Yangzijiang Shipbuilding is China's most profitable shipyard with one of the largest shipyard order books worldwide. Photo: Company Yangzijiang Shipbuilding is China's most profitable shipyard with one of the largest shipyard order books worldwide. Photo: Company

GLOBAL SHIPBUILDING orders decreased by 67% year-on-year (yoy) to 17.7 million DWT during the first half of 2016. As at the end of June, Yangzijiang Shipbuilding had an outstanding order book of USD 4.7 billion, comprising of 89 vessels, the 4th largest globally among shipyards.

The Group secured new orders for ten vessels with a total contract value of about USD 600 million year to date: In July, the Group secured new orders for four units of 1800 TEU containerships with the options for eight identical vessels. In April, it announced orders for six units of 400,000 DWT VLOC. |

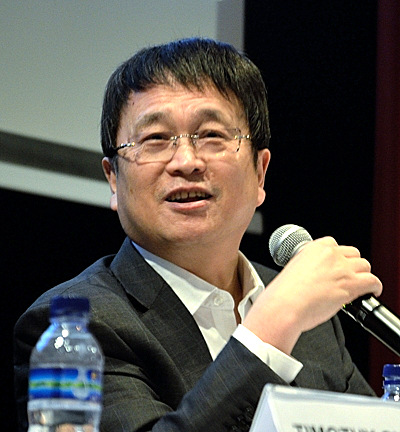

Below is a summary of questions raised at the Group’s briefing for investment professionals on Friday (5 August) and the replies provided by Executive Chairman Ren Yuan Lin, CEO Ren Le Tian and CFO Liu Hua.

|

- CEO Ren Le Tian |

Q: What is the status of your jack-up rig?

The customer is not ready to take delivery of the vessel because of the poor market conditions. Construction has completed and it is now laid up at Taichang. The vessel has been rescheduled to be delivered at the end of July 2017. We will review the market conditions closer to that date for a decision on how to proceed for this project.

Q: How many vessels do you intend to deliver this year?

We delivered 18 vessels in the first half of this year. Our previous target to deliver 56 vessels this year will be revised to about 50 vessels.

We have negotiated with customers who have difficulty financing their vessels to take delivery several months later instead of canceling their orders and forfeiting their deposit. This is workable as there will be replacement demand for vessels that come of age by early next year.

Q: You found buyers for 8 out of 10 canceled vessels. What is the resale price for these 8 vessels?

The original contract value of these vessels varied by about 10%. The deposit payment also varied from 10% to 30% of the contracted value. However, the resale price will be the same for all resale vessels.

|

- CFO Liu Hua |

Combining proceeds from the resale with the deposits forfeited by the original owners, we will still have some profit. Proceeds from the resale will be accounted as sales turnover for the current financial year while the deposit is likely to be recognized in the next financial year.

The majority of the 8 vessels that we resold in 1H2016 were already under construction. Because the vessels had been canceled, we had to recognize the assets as inventory. That is why our inventory increased from RMB 1.2 billion to RMB 2 billion.

These 8 vessels will be delivered in the 2nd half of this year. When we complete construction of the vessels and deliver them to the new buyer, the sales proceeds will be recognized as revenue.

| Stock price | 87c |

| 52-week range | 86.5c-S$1.27 |

| Market cap | S$3.4 billion |

| PE | 7.5x |

| Dividend yield | 4.9% |

| Debt/EBITDA | 2.4x |

| Source: StockFacts |

Q: Given the decline in transportation demand, are you seeing greater demand for smaller vessels and a decline in demand for larger containerships of 10,000 TEU and above?

There is tender activity for the very large vessels and the very small ones: Containerships of 10,000 TEU to 18,000 TEU and those of 3,000 TEU or less.

Q: How much of your shipbuilding margin expansion was due to warranty reversal and how much was due to the RMB depreciation against the USD?

Warranty reversal contributed about 3 percentage points to the margin expansion. When the RMB depreciates, we receive more cash for the quarter. In the current environment of RMB depreciation, contracts with a larger tail end payment will give us a higher margin.