyThat suggests there is room for growth as consumers become more aware of Cordlife's services. The growth potential is even more stark in overseas markets with larger populations.

3. Assets: Apart from Singapore, Cordlife has processing and storage facilities in five other key markets -- Hong Kong, Malaysia, India, Indonesia and the Philippines. It also has brand presence in Myanmar and Vietnam.

The Group is one of the first private cord blood banks in Asia to release cord blood units for transplants and cellular therapy. To date, the Group has released more than 500 stem cell units for use in successful transplants and therapies.

|

Tan Poh Lan |

|

|

Feb 2019 – present |

Chief Executive Officer |

|

April 2016 – Feb 2019 (Cordlife Group) |

Group Chief Operating Officer |

|

April 2016 - October 2016 |

Group Chief Operating Officer and Executive Director |

|

2008 – 2011 |

Chief Executive Officer |

|

2011 - 2012 |

Chief Executive Officer |

|

2012-2015 |

Chief Executive Officer |

4. New management: In March 2016, Jeremy Yee resigned as CEO after five years at the helm of Cordlife.

Two successors came and went before Ms Tan Poh Lan, then the group chief operating officer, was appointed CEO in Feb 2019.

Notably, she has a track record of being CEO of top hospitals (see table).

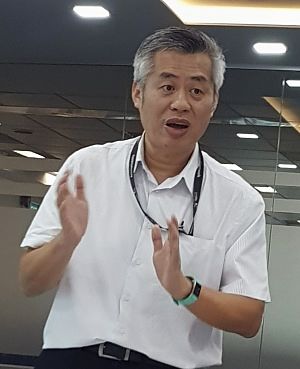

CFO Choo Boon Yong at 1H2019 results briefing. NextInsight photo.5. 1H2019 financial highlights: Cordlife reported $33.1 million in revenue for 1H2019, down 3.6% y-o-y, partly because baby deliveries were lower in Singapore, Hong Kong and Malaysia.

CFO Choo Boon Yong at 1H2019 results briefing. NextInsight photo.5. 1H2019 financial highlights: Cordlife reported $33.1 million in revenue for 1H2019, down 3.6% y-o-y, partly because baby deliveries were lower in Singapore, Hong Kong and Malaysia.

Accordingly, gross profit was S$22.0 mllion (-3.8% y-o-y).

The gross profit margin was an attractive 66.3%, which is a blend of margins across various markets and across cord blood banking, cord lining banking, cord tissue banking and diagnostic test services.

Selling and marketing expenses and administration expenses consumed a large part of the gross profit.

In 1H2019, these expenses were reined in, which helped net profit rise to S$1.4 million (+45.4% y-o-y).

That's 37% of the current market cap of S$117 million (stock price: 46 cents). Net asset value was 46.6 cents a share, ie the same as the recent stock price. A game changer would be a successful merger with GCBC, as it would be highly earnings-accretive. Under a proposed share swap, GCBC shares would be converted into Cordlife shares and GCBC will be delisted from the New York Stock Exchange. The merged entity (Cordlife listed on Singapore Exchange) would be the largest cord blood bank in the world. Stay tuned. |

||||||||||||||||

How a mother's cord blood is extracted and banked

How a mother's cord blood is extracted and banked

The 1H2019 Powerpoint presentation material is here.