Best World is a leading direct seller of premium skincare, health supplements and wellness products, such as its best-selling DR's Secret skincare range. (Photo: Company) Best World is a leading direct seller of premium skincare, health supplements and wellness products, such as its best-selling DR's Secret skincare range. (Photo: Company)

BEST WORLD INTERNATIONAL has emerged as a top gainer on SGX in the past year (if you exclude the 2,000% gain of ISR Capital which is under probe).

China is the world's second largest direct-selling market, worth US$35.5 billion in 2015 and growing at 19% per annum. |

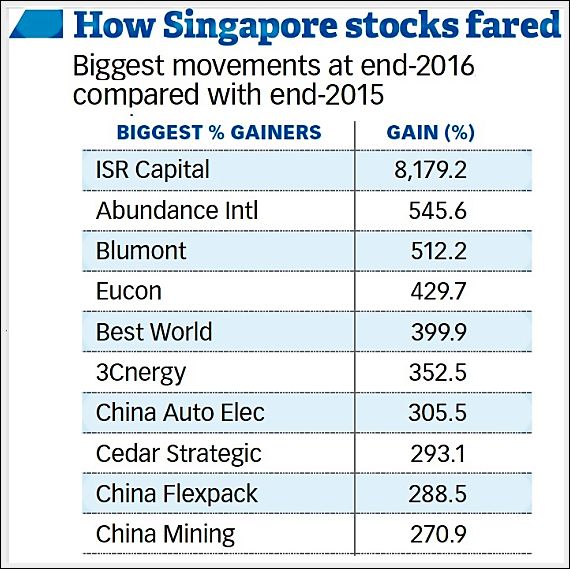

The tables below show the top 20 gainers and losers of 2016. Top gainers with a PE ratio of less than 15 times are highlighted.

| Top 20 Gainers |

Total Return | Stock Price (end-2016) |

PE |

| BEST WORLD | 416% | $1.34 | 14.0 |

| MERCURIUS CAPITAL | 200% | 3c | - |

| S I2I | 196.8% | 174c | 4.3 |

| CITYNEON | 195.3% | 94.5c | 30.4 |

| AEM HOLDINGS | 195.3% | 86c | 4.7 |

| SING MEDICAL GROUP | 166.9% | 43.5c | 169.0 |

| CHINA KANGDA FOOD | 159.1% | 28.5c | - |

| EQUATION SUMMIT | 140% | 1.2c | - |

| JASPER INVESTMENT | 137.5% | 1.9c | 726 |

| CNMC GOLDMINE | 136.8% | 43.5c | 8.5 |

| TSH CORP | 133.4% | 2.8c | - |

| CWG INTERNATIONAL | 127.8% | 16.4c | - |

| MM2 ASIA | 126.1% | 45.5c | 56.4 |

| ALLIED TECH | 120% | 2.2c | -- |

| KODA | 114.5% | 82c | 8.4 |

| FOOD EMPIRE | 114.3% | 45c | 19.6 |

| 800 SUPER | 107.2% | 96.5c | 10.3 |

| CHINA AVIATION | 105.5% | 140c | 10.1 |

| GSH CORP | 104.4% | 51c | 157.3 |

| CHINA FLEXIBLE | 101.2% | 75.5c | - |

| Top 20 Losers |

Total Return | Stock Price | PE |

| SERRANO | -96.9 | 0.2c | - |

| SWEE HONG | -92.9 | 0.9c | 3.0 |

| OKH GLOBAL | -91.0 | 6c | 3.2 |

| KOYO INTERNATIONAL | -83.9 | 5.9c | 19.6 |

| UNITED FOOD | -81.5 | 2.8c | - |

| A-SONIC AEROSPACE | -81.1 | 17.3c | - |

| INFORMATICS | -80.0 | 15.2c | - |

| STRATECH GROUP | -78.0 | 8.8c | - |

| USP GROUP | -77.2 | 9.8c | 0.8 |

| NICO STEEL | -76.7 | 1.4c | - |

| DRAGON GROUP | -75.4 | 1.4c | - |

| MARCO POLO MARINE | -75.2 | 5.2c | - |

| TRANSCORP | -75.2 | 3.3c | - |

| MAGNUS ENERGY | -75.0 | 0.1c | - |

| MMP RESOURCES | -75.0 | 0.3c | - |

| FAR EAST GROUP | -75.0 | 3.5c | - |

| LERENO BIO-CHEM | -71.4 | 2c | - |

| LIONGOLD CORP | -71.4 | 0.2c | - |

| AUSGROUP | -70.7 | 4.6c | - |

| GAYLIN | -69.8 | 12.4c | - |

The above total return data from Bloomberg includes capital adjustments and dividends over the year to 30 Dec 2016.  The Business Times last Saturday published its version of top gainers some of whose figures are very incorrect.

The Business Times last Saturday published its version of top gainers some of whose figures are very incorrect.

The BT table (left) showed ISR Capital as the top gainer with 8,179% gain.

But from 0.6 cent to 12.7 cents is actually about 2,000%. (The stock has been suspended since late Nov and is under a cloud ).

Eucon, to which BT ascribed a gain of about 430%, actually had a negative return of 7% (from 3 cents to 2.8 cents).

Did Blumont turn in a 512% gain?

Nope, it was minus 33%. And Abundance International's gain was nowhere near as abundant as reported.

Top 5 gainers today... up to 98cts. Here are the sales, gross profit, gross margin %, net profit, Profit Before Tax (figures are in USD)

Their cash jumped to US$6M, NAV is 86cts USD (S$1.22). Debt continues to reduce on a very healthy balanced sheet.

Q1 2017 Q2 2017

$11,765,000 $13,441,000

$3,339,000 $4,003,000

28.4% 29.8%

$1,261,000 $1,398,000

10.7% 10.4%

$3.18 $3.84

In the next few months, the company will be starting a tmall.com online store to get sales, and for their franchisees to deliver.

1. After years of restructuring,it is now growing the COMMUNE brand via franchising in China. The plan is to sign up 100 franchisees in 2 years. They are also setting up tmall online presence in next few mths

2. The focus on key accounts is showing results.

3. At $20M market cap, this coy has a solid balance sheet and is poised to more than double its earnings. Current valuation is at Price to Book of 0.6

Still not late to load up!!!