Global coal prices have surged since June 2016, and miners have turned profitable. 2017 could see massive profits returning, if coal prices stay where they are. Photo: Company

Global coal prices have surged since June 2016, and miners have turned profitable. 2017 could see massive profits returning, if coal prices stay where they are. Photo: Company

This is Part 2 of a report. The first was: GOLDEN ENERGY & RESOURCES: To resume trading on SGX amid coal bull run

Coal prices are currently way off the peaks of several years ago but they are still very pleasing to shareholders and coal company managements contemplating the potential profits awaiting them in 2017.

Take Golden Energy & Resources (GEAR), which resumes trading on the SGX today after being suspended since April 2015 for it to complete a compliance placement of its shares.

It plans to mine 14 million tonnes in 2017. Given its cash cost of about US$20 and an assumed selling price of, say, US$40 per tonne, the cash profit will amount to a whopping US$280 million.

Compare that to its market cap of US$1.57 billion, based on the 67 cents a share compliance share placement.

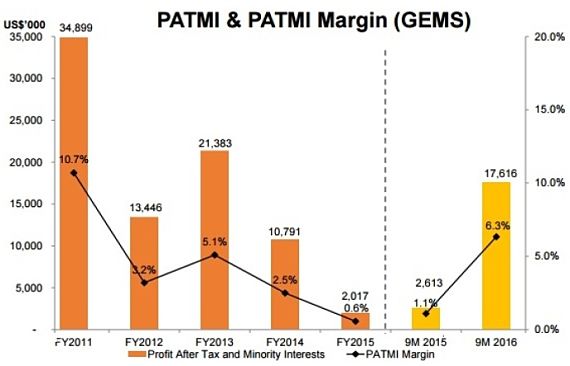

Its notably low cost of production is key to understanding why GEMS was one of a few coal producers which had remained profitable, and even increased its production, during the downtrend of the coal cycle (see chart below).

GEMS is PT Golden Energy Mines Tbk, which GEAR owns 66.9998% of through a reverse takeover in April 2015. Notes: Sales volume of GEMS increased by 35%, 9%, 8% and 5% y-o-y from 2013 to 2015, and 31% y-o-y for 9M 2016.

Notes: Sales volume of GEMS increased by 35%, 9%, 8% and 5% y-o-y from 2013 to 2015, and 31% y-o-y for 9M 2016.

Average realisable selling prices/mt were US$57.26, US$54.81, US$50.05, US$48.36, US$37.28, US$34.48 and US$33.83 for, respectively, 2011, 2012, 2013, 2014, 2015, 9M 2015 and 9M 2016.

The selling price of coal is crucial to the financial health of miners.

The ICI4 index, which reflects the market price for the majority of GEAR's coal quality, rose to US$36.89 in September 2016 from US$27.96 and US$26.64 in June 2016 and March 2016, respectively.

Early this month, the index stood at US$42.40.

What drove prices up was largely a fall in Chinese coal production as the country reined in its overcapacity and closed unprofitable mines in order to cut air pollution.

Its coal industry had cut production by 95 million tonnes, or 39% of its target, as of the end of July 2016. (See Bloomberg story: Coal Rises From Grave to Become One of Hottest Commodities).

China has commited to reducing its annual coal production by 250 million tonnes.

| GEAR's factsheet describes the domestic and international factors driving demand for coal: • Domestic demand in Indonesia is likely to grow as new coal-fired power plants will be developed to account for 60% of the planned additional power capacity, in accordance with the target energy matrix set by the Indonesian Government. • Electrification and industrialisation will continue in Asia’s developing countries, sustaining long term demand for thermal coal. • Industrial production is likely to grow significantly in China and strongly in India; high volumes of coal-fired power plant construction will drive demand for thermal coal. • China is forecasted to increase import demand to 230 million tonnes by 2020 while India is forecasted to increase imports to 233 million tonnes in 2020. GEAR has raised S$121.1 million in gross proceeds from the compliance placement of 181 million shares. Of that sum, S$16,493,000 (or 13.6% of the total gross proceeds), will be allocated to general working capital while the rest is for the repayment of debt. The top placees:

Notably, Trafigura is a leading global commodity trading firm with 2016 revenue of US$98 billion. Its website describes its role: "We access, develop, service and sustain international commodity markets on behalf of producers and end-users. We invest in high-quality infrastructure and build innovative, end-to-end services that bridge the gap between buyers and sellers more effectively." |