Excerpts from analysts' report

A Gem Not To Be Missed

|

|

ο Earnings recovery ahead on doubling of capacity. CDW recently invested CNY10m in Suzhou Pengfu Photoelectric Technology Co Ltd (Pengfu) to double its production capacity of ultra-thin light guide panels used in its mobile segment to 2m units per month.

Going forward, Pengfu is obliged to accept orders from and supply to CDW on top priority. We expect this to resolve the supply shortage of light guide panels, which was one of the key reasons for CDW’s weak FY14 performance. With full production by 2Q15, we believe this should help CDW achieve a stronger FY15.

ο Potential high dividend yield of 9% for FY15. With a dividend payout policy of at least 40% of NPAT, CDW paid a total dividend of 1.2 cents (USD) for FY14, which resulted in an attractive dividend yield of 7.8%. The high yield was partly aided by the appreciation of the USD against the SGD. With expectations of an earnings improvement in FY15, we expect CDW to pay out better dividends going forward, translating into a potential 8-9% yield.

|

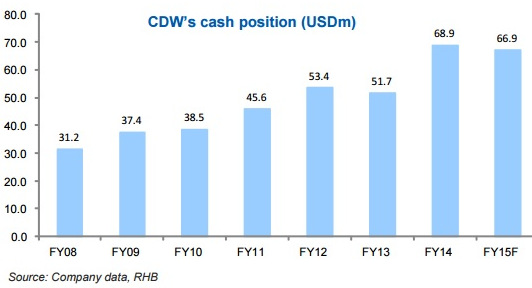

ο Net cash = 76% of market cap. CDW’s business is has been cash-generative over the years and currently 76% of its market cap is made up of net cash, despite paying generous dividends.

ο Initiate coverage with BUY and DCF-backed TP of SGD0.31 (TG: 0%, WACC:12%), representing a 55% upside. Currently, CDW is only trading at 1.8x FY15 ex-cash P/E which we consider low.

Going forward, with the supply shortfall, we believe earnings would most likely recover in FY15. We have also found out that CDW has placed over 90% of its cash in more prominent Japanese banks.

ο Key Risks. Customer concentration risk (one customer contributed 70% of its FY14 revenue). On-going supply of key components.

Full report here.