"Money Plant" contributed this article to NextInsight

| The market has been punishing mm2 Asia for its acquisition of Cathay Cineplexes (in Nov 2017). The share price currently is 27 cents, down 50% from 54 cents at the start of 2018. However, the core fundamentals of mm2's business remain unchanged with continued growth and the group riding on key trends such as rising demand for content, experiential spending (UnUsUaL) and Virtual Reality (Vividthree). Despite mm2 being one of the largest and prominent producers in Singapore (and potentially the region), investors are attributing only an implied 8x PE for its core production business. |

|

No. of shares |

1,162.8 |

|

|

Current price |

0.270 |

|

|

mm2 (current mkt cap) |

314.0 |

|

|

Less |

||

|

Attributable Mkt cap of UnUsUaL |

108.9 |

Trading at 28x FY18 PE (9MFY19 net profit +32% yoy) |

|

Attributable mkt cap of Vividthree |

24.4 |

Trading at 22x FY18 PE |

|

Assume 0 value for cinema |

0 |

|

|

Assumed market cap for core production business |

180.63 |

|

|

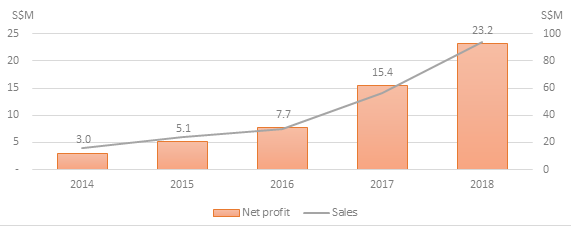

FY18 core production income |

23.202 |

|

|

Implied FY18 PE of core production business |

7.8 |

7.8x PE for one of the largest and most prominent producers in Singapore. At its current price, if we assumed zero value for the cinema business, investors are paying an implied FY18 historical PE of only 7.8x for one of the largest and most prominent producers in Singapore.

Profit from mm2’s core production business has grown more than 4x from S$5m in FY15 to S$23.2m in FY18, and the group continues to see revenue growth for its core business in the 9MFY19, with a solid pipeline and more partnerships (eg. Netflix, Fox Networks, CJE&M) ahead.

The group rides on its growing prominence as a quality producer with its most recent movie success “More than Blue”. FY ends 31 March.

FY ends 31 March.

Sentiments hit a new low. Profit growth has hit a snag following the acquisition of Cathay SG Cinema, as mm2 consolidated its results and incurred higher interest expense to finance the cost of acquisition.

Consequently, share price has also plunged nearly 60% from its peak, with analysts slashing forecasts along with some downgrades. Admittedly there are reasons for the decline, with 3QFY19 profit plunging 59% yoy due to a rise in interest expense. Take a break, watch trailer of mm2 production, A Land Imagined (now showing in cinemas):

Take a break, watch trailer of mm2 production, A Land Imagined (now showing in cinemas):

Just how low can it go? However, as we step back and consider, with the sharp price pullback, and all the recent happenings, just how low more can the share price drop?

While profit plunged, it was not due to a drop in revenue (with the group reporting higher revenue from its core business, event production and promotion business etc in 3QFY19) but rather a surge in interest expense.

As the group approaches the end of its financial year (31 March), the group will have hopefully reported its normalised interest expense and earnings following its first full year consolidation of the SG cinema asset.

And should revenue and earnings continue to improve for its individual business units, could this be an earnings and price trough for the group?

Interest expense is bad, but not an “incurable problem”. One of the main factors hitting results this FY was the surge in interest expense due to the financing for the acquisition of Cathay Singapore.

mm2 received a double whammy, as the interest incurred was non-tax deductible as it is held at the listco level (instead of the operating subsidiary level - I think for reasons for potential spinoff as hinted by its appointment of Haitong for a strategic review of its assets).

But this is not an incurable problem in my opinion. A spin-off or sale of a partial stake in the cinema group may provide an immediate lift to earnings, providing an immediate re-rating catalyst.

Reasons for optimism in FY20

|

Segments |

Commentary |

|

Production |

Continued growth with greater industry recognition for production projects leading to increased partnerships and more investors in projects • Look the replicate the success of “More than blue” with similar projects in the pipeline • More B2B deals with likes of Netflix |

|

Cinema |

1. $1.6m uplift (from one off expense of PPA in 2018) 2. Blockbusters year to lift box office and attendance (Starwars, Avengers, Frozen 2, Lion King etc) 3. Uplift from better terms in renegotiated contracts (eg. For advertising) |

|

UnUsUaL |

Family entertainment shows to kick in earnings • Walking with dinosaurs, APOLLO, Disney on ice |

|

Vividthree |

Continued recognition of profits from Train to Busan VR tour show |

As one of the key producers of local films over the years, mm2 can be considered one of the backbones of local film industry-with growing industry recognition as a quality producer as evident from increased partnerships and box office successes.

It is unfortunate that market is punishing it for its heightened interest expenses, but it is not an incurable problem in our opinion.

As mm2 approaches the end of its current FY, we believe that period could be the earnings trough with market getting a full grasp of the expenses involved for the Singapore cinema operation.

Hopefully, FY20 will be a more eventful year with yet another busy pipeline of projects.