For many shareholders of Sino Grandness, the recent sharp fall in the stock price of the company has been baffling. To share a better understanding of the situation, Loquat Fan examines the key recent developments of the company, and outlines possible outcomes to some important matters in the near future.

|

In Oct 2014, Sino Grandness announced that it would issue 86 m shares to two Thai companies to pave the way for collaboration in the development of new products and the establishment of new markets for Sino Grandness in South East Asia.

A key unit in PM Group is Quality Coffee Products, a partnership set up in 1989 with Nestle to produce the popular 3-in-1 Nescafé instant coffee. The share placement was unusual in that TTA undertook to lock up, for 10 years, 47.1m of the 60.6m shares it would own. Mr Prayudh would become the honorary chairman of Sino Grandness. In a press release, Mr Prayudh explained investment in Sino Grandness as follows: "The F&B industry in China continues to fuel exciting growth and offers growth opportunities for companies like Sino Grandness that has established a strong competitive edge. I am particularly impressed with Sino Grandness’ beverage products positioning targeting increasingly health conscious consumers through offering juices with mid-high juice content which are perceived to be more nutritional and comprising unique fruits such as loquats and hawthorns. I believe the future remains bright for Sino Grandness and I am pleased to assist them in their future journey.” |

Share plunge

As Sino Grandness and the Thai investors were completing the deal, Sino Grandness shares plunged on allegations by Newman9, an anonymous writer, that the company is a sham.

Among other things, Newman9 dismissed the survey results by Frost & Sullivan which ranked Garden Fresh (the beverage subsidiary of Sino Grandness) as the top loquat juice brand in China with a 1.4% share of the entire fruit juice market in China. Newman9 alleged that this was not corroborated by reports of two market survey firms, AC Nielsen and Euromonitor. Huang Yupeng, CEO of Sino Grandness. NextInsight file photo.To this, Mr Huang Yupeng, Chairman and CEO of Sino Grandness, pointed out that as loquat juice is a new segment within the fruit juice market in China, accounting for less than 2% of the market, it might not have been highlighted in some market research reports.

Huang Yupeng, CEO of Sino Grandness. NextInsight file photo.To this, Mr Huang Yupeng, Chairman and CEO of Sino Grandness, pointed out that as loquat juice is a new segment within the fruit juice market in China, accounting for less than 2% of the market, it might not have been highlighted in some market research reports.

He added that the survey by Frost and Sullivan, on the other hand, focused on Asian specialty fruits such as longan, loquat, hawthorn, kumquat and plum.

(Interestingly, on 9 Mar 15, Sino Grandness announced that in Jan 2015, it had commissioned Euromonitor to conduct an independent assessment of the loquat juice market in China.On 14 Mar, in a Business Times report, Mr Huang shared that the outcome of Euromonitor’s study would be known within the next one to two months. It appears that Sino Grandness is confident of Garden Fresh, and is willing to subject the brand to further scrutiny.)

Newman9 also predicted that Sino Grandness would face a bond default in Oct 14. But the default did not occur as holders of 80.5% of the bonds extended the maturity deadline to 30 June 2015.

At that time, to many investors, the risk of Thai investors calling off the deal in the face of negative sentiments created by Newman9 was real.

TTA and PM Group invested, nevertheless, though at a much lower subscription price; and Sino shares recovered briefly, only to fall again after reporting its first-ever loss of a hefty RMB 64m in 4Q 2014. The surprise loss added to uncertainty created by the looming maturity dates of the two convertible bonds (June and July 2015). Sino Grandness had yet to announce any financing arrangement that would enable it to repay the bondholders in cash if necessary.

Convertible bonds

The two tranches of convertible bonds, issued in 2011 and 2012, will be converted into Garden Fresh shares if Garden Fresh is listed on an established stock exchange. Otherwise, penalties in the form of high interest will have to be paid to the bondholders.

Preparatory work for the IPO, which started in early 2014, is still in progress as numerous distributors and retail points in different provinces of China have to be visited by the various professional parties.

When 2011 RMB 100m bonds matured on 19 Oct 2014, and Garden Fresh was not listed yet then, RMB 19.5m were redeemed with interest of RMB 18.4m that nearly matched the principal sum. The remaining RMB 80.5m were rolled over to June 2015.

