This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 8 January 2016. The article is republished with permission.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 8 January 2016. The article is republished with permission.

OCBC Bank is Southeast Asia's second largest bank. OCBC Bank is Southeast Asia's second largest bank.

(Photo: Company) |

To Samuel Tsien, the maxim of learning from one’s mistakes has become more than a cliché.

Its relevance in today’s world is more pronounced than ever – progress necessitates exploration and exposure to new things, which invariably lead to mistakes sometimes, says the Group Chief Executive Officer of OCBC Bank.

Tsien believes adopting a more tolerant attitude towards mistakes would be helpful in promoting innovation, creativity, and eventual success.

“I would go beyond encouraging people to learn from their mistakes. I would rather put it this way – be more tolerant of mistakes, from yourself as well as others. In this respect, we as a nation can do more to cultivate such a mindset,” said the affable Shanghai-born career banker.

|

Be more tolerant of mistakes, from yourself as well as others. In this respect, we as a nation can do more to cultivate such a mindset. Be more tolerant of mistakes, from yourself as well as others. In this respect, we as a nation can do more to cultivate such a mindset.

- Samuel Tsien

Group CEO

OCBC Bank

|

Other principles that form the backbone of his management philosophy include honesty and gratitude.

“In my dealings with friends and colleagues, being sincere is very important,” he said. “You want to be your true self, and you want the other person you interact with also to be their true selves.”

Showing appreciation is also essential. “You may take many things for granted, but a lot of effort could have gone into the work or service that you received,” he added.

Sound, practical advice from a man who has more than 30 years of banking experience, with a good number at the helm. Tsien, 60, joined OCBC in 2007 as head of its global corporate bank before being appointed Group CEO in April 2012. Prior to that, he was President and CEO of Bank of America (Asia) and China Construction Bank (Asia) Corporation respectively for 12 years.

When asked about the prerequisites of success, Tsien highlights two essential qualities – self-confidence and determination.

Referring to OCBC’s acquisition of Hong Kong’s Wing Hang Bank, Tsien said, “Any acquisition will have uncertainties, as they did in the Wing Hang case. You cannot foresee or plan for all the issues that may arise, but you must have the confidence and determination to address, and deal with them, as they come up.”

|

Expanding Asian Footprint

|

If an acquisition supplements our franchise in our core markets, we will definitely look at it. If it is simply to enter a new country outside our core markets, then that’s not our preferred route.

- Samuel Tsien

Group CEO

OCBC Bank

(Photo: Company)

|

Southeast Asia’s second-largest bank has established a solid regional franchise over the past decade.

In 2004, it bought a stake in Indonesia’s NISP, which it has since increased to 85.1%.

Two years later, it invested in China’s Bank of Ningbo.

In 2010, it clinched a deal to buy ING Asia Private Bank, which was combined with OCBC Private Bank and named Bank of Singapore.

The most recent was its S$6.23 billion acquisition of Wing Hang Bank in 2014.

“These investments are all in our four core markets of Singapore, Malaysia, Indonesia, and Greater China. Our strategy has been about broadening and deepening our presence in these markets – we’ve never veered away from that focus,” he said.

OCBC does not have ambitions to be a global bank, though it is an international bank. The distinction?

“We are international in that we have offices and branches to serve our customers from our core markets when they are in different parts of the world, but we don’t have to be a local bank in every spot just like global banks,” Tsien said.

“If an acquisition supplements our franchise in our core markets, we will definitely look at it. If it is simply to enter a new country outside our core markets, then that’s not our preferred route.”

The Group was formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912. Listed prior to Singapore’s independence in 1965, and a constituent in the benchmark Straits Times Index (STI), OCBC has the second-biggest weighting at 12.3%, behind DBS Bank’s 12.7%.

| ♦ Springboard for Diversity |

|

OCBC’s acquisition of Wing Hang Bank – the largest takeover of a Hong Kong lender since 2011 – was attractive in terms of both funding and earnings diversification, Tsien said.

