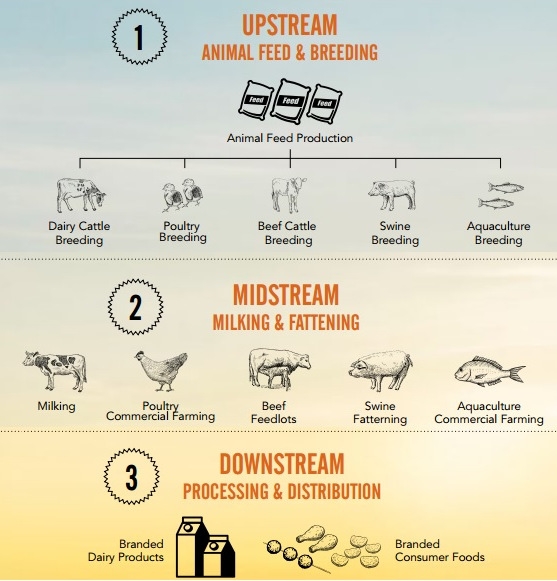

Japfa has a vertically integrated business model. Source: annual report

Japfa has a vertically integrated business model. Source: annual report

|

|

JAPFA's IPO price (in Aug 2014) was $0.80, and now it is trading at almost half that price.

Q1 2015 net profit attributable to shareholders dropped 48% quarter-on-quarter to US$7 million, hit by lower margins and foreign exchange losses.

Managing costs is the key to success for JAPFA as we can see that 2014 full year profits were hit by higher depreciation, finance costs and fair value losses on biological assets.

Its debt is huge at US$945 million when compared to its equity of US$972 million.

Quick ratio is 0.75, indicating its high level of inventory and debt maturing within a year.

Managing inventory and working capital effectively is another great challenge for this business. Overall net profit attributable to shareholders has been deteriorating: 2012: US$53 million; 2013: US$42 million; 2014: US$31 million; 2015 annualised: US$28 million.

Those invested must now look behind the financial aspects and into its leadership capabilities, its finance team's ability to manage cost control, working capital, foreign exchange risk, debt optimisation and inventory management. All these areas are not easy and require a strong finance team with good background and experience in order to address these issues and manage them well.

In its 2014 annual report, I don't see a Head of Finance and Accounting in its Senior Management team. That is because its Executive Director, Kevin John Monteiro, also takes on the role of CFO.

Does that hinder the company from doing an efficient and effective financial management and control role? Only the Board can answer that question.