|

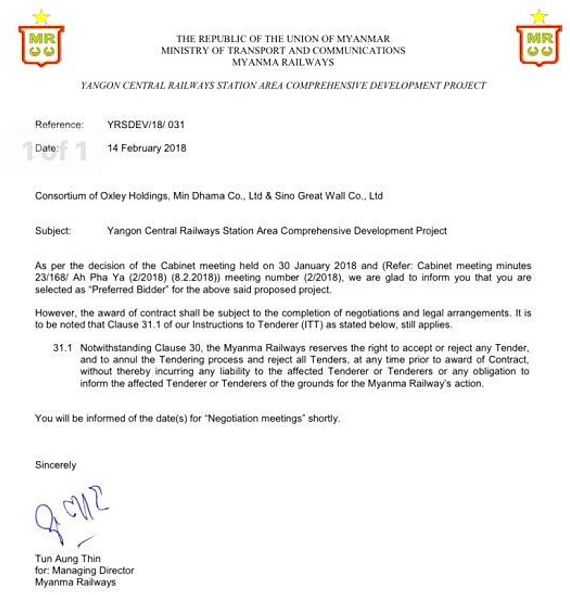

This letter, released by Oxley Holdings on 14 Feb 2018, marks the near-achievement of a project that will rank among the most prestigious it has ever done.

|

Stock price |

66 cents |

|

52-week range |

48 - 73 cents |

|

PE (ttm) |

10.4 |

|

Market cap |

S$2.1 billion |

|

Shares outstanding |

3.24 billion |

|

Dividend yield |

0.96% |

|

1-yr return |

32% |

|

Source: Bloomberg |

|

Oxley is leading a consortium whose two other partners are Sino Great Wall, a Beijing-based company listed on the Shenzhen Stock Exchange, and Min Dhama, a subsidiary of Mottama Holdings owned by Chinese-Myanmar businessman U Yang Ho.

The consortium is the “Preferred Bidder” for the Yangon Central Railways Station Area Comprehensive Development Project whose tender first opened in 2014, attracting bids from a number of countries.

The Oxley team trumped over other consortiums fielding companies including Singapore-listed Yoma Strategic Holdings and Myanmar-listed First Myanmar Investment.

|

♦ It spans 25.7 hectares, equivalent to about 35 football fields. ♦ It will be a transportation hub that integrates rail and mass transit, surrounded by amenities of housing and commerce. |

The award of contract shall be subject to the completion of negotiations and legal arrangements.

In some media reports, the project is cited to be valued at US$2.5 billion.

That makes it another piece of massive work ahead for Oxley as it is slated to launch S$3 billion worth of properties in Singapore in the next few months. Artist's impression.

Artist's impression.