“Wing Hang’s deposit franchise is primarily in Hong Kong dollars – which is US dollar-linked – and US dollars. The franchise substantially increases our US dollar funding base, which is the most dominant currency for international trade and capital flows.”

Wing Hang’s contribution also diversifies OCBC’s earnings base. With its inclusion, the Greater China region accounted for 20% of Group pretax profits at the end of the third quarter, whereas a few years ago, it was single-digit, he added.

|

We need people with more regional exposure, who have a deeper understanding of different business practices and a greater tolerance towards cultural biases. We need people with more regional exposure, who have a deeper understanding of different business practices and a greater tolerance towards cultural biases.

- Samuel Tsien

Group CEO

OCBC Bank

|

The Hong Kong lender also serves as a springboard for OCBC to pursue its Pearl River Delta strategy.

With 12 of its 32 branches in China located in the Pearl River Delta, the combined OCBC and Wing Hang franchise has a strong foothold in this region.

Tsien believes the Pearl River Delta holds significant promise, and is likely to receive increased attention from the Chinese authorities as an economic zone.

As one of China’s growth hubs, it overtook Tokyo to become the world’s largest urban area in size and population as early as 2010, according to a recent World Bank report. The size of its economy is on par with that of Indonesia, Southeast Asia’s largest economy and the world’s fourth-most populous country.

The megacity encompasses a large swath of China’s manufacturing heartland –Shenzhen, Guangzhou, Foshan, Dongguan – and has a population of 42 million.

Shenzhen, in particular, boasts a thriving culture of innovation that focuses on high-tech consumer gadgets like smartphone keyboards and screens. The city’s gross domestic product growth has also been trending way above the national average.

“OCBC has done well in northern China, but prior to the Wing Hang acquisition, we were not as strong in the south, with only one branch in Guangzhou,” Tsien noted.

Boosted by Wing Hang’s branch network in the Pearl River Delta, OCBC will pursue opportunities with customers – from Guangzhou to Shenzhen to Zhuhai, and across to Hong Kong and Macau – who have cross-regional banking and financing needs, he added. This lends OCBC a strong competitive edge, as most foreign banks are better-established in northern China, but have a smaller presence in the south.

|

Niche Consumer Focus

For China as a whole, OCBC’s retail banking strategy will not revolve around the mass market, Tsien said. Instead, it will focus on the high end, using its overseas network to support the needs of Chinese nationals.

“It’s tough for foreign banks like ourselves to make inroads into mass-market consumer banking in China, as our name recognition is not as strong as the local banks, and our branch network is not as comprehensive,” Tsien said.

“Higher than mass – premier, private – it’s possible. Even with that, we have to be very competitive, and our advantage is the ability to service them overseas.” To that end, OCBC is looking forward to the rollout of China’s QDII2, he added.

The world’s second-largest economy plans to introduce the next phase of its Qualified Domestic Individual Investor programme in six cities, which could potentially release billions of dollars of Chinese savings into global investment markets.

The scheme is Beijing's latest step to gradually liberalise the country’s capital accounts, following the introduction of the Shanghai-Hong Kong stock connect last November.

| ♦ Soft Growth Outlook |

|

Meanwhile, loans growth for the Group is likely to come in at a “low to mid single-digit” figure this year, as loan demand is “pretty soft”, Tsien said. Loans growth in 2015 will also probably be in the low single-digit range, he added.

“If we just rely on Singapore’s domestic activities to drive loan demand, it’s going to be quite weak.”

Instead, OCBC’s flows business, which comprises trade and cross-border investments, has been instrumental in maintaining “reasonable growth” in its loan book. Its Singapore loan book, for instance, comprises both onshore and offshore activities booked in the city-state, including trade in goods that may or may not have physically transited the country.

“This phenomenon will probably extend into 2016,” he added.

