Teo Luan Boo, who posted this article on his blog, contributed this article to NextInsight. Teo Luan Boo, who posted this article on his blog, contributed this article to NextInsight. |

On 29-Apr-2019, Alliance Mineral Assets made a very important announcement “Alliance signs MOU for downstream JV to produce and sell Lithium Hydroxide”.

Key points:

- Unique opportunity to participate in the downstream lithium products market

- Quick time to market – within next 6 to 12 months (whereas others take 3-5 years)

- $0 capital cost required (whereas others like Tianqi spent $400-700m Read more…)

- No exposure to risk associated with conversion facility construction

- Alliance to benefit directly from its own high-quality Bald Hill lithium concentrate

- Significantly improve profit margin per tonne of spodumene concentrate

Judging from the market reaction, I guessed the market sees it positively but is not overly excited. Many probably want to wait for the JV agreement to be formalised (target 30-Jun-2019). I also believe the market has not realised the significance of a hydroxide JV.

Will Jiangte Hydroxide MOU turn into JV agreement?

Until the JV agreement is signed & chopped, it is a non-binding MOU. Are we confident that the JV will ultimately go through? Question of probability… never 100% sure.

On 16-May-2019, Alliance announced another A$10m strategic conditional placement of A$10m Alliance shares to Jiangte (increasing their holdings from 6.42% to 9.08%). I believe the 2 companies have again moved another step closer on the road to a solid partnership – with both companies’ future tightly bound and will win/lose together.

Notice that the placement to Jiangte is conditional while the placement to Galaxy is not. The placement to Jiangte is subject to shareholder approval due to SGX Catalist rules on placement to existing SSH (significant shareholder).

However, the timing tells me something. EGM for the shareholder approval for Jiangte placement should be mid-end Jun-2019 and coincides with the timeline for the JV agreement finalisation. In my opinion, the 2 activities are linked. No JV, no placement. Hence, I believe this significantly increases the chance of the MOU becoming a JV agreement.

What’s the significance of Jiangte hydroxide JV?

In my humble opinion, this is a brilliant chess piece move by the Alliance management for the mid/long term, that few truly understand.

It is a strategic move in this difficult stage of the cyclical market where spodumene prices might be challenged in the next few years (with some forecasting turnaround/supply deficit in 2021, some 2022, some only in 2025). Everyone knows by now the severe impact to the top & bottom line for all spodumene producers when the selling price (ie sole source of revenue) of spodumene / carbonate / hydroxide goes down 40-50%.

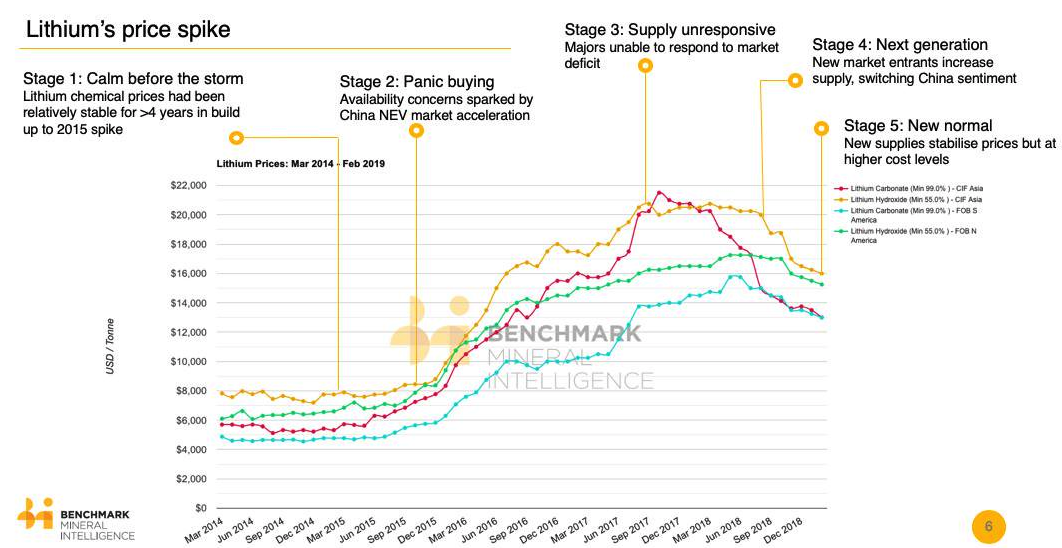

The lithium sector is now in the “New Normal” state – whereby new supplies stabilise prices but at higher cost levels.

