| Oxley Holdings | |

| Share price: 50 c |

Target: 85 c Source: RHB |

Not only is Oxley Holdings' profitability rising but its risk profile (going by gearing and cashflow) is turning positive, as CIMB's report shows.

Excerpts from CIMB report

Analyst: William Tng, CFA

Management aims to lower gearing and raise recurring income  L-R: Excutive chairman Ching Chiat Kwong and deputy CEO Eric Low. NextInsight file photo. Given the rising interest rates, management is working to de-gear and intends to explore other asset-light approaches for further expansion in overseas markets.

L-R: Excutive chairman Ching Chiat Kwong and deputy CEO Eric Low. NextInsight file photo. Given the rising interest rates, management is working to de-gear and intends to explore other asset-light approaches for further expansion in overseas markets.

As at 31 Dec 2016, Oxley Holdings Limited (OHL) had S$2.60bn unbilled contracts (S$0.49bn in Singapore and S$2.11bn overseas).

Typically, management aims to achieve gross margins of above 30% for its projects. It also expects recurring income to expand from its portfolio of industrial and hotel assets.

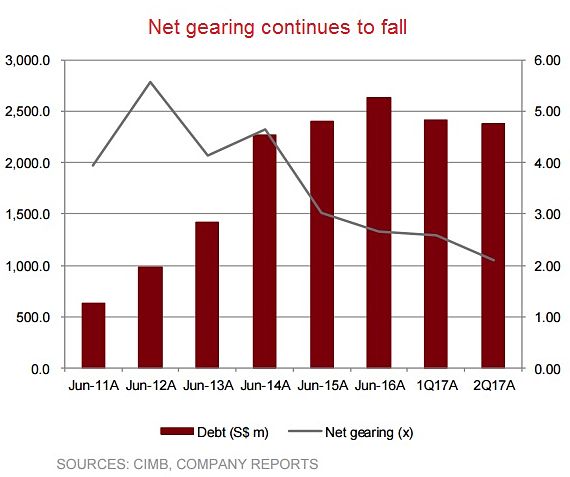

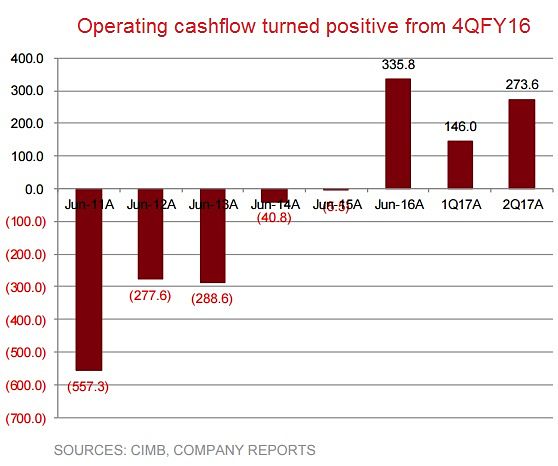

Net gearing ratio has declined Net gearing ratio has declinedOHL’s net gearing has decreased substantially from a historical high of 5.58x at endFY6/12 to 2.11x at end-2Q17. In FY11-15, OHL registered negative operating cash flow. However, in FY16, operating cash flow turned positive and the trend continued in 1Q- 2Q17. In 1Q17 and 2Q17, OHL’s free cash generated covered 5.9x and 8.4x, respectively, of cash interest expenses paid.  |

Full report here.