With the slowdown in regional economies, lower demand from China and higher interest rates, non-performing loans (NPLs) have come under scrutiny.

But Tsien remains unfazed. “We need to put this into the right context. NPLs have been extremely low by any standards.”

“So even if they were to rise, we need not panic as they are, in a way, normalising, and this is not unexpected. Nonetheless, I don’t expect NPLs to increase to a level of grave concern.”

NPLs are unlikely to hit levels seen during the Global Financial Crisis, which means they would be much better than during the period of the Asian financial crisis, he added.

The Group had a non-performing loan ratio of 0.9% at the end of the September quarter, matching that of DBS and compared with 1.3% for UOB.

|

It’s tough for foreign banks like ourselves to make inroads into mass-market consumer banking in China, as our name recognition is not as strong as the local banks, and our branch network is not as comprehensive. Our advantage is the ability to service them overseas. It’s tough for foreign banks like ourselves to make inroads into mass-market consumer banking in China, as our name recognition is not as strong as the local banks, and our branch network is not as comprehensive. Our advantage is the ability to service them overseas.

- Samuel Tsien

Group CEO

OCBC Bank

|

OCBC’s customers have stronger fundamentals now than before, which would boost their ability to survive a downcycle like this, he added.

“The other factor is that in previous cycles, central banks had been less active.

Now, central banks are not only more active in ensuring a sound domestic banking system, they are also coordinating with one another to ensure the country, region and economic bloc are able to withstand shocks.”

To improve its net interest margin (NIM), OCBC is targeting a higher loan-to-deposit ratio (LDR) of between 85% and 90%, Tsien said. As of end-September 2015, its LDR stood at 83.5%, versus 89.7% for DBS and 81.6% for UOB.

“On the lending side, there are fewer opportunities than expected. We have a lower LDR, because our deposits have grown faster than our loans,” he said.

“We would like to see a higher LDR, but we need to manage the deposits carefully as we don’t want to disrupt our deposit franchise, and weak loan demand – at low single-digits – is a short-term phenomenon.”

Both future domestic demand, as well as export requirements from emerging Asian economies, will drive loan demand back up again. In the meantime, the bank will carefully manage its LDR and NIM, as a lower LDR typically drags down the NIM, he added.

OCBC’s NIM – a measure of lending profitability – is expected to hover at the current level of 1.66% or rise slightly, but not by much, because funding costs are increasing, he noted.

“The battle for deposits has been quite fierce, particularly towards the end of last year. The NIM will improve, but you will not see the same magnitude as the increase in interest rates.”

As at the end of the September quarter, DBS’s NIM stood at 1.78%, while UOB’s was 1.77%.

Comparing NIMs on an absolute basis across banks, however, may not be meaningful. “Each bank’s portfolio composition is different, and a different portfolio composition would mean different NIMs,” Tsien said.