(Source: The “New Normal” in the Lithium Space)

So what can lithium producers do? Other than trying to optimise existing operations to produce more (hence reduce the operating cost per tonne) and cutting other costs, Alliance is attempting to improve margins & profitability through going downstream with close partners.

Improving Margin – What does that mean?

Footnote (1) of the Hydroxide JV announcement stated that with the JV, the gross operating margin per tonne would increase from about 36% to 63%. What does that mean to investors?

Based on an estimated cost of production of US$550/t, transport costs, Jiangte estimated conversion costs, import and sales taxes, a spodumene concentrate grade of 6.1% and 83% lithia recovery rate. The gross operating margin for Alliance, for tonnage processed by the Joint Venture, would increase from about 36% to 63% when compared to our current spodumene pricing formula based on market prices for lithium carbonate, excluding royalty and tax provisions.

Using those numbers from the announcement, I have derived some key information and I hope we can better quantify the impact of “improving margin”. With the Hydroxide JV, Alliance is trying to increase the gross operating profit from USD$31m to USD54m (whopping 74% increase!!!). How many companies out there can do that in the shortest possible time (6-9 months), without incurring large capital outlays ($0 capex) with minimal risks involved? If that’s not brilliant, I don’t know what is.

Once fully operational, the JV will process approximately 100,000t of spodumene per annum

Simply selling spodumene, no Hydroxide JV

- Gross operating profit per ton of spodumene ~USD$310 (margin = 36%)

- Cost of spodumene per ton = ~USD$550

- Sales Price per ton (grade of 6.1%) = ~USD$860 {derived}

- Gross operating profit per annum (100,000t of spodumene) ~USD$31m

With Hydroxide JV

- Gross operation profit per ton of spodumene ~USD$540 (margin = 63%)

- ~7t of spodumene concentrate to produce 1t of lithium hydroxide

- Cost of 7t of spodumene (including transport cost) = ~USD$3,900

- Current market selling price for 1t hydroxide = ~USD$14,000 {estimated}

- Conversion operating cost for 1t of hydroxide = ~USD$2,500 {derived}

- Estimated profit margin for 1t of hydroxide approx. USD$7,600 (ie. USD$3,800 for Alliance)

- Gross operating profit per annum (100,000t of spodumene) ~USD$54m

What are the risks?

Of course, all business ventures carry some form of risk, especially when expanding into a new line of business, in this case going downstream. Alliance does not have any experience building/operating a chemical conversion business. There’s a Chinese saying “不入虎穴,焉得虎子” (If you do not enter the tiger’s den, how can you get the tiger junior?). If we don’t make any attempt, how can Alliance expand & grow beyond the mining business?

What’s the best way to get started then? Do business with a close business partner in the chemical conversion business (and who has a large stake in our business and want us to succeed too) and contain/manage the downside risk. In reality, what can go very wrong when we don’t have to come out with hundreds of million capital costs? In the worst case scenario, we might lose some revenue from the spodumene that we put in. In return, we get involved and learn to do business in downstream chemical conversion.

- Business practices risk, especially dealing with Chinese companies. I tend to agree that being an Australian company first time going into JV with a Chinese company, Alliance needs to be careful (but IMO not overly worrisome). I would expect Alliance management to take the necessary contractual precautions to protect our interest, in case things do not work out as planned/projected.

- Risk of the extent of potential losses in JV. We don’t have the JV agreement T&Cs in discussion and might not have even after the JV agreement is signed. But we certainly hope the Alliance management would be aware of such downside risks & ensure that there are limits to protect the company.

Those risks then triggered me to think further and do some simulations on the numbers.

