This article is republished with permission from Dollars and Sense.

Many Singaporeans use their CPF to pay for their HDB home mortgage. In fact, more than 80% of HDB homeowners do not pay any cash for their monthly home loan repayment.

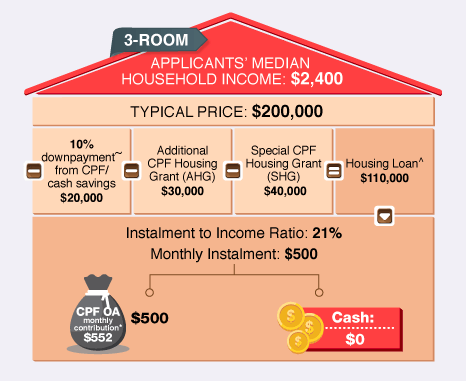

In recent BTO launches, HDB has taken the initiative of illustrating the affordability of its flats by showing how much a couple could expect to pay in terms of CPF and cash based on the estimated price of a flat and the assumed household income. For example, we found these infographics in the latest November BTO launch. 3-Room Flat at Punggol. Infographic: HDB.

3-Room Flat at Punggol. Infographic: HDB.

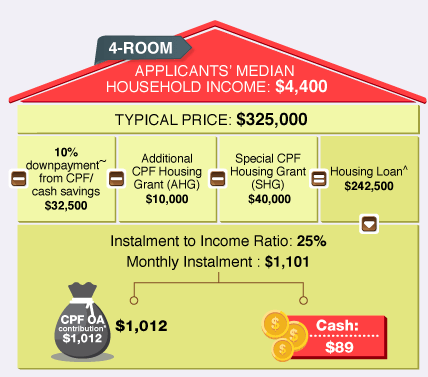

4-Room Flat at Punggol. Infographic: HDB

4-Room Flat at Punggol. Infographic: HDB

These infographics are useful. They highlight the amount of grant a household is entitled to, based on the assumed income depicted in the illustration. They also provide relevant finance related information on the monthly instalment that a household would expect to pay and the additional cash component (if any) that they need to top up.

Should Your CPF Ordinary Account (CPFOA) Be Used For Housing?

While we appreciate the assurance that HDB aims to provide Singaporeans by reminding us that our CPF monies can be utilised for flats that we buy, we do not think that Singaporeans should simply use up all of their CPFOA monies for their home repayment.

The (Bad) Attitude Of Relying On CPF To Pay For Our Home Loan

When people from other countries buy a home, they usually take a housing loan and repay it with their salary. In Singapore, the current trend is to rely on the money in our CPF account.

To be fair, there is nothing really wrong with that. Ultimately, money in your CPF account is yours to be used.

Yet at the same time, we tend to forget that the primary purpose of CPF is to support our own retirement. In other words, even as we enjoy living in our home without needing to fork out any additional cash outlay, we need to be mindful of the fact that we are actually taking away money from our future retirement to use it today.

The Opportunity Cost Of Using Your CPF

The opportunity cost of using CPF has been hotly discussed and debated over for the past few years, but we are still going to talk about it because we believe it is important.

Building a retirement portfolio is not just about saving diligently. You need to be able to grow your portfolio as well. The money in your CPFOA earns risk-free interest of between 2.5% to 3.5% per annum. This interest is earned without incurring any additional transaction costs, which you would typically have to pay when you invest money through financial institutions (e.g. brokerage fee, commission, bid-ask spread).

Here is a simple comparison table to illustrate the difference.

| Household A | Household B | |

| Monthly Mortgage | $1,000 | $1,000 |

| Cash Outlay | $0 | $1,000 |

| CPF Outlay | $1,000 (CPFOA fully used) |

$0 |

| Money in CPFOA After 20 Years (Assuming 2.5% per annum return) |

$0 | $310,975 |

Household B, who chose to pay the monthly mortgage using cash instead of their CPF would have paid $240,000 over the 20 years period. However, during that same period, the money in their CPFOA would have accumulated $310,975, giving them an extra $70,975. Assuming that they did not use any cash for investment opportunities, this is the opportunity cost that Household A would have missed out on.

At this point in time, we like to stress that leaving your CPFOA untouched is not a one size fit all solution for everyone. There are good and bad reasons for wanting to use your CPF money for home loan repayment, which we had covered in a previous article. We encourage you to read the article and determine for yourself if you should or should not be using your CPF money for your home.

Retirement Vs Home – Both Are Important

Having a place to call home is an important part of life. Being able to retire when you are old is equally important. You shouldn’t be deciding between these two important matters.

Rather, what we should be doing instead is to allow our monthly mortgage obligations to be competing against other more frivolous spending in life such as our holiday trips or the need to purchase a car. If servicing our monthly mortgage using cash appears too difficult, it would be these discretionary spending that needs to be sacrificed, and not the money in your CPF which is meant for your retirement.

check this out also: Stock Trading in Singapore

B is saving $1000 (via house) and $1000 (via CPF)

A is saving $1000 (via CPF used to buy house)

Not an apples to apples comparison with regard to how much money is invested (in both house and CPF) if A took the $1000 cash outlay he saved compared to B and invest in stocks. he could have ended up with more.

At the end of the day either govt invest for you (CPF) or you invest yourself ...

cash money is live money. can do anything one wants with it.

if one is to save which one will you save. if one stop unnecessary spending, the money should also be saved as cash and not pay installment. pay with cpf.

housing asset is a good protection against inflation. not too sure about cpf savings. 2.5 % ??? your live money properly invested can get a few percent higher.