|

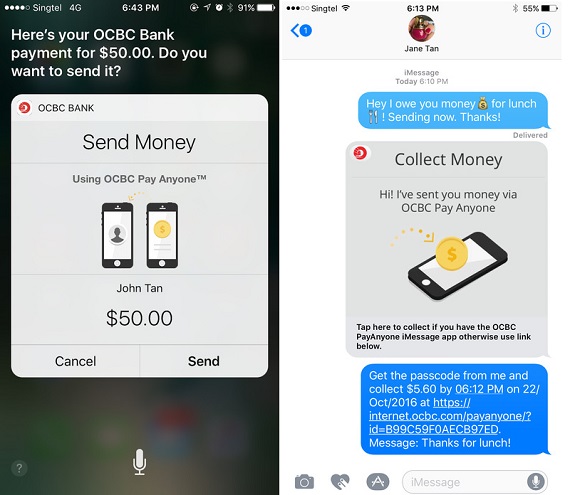

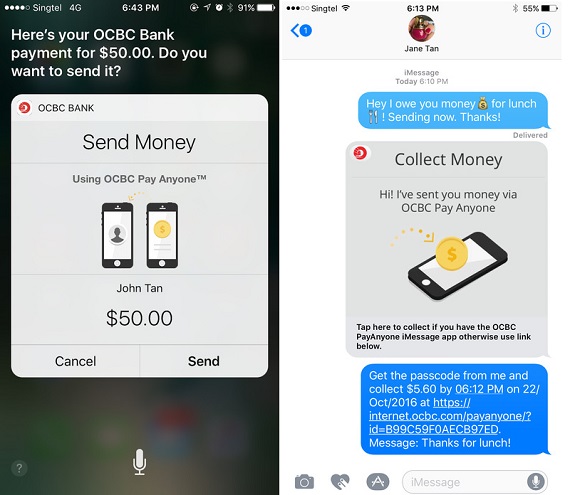

OCBC is the first bank in Asia Pacific that allows customers to pay anyone on their phone contact list via mobile banking.

OCBC is the first bank in Asia Pacific that allows customers to pay anyone on their phone contact list via mobile banking.

(Images: Company)

| ♦ Boosting Capital Ratios |

|

As for its capital strength, OCBC is progressing well on building up its Common Equity Tier One (CET1) ratio in line with Basel III norms, which will take effect on 1 January, 2018, Tsien said.

CET1 measures a bank's core equity capital compared with its total risk-weighted assets, and excludes any preferred shares or non-controlling interests. Basel III – aimed at raising bank capital requirements by increasing liquidity and decreasing leverage – was developed in response to deficiencies in financial regulation as revealed by the 2008 financial crisis.

| Stock price |

$9.66 |

| 52-week range |

$8.02 - $9.75 |

| Market cap |

S$40.4 bn |

| PE ratio |

11.8 x |

| Dividend yield |

3.73% |

| Source: SGX StockFacts |

“Typically, we are looking at about 12% range for CET1, and we have been gradually building up to that. We’re progressing very well, better than expected.

“We should get close to 12% pretty quickly,” he added.

As at end-September, OCBC’s fully-loaded CET1 based on Basel III rules stood at 11.4%. Based on Basel III transitional arrangements, its CET1 ratio of 14.5% was highest among the three local banks, with 12.9% for DBS and 13.6% for UOB.

OCBC’s capital adequacy ratio (CAR) had been impacted by the acquisition of Wing Hang Bank, which was only partially financed by equity, and Basel III’s treatment of non-bank investments in the case of its shareholding in insurer Great Eastern Holdings. Stricter rules on capital aside, nothing has fundamentally changed, with both subsidiaries remaining profitable, Tsien added.

The Group was named the third-strongest bank in the world, behind Hong Kong’s Hang Seng Bank and Japan’s Norinchukin Bank, in a July 2015 ranking by Bloomberg Markets magazine.

|

Enhancing Cyber Security

On the digital front, OCBC has been making substantial headway in boosting convenience for customers via its digital and mobile offerings.

It launched Southeast Asia’s first personal finance management tool for online and mobile banking – OCBC Money Insights – in 2013, and the first-to-market deposit account-opening mobile app – OCBC Open Account – a year later. It was the first and only bank to leverage biometrics to allow customers to access their account balances via smartphones using the Touch ID fingerprint sensor.

As one of the few banks that boast an enterprise-wide data warehouse where all its client data resides, OCBC is also equipped to perform in-depth analysis of customer behavior, leading to a deeper understanding of their needs.

Cyber security, meanwhile, is an area that the bank continues to keep a watchful eye on, Tsien said.

|

People need to come together and share information very unselfishly, even if it means embarrassing yourself by telling the world you have been attacked. In return, you hope that when someone else is attacked, they would also share that information with you. People need to come together and share information very unselfishly, even if it means embarrassing yourself by telling the world you have been attacked. In return, you hope that when someone else is attacked, they would also share that information with you.

