Some of the company's developments are:

1. Oxley enters Chongqing

Based on their announcement dated 5 Sep 2016, Oxley intends to develop an integrated medical hub in the Chongqing Liangjiang New Area via a Strategic Cooperation Framework Agreement.  Deputy CEO Eric Low with Executive Chairman & CEO Ching Chiat Kwong.

Deputy CEO Eric Low with Executive Chairman & CEO Ching Chiat Kwong.

NextInsight file photo 2. Just completed a China/HK investor conference the week of 5 Sep

During their post results briefing hosted in end Aug in Singapore, management seems to be pretty positive on the company outlook. (Refer to point 4 below)

3. Company share buyback, coupled with management buybacks

Since Jun 2016, Oxley has bought back shares between $0.385 – 0.420 with the latest purchases on 9 Sep 2016 (as of 13 Sept date of writing). Oxley executive chairman and CEO Ching Chiat Kwong has also bought shares in Jun 2016 between $0.420 – 0.428.

| Stock price | 42 cents |

| 52-week range | 37.5 – 46 cents |

| PE (ttm) | 5.86 |

| Market cap | S$1.2 billion |

| Shares outstanding | 2.93 billion |

| Dividend yield (FY16) |

4.52% |

| Revalued Net Asset Value/share | $1.14 (RHB Research estimate) |

| Source: Bloomberg, RHB | |

4. FY17F is likely to be a record year

FY17F seems likely to be a record year on the back of contributions from Oxley Tower and Phase 1 of The Royal Wharf. RHB estimates that Oxley Tower can contribute about S$500m to Oxley’s FY17F revenue. It also postulates that approximately S$1.9b worth of projects should receive T.O.P. in the next 12 months. As a result, RHB expects FY17F to be a record with net profit of $350-360m.

Some noteworthy risks

With (almost) all investments, there are bound to be risks. For Oxley, some of the risks may be the following:

1. S$1.4b of debt maturing in 12 months

According to Oxley’s FY16 press release, it reduced its net gearing ratio from 3.1x as at 30 June 2015 to 2.8x as at 30 June 2016 on the back of strong revenue and cost recognition.

On the back of strong revenue and cost recognition on completion of Oxley Tower in Singapore and the progressive completion and handover of units to buyers of Phase 1 of The Royal Wharf, Oxley expects that gearing will be further reduced in FY17F.

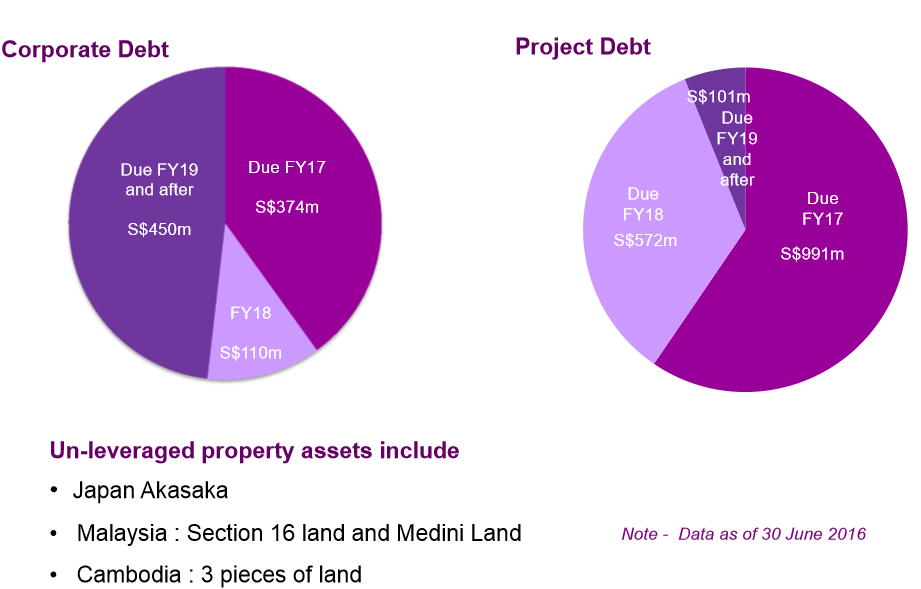

It is noteworthy that Oxley has about S$1.4b debt maturing in less than 12 months as compared to its cash holdings of S$551m as of 30 June 2016. However, out of this S$1.4b debt maturing in less than 12 months, 73% is project debt. (See Figure 1 below on its debt profile and un-leveraged property asset).

Figure 1: Debt profile and un-leveraged property asset

Source: Company

2. Only one rated analyst report

| Oxley Holdings | |

| Share price: 42 c |

Target: 85 c Source: RHB |

Based on Bloomberg, there is only one rated analyst coverage on Oxley by RHB with a target price of $0.95. Thus, it should be reasonable to assume that the investment community may not be fully familiar with the company.

On this front, besides focusing on its business, Oxley has done a post results briefing in end Aug and it has just completed a China / HK investor conference the week of 5 Sep 2016 to raise investor awareness in the company.

3. Illiquid stock

Oxley is an illiquid stock. Its average 30D and 100D transacted volume amounted to 824K and 463K shares respectively. Consequently, it is not easy for investors to either buy or sell Oxley in meaningful sizes. For example, if there are investors with significant positions who wish to exit Oxley, they may have to sell down several levels.

|

"In my opinion, the most attractive point in Oxley is in its chart. Oxley seems to be building a base between $0.380 – 0.460 for a year. Coupled with likely record result in FY17, the odds of an eventual breakout of $0.460 seem higher than a breakdown. Nevertheless, do be aware of the aforementioned risks." |

4. Not very familiar with the company yet

Oxley has been touted as one of the most aggressive property companies in Singapore. Personally, I have just got to know about this company through their results briefing at end-Aug 2016. Thus, I am not very familiar in this company yet. (What attracts me to take a closer look is its chart).

Furthermore, what I have written above, is a compilation from the press releases announced on SGX and also based on my personal chart interpretation.

The above risks are just some of the risks that readers have to be aware. It is not an exhaustive list.

This is merely an introduction to the company. Readers should check out Oxley’s company website (click HERE) for more information.

Disclaimer

Please refer to the disclaimer HERE