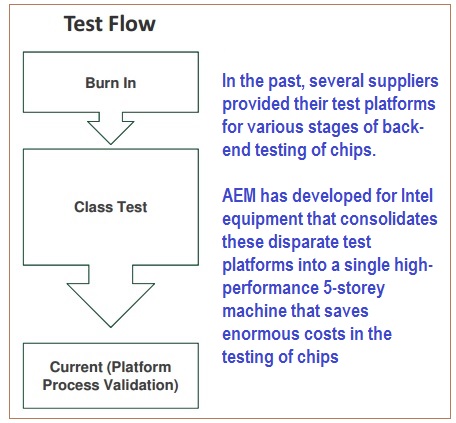

| This one should rank up there with the most innovative made-in-Singapore products of recent times. For eight years, AEM Holdings has, in partnership with its key customer (widely known to be Intel Corp), developed equipment that is so attractive to Intel that it renders AEM's competition obsolete. |

CEO Charles Cher."The semiconductor world has not seen anything like this before," says Charles Cher, CEO of AEM Holdings, at a 1Q17 results briefing this week. "Hopefully, over time, this will be the platform of choice for test handling in the industry."

CEO Charles Cher."The semiconductor world has not seen anything like this before," says Charles Cher, CEO of AEM Holdings, at a 1Q17 results briefing this week. "Hopefully, over time, this will be the platform of choice for test handling in the industry."

AEM, which owns the IP, has become the sole source -- a status that is practically unheard of in global manufacturing -- of such equipment for Intel.

"Our equipment has the ability to significantly reduce the cost of testing for our customer. As you know, in the semiconductor world, cost reduction is the holy grail. If you can drive down costs, you have a big advantage over competitors," says Mr Cher.

@ 1QFY17 briefing. Photo by El Lee For delivery in 2017, which is the maiden full-year of mass production, AEM has received an order book of S$152 million so far, and the number has more room to balloon.

@ 1QFY17 briefing. Photo by El Lee For delivery in 2017, which is the maiden full-year of mass production, AEM has received an order book of S$152 million so far, and the number has more room to balloon.

"We are at the start of a multi-year ramp-up of our completely modular high-density handler platform for our customer," says Mr Cher. "The customer has elected this to be its platform of choice."

|

S$’m |

1Q2017 |

9M2017F* |

|

Revenue |

42.1 |

> 142 |

|

Pre-tax profit |

4.9 |

> 17.5 |

|

Profit after tax attributable to equity owners |

4.1 |

no forecast given |

|

*9MFY17 forecast by AEM |

||

AEM non-executive chairman Loke Wai San adds that aside from upgrading its equipment, the customer is ramping-up its orders from AEM ahead of a possible high-volume production of chips for new applications, such as driverless vehicles, in the 5G economy.

While equipment delivery -- out of its Singapore plant and, by year-end, Penang too -- will figure significantly in the years ahead for AEM, selling maintenance service and consumables will become increasingly so as well.

|

AEM share price: $2.40 |

|

|

Target price |

$3.39 |

|

Year-to-date gain |

327% |

"We are not just delivering machines to our customer's factories. Ours is a total solutions approach -- we deploy our service people 24/7 across 10 sites in the world," says Mr Cher.

"This is a big differentiator. We will service the machines till their end of life, perhaps for 15 years."

Given its ability to design complex equipment, AEM is seeking other growth opportunities and has a toehold in solar and smart card segments.

"Aside from semicon, we also build equipment that automates the manufacturing process in the smart card and solar industries as well," says Mr Cher.

Interestingly, AEM doesn't need equipment to build equipment -- which is why...

| 1) Its depreciation of property, plant and equipment (PPE) was only $155,000 in 1Q17; 2) Its purchase of PPE in 1Q17 was merely $51,000; 3) Its operating cashflow was $2.86 million; 4) Its cash balance rose by $2.8 million to $9.1 million. |

For details on the 1Q17 results, see press release.