- Samuel Tsien

Group CEO

OCBC Bank

|

“This is especially so these days, when the lure of potential financial gain is no longer the sole motivation behind cyber attacks,” he added.

Cyber security can only be properly addressed by open sharing of information among market participants and collaboration across public/private sectors and industries.

“People need to come together and share information very unselfishly, even if it means embarrassing yourself by telling the world you have been attacked. In return, you hope that when someone else is attacked, they would also share that information with you,” he said. “But I think we’re not there yet.”

That’s where informal platforms – where individuals meet and exchange information – are arguably more important than formal channels of communication, where people are typically more guarded, he added.

When Tsien is not focused on the day-to-day operations of the bank, he is strategising for the future. A night owl by habit, he is usually up till the wee hours.

“The issues I think about – not necessarily worry about – revolve around how to grow the banking business, which is now becoming much more regional, much more cross-border,” said the gourmand, who prefers Shanghainese food and cuisines with strong flavours.

Knowing how to read between the lines and understanding the nuances of cross-cultural communication are vital when the bank interacts with counterparties, clients and government agencies outside its home country, he added.

“We need people with more regional exposure, who have a deeper understanding of different business practices and a greater tolerance towards cultural biases.”

Financial results

Year ended 31 Dec

(SS$ m) |

FY2016 |

FY2015 |

FY2014 |

FY2013 |

| Total income |

8,489 |

8,722 |

8,340 |

6,621 |

| Profit before tax |

4,275 |

4,825 |

4,763 |

3,567 |

| Group net profit |

3,473 |

3,903 |

3,842 |

2,768 |

| Quarter ended 31 Dec (SS$ m) |

4QFY2016 |

4QFY2015 |

yoy chg |

| Net interest income |

1,251 |

1,341 |

-7% |

| Total income |

2,177 |

2,301 |

-5% |

| Net profit from banking |

630 |

780 |

-19% |

| Group net profit |

789 |

960 |

-18% |

Source: Company data

|

Outlook & Risks |

|

- Against a more uncertain and challenging operating environment, OCBC will continue to be focused and prudent as it grows its franchise across key markets.

- OCBC will maintain its strong capital position, remain disciplined in cost management and set aside an adequate level of allowances.

|

Oversea-Chinese Banking Corporation Ltd

OCBC is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912. It is now the second-largest financial services group in Southeast Asia by assets.

OCBC Bank and its subsidiaries offer a broad array of commercial banking, specialist financial and wealth management services, ranging from consumer, corporate, investment, private and transaction banking to treasury, insurance, asset management and stockbroking services.

OCBC’s key markets are Singapore, Malaysia, Indonesia and Greater China. It has over 620 branches and representative offices in 18 countries and territories. These include the more than 330 branches and offices in Indonesia operated by subsidiary Bank OCBC NISP, and 94 branches and offices in Hong Kong, China and Macau under OCBC Wing Hang.

OCBC’s private banking services are handled by subsidiary Bank of Singapore, while its insurance unit, Great Eastern Holdings, is the oldest and most established life insurance group in Singapore and Malaysia. Its asset management subsidiary, Lion Global Investors, is one of the largest private sector asset management companies in Southeast Asia.

For its full year results for the financial year ended 2016, click here.

The company website is: www.ocbc.com.

The ccompany's Stock Facts page is here.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 8 January 2016. The article is republished with permission.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 8 January 2016. The article is republished with permission. OCBC is the first bank in Asia Pacific that allows customers to pay anyone on their phone contact list via mobile banking.

OCBC is the first bank in Asia Pacific that allows customers to pay anyone on their phone contact list via mobile banking.

Be more tolerant of mistakes, from yourself as well as others. In this respect, we as a nation can do more to cultivate such a mindset.

Be more tolerant of mistakes, from yourself as well as others. In this respect, we as a nation can do more to cultivate such a mindset.