|

It's record earnings and revenue at Nordic Group in FY17, as expected.

Though it's early days, FY18 may be a record year too, based on Nordic's internal earnings growth target of 20% a year which it has publicly committed to.

|

The shipbuilding industry is, however, now enjoying a nascent recovery.

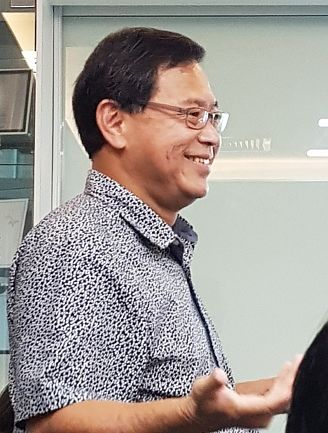

And it has translated into a spurt in contracts won by Nordic's system integration (SI) segment: S$5.5 million in Jan/Feb 2018 versus S$8.2 m for the whole of 2017. Chang Yeh Hong, executive chairman of Nordic Group, owns a 55.38% stake in the company. NextInsight file photo.The pick-up became evident in the later part of 2017 which reversed a downturn in Nordic's SI segment.

Chang Yeh Hong, executive chairman of Nordic Group, owns a 55.38% stake in the company. NextInsight file photo.The pick-up became evident in the later part of 2017 which reversed a downturn in Nordic's SI segment.

Chang Yeh Hong, executive chairman of Nordic, said that in the course of 2017, the SI segment was headed for a small loss -- for the first time -- despite further cost-cutting, including a reduction in the salaries of two directors.

In the end, the SI segment managed to break even, excluding a forex loss, at the close of FY17.

Ready to catch a big wave, the SI segment has submitted tenders for about $30 million worth of jobs.

|

Stock price |

56 c |

|

52-week range |

23 – 57c |

|

PE (ttm) |

14.4 |

|

Market cap |

S$218 m |

|

Shares outstanding |

393 m |

|

Dividend |

2.5% |

|

1-year return |

155% |

|

Source: Bloomberg |

|

In the meantime, Nordic as a group has an outstanding order book of S$106.8 million as at end-Jan 2018.

Within the orderbook is, notably, a S$35.0 million contract secured in May 2017 from a petrochemical MNC for a scaffolding, insulation and coating capital project.

As the building blocks for a 2018 record profit take shape, the share price of Nordic (currently 56 cents) has reached all-time highs.

CFO Chia Meng RuRather unusually, the last page of Nordic's Powerpoint presentation for its FY17 results lists the shareholding of the CFO, Chia Meng Ru, along with that of three directors. CFO Chia Meng RuRather unusually, the last page of Nordic's Powerpoint presentation for its FY17 results lists the shareholding of the CFO, Chia Meng Ru, along with that of three directors.Being an executive officer (and not a director or a substantial shareholder), she is not required to reveal her holding or purchases in any SGX filing on an ongoing basis. When appointed as CFO in Aug 2017 (from her post as Nordic's head of strategic management), the statutory filing said she held 701,500 Nordic shares. She now holds 1,511,500 shares, according to the Powerpoint presentation, so it follows that she bought 810,000 shares not too long ago. The table shows her holding along with that of the three directors which, in aggregate, add up to a very high 75.2% stake in Nordic.

It's not often well appreciated that when insiders have lots of skin in the game, they are highly motivated to do right by minority shareholders (and themselves). Among other things, they avoid taking high risks that promise high returns but could instead damage the business badly. |

||||||||||||||||||||||||||||