Scenario 1 – Back-to-Square-One (Conversion cost is somewhat exceptionally high)

- In this scenario, my starting assumption is Alliance will not be any better or worst off from just selling spodumene compared to just selling spodumene – ie. Alliance still make USD$310 per ton of spodumene.

- The conversion cost would need to be above USD$5,810 (& that’s 132% above the planned cost of ~USD$2,500) for Alliance to be worst off.

- Any conversion cost below USD$5,810, Alliance will be better off with the JV.

- Hence, Alliance management needs to ensure that we have an exit option to terminate the JV when the conversion costs are exceptionally out of whack. Alliance management team is made up of people with decades of working/business experience who are capable and proven thus far (ie. not some 20+ years old running a startup). For the time being, I would entrust them to do what they need to do. However, as soon as I detect signs that the JV is not in good hands, I would the first few to exit. Hence, we will need to watch the progress closely. And we don’t have to wait too long to know this, perhaps just a few months into the operations. Hence, I think the risk to this scenario would be well mitigated.

- The conversion cost would need to be above USD$5,810 (& that’s 132% above the planned cost of ~USD$2,500) for Alliance to be worst off.

- Scenario 2 – Back-to-Square-One (further decline of hydroxide price)

In this scenario, my starting assumption is Alliance will not be any better or worst off from just selling spodumene compared to just selling spodumene – ie. Alliance still makes USD$310 per ton of spodumene.

- The hydroxide price would need to drop below USD$10,690 per ton for Alliance to be worst off.

- Anything above USD$10,690, Alliance will be better off with the JV.

- This is a medium possible scenario. But we have to bear in mind that our spodumene offtake price is market linked pricing. Hence, when hydroxide price declines, our spodumene price will go down too (ie. we won’t be making a margin of USD310 selling just spodumene).

- The hydroxide price would need to drop below USD$10,690 per ton for Alliance to be worst off.

More JVs?

In my opinion, the Hydroxide JV with Jiangte is just Alliance’s first step out of its core competency / comfort zone. This JV will provide Alliance the experience & know-how to do more JVs with other industry players (be it Galaxy for a new Australian-based hydroxide conversion facility and/or other Korean & Japanese & Chinese converters). This Jiangte JV will also provide us the baseline to negotiate other JVs.

Who knows, in years to come (provided Alliance management & shareholders can resist & fence off the sharks), the business might go even further downstream and be involved in battery & electric vehicle manufacturing. I know this sounds like farfetched but who would have thought that a small cafe in Seattle started in 1971 (IPO in 1992) would have become a world leader Starbucks with 30,000 locations after 48 years. All large successful enterprises started from a small company with a big dream.

Best Grade/Quality Spodumene from Bald Hill

Alliance had established it’s reputation & gained well-deserved recognition for producing High Quality Premium spodumene concentrate (High Li >6%, Low Impurities <0.5% Fe, <0.5% Mica, <3% H2O etc and coarse concentrate). It’s becoming a preferred product by many converters as the quality provides them real bottomline benefits; such as no slagging problem, no extra cost to burn off the water content and less wastage as too much fines get blown off their kiln.

However, in the current non-transparent market for lithium, quality may not directly translate into pricing differences. Even the spodumene pricing tracked/published by the various pricing analysts do not differentiate products with different grade and impurities level. While Alliance currently do enjoy higher sales prices compared to our peers, most current lithium offtakes are still priced based on a formula on carbonate / hydroxide prices.

What I particularly like about this Hydroxide JV – is the additional benefit that comes with having our own hydroxide operations and subtly “force” the market to recognise our grade & quality. If a customer do not want to pay for the premium, Alliance can always ship them the normal grade spodumene (6 to 6.1%, which is still far better than some of our peers) and keep the high grade (6.2 to 6.5%) for our own hydroxide operations which would further lower our own cost of conversion, and ultimately increase our JV bottomline.

I will just end here before this post become too long to read.

In short, I continue to be bullish about Alliance Mineral in the mid/long term. Short term share price movement does not align with the mid/long term business fundamentals, and that’s OK for me. It will one day.

(Note: I am not a permabull trying to talk up Alliance because I am vested. This is not investment advice. Please DYODD.)