The redemption of RMB 19.5m of bonds in Oct 14 did not result in holders of 2012 RMB 270m bonds exercising their right to follow suit, before maturity in Jul 2015. It seems that Goldman Sachs, which holds the bulk of 2012 bonds, believes the stake in listed Garden Fresh may fetch a value higher than the redemption sum.

The aggregate principal sum of the outstanding bonds is RMB 350.5m.

If the professionals handling the Garden Fresh IPO does not submit the required application at all, RMB 650m will have to be paid to bondholders -- the penalty is a hefty RMB 300m.

A submission will result in a lower amount payable of approximately RMB 580m in the event that the IPO cannot be completed before maturity.

Many investors are spooked as they are of the view that Sino Grandness will not be able pay off the bondholders.

The gamble Garden Fresh is the first company to produce juice from loquats. As the therapeutic effects of loquat in soothing throats and lungs are well-known, loquat juice should be saleable, and competiting producers will emerge.

Garden Fresh is the first company to produce juice from loquats. As the therapeutic effects of loquat in soothing throats and lungs are well-known, loquat juice should be saleable, and competiting producers will emerge.

To be inextricably identified with loquat juice, Garden Fresh had to grow quickly, not letting its lead slip. This required money, and Garden Fresh took the gamble of issuing bonds to finance its expansion.

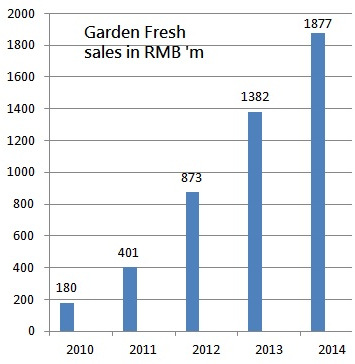

Money from the bonds have enabled Garden Fresh to grow its sales strongly, from RMB 180m in 2010 to RMB 1,877m in 2014, an amazing 9-fold increase in 5 years.

Without the bonds, could Garden Fresh have grown? Quite unlikely.

Cash position

In its 9 Mar 2015 business update, Sino Grandness shared that as at 31 Jan 15, it had RMB 300m in cash, and untapped credit lines of RMB 150m from PRC banks. Moreover, it was in talks with international banks to borrow.

The company also added that to conserve cash, construction of the Anhui factory can be slowed down.

These announcements have not quelled investor anxiety, however, as the outcome of talks with the international banks is uncertain.

Has Sino Grandness been keeping close watch on its financial position and, as a matter of prudence, planned for the possibility of Garden Fresh not being listed?

However, it cannot be that prior to the share placement, the Thai investors had not assessed the adequacy of measures mapped out by Sino Grandness to deal with the possible bond redemption.

Business beyond China Garden Fresh's loquat drink and hawthorn drink positioned next to Minute Maid in a Wellcome store in Concord Square shopping centre in Tsuen Wan, HK. Photo by readerOn the business front, Garden Fresh has made big strides, going beyond China.

Garden Fresh's loquat drink and hawthorn drink positioned next to Minute Maid in a Wellcome store in Concord Square shopping centre in Tsuen Wan, HK. Photo by readerOn the business front, Garden Fresh has made big strides, going beyond China.

In late 2014, Wellcome in Hong Kong (with 200 supermarkets) started selling the loquat juice, By the end of March 15, Garden Fresh beverages will be progressively rolled out to 7-Eleven’s 900 convenience stores in the territory.

Both Wellcome and 7-Eleven in Hong Kong are owned by Jardine Matheson, and Hing Sang, the distributor, is listed on the Hong Kong Stock Exchange.

The Business Times reported on 14 March 2015 that in the second half of this year, management is planning to market Garden Fresh juices in Thailand, which has a population of 67 million.

Mr Charlermchai Mahagitsiri, TTA Chairman, told "The Edge" (16 Mar 2015) that many Thai beverage manufacturers have sought help to sell their products in China through the distribution channels of Sino Grandness.

These developments confirm the declared intention of the Thai investors to be strategic partners of Sino Grandness, and not just as financial investors.

Sino Grandness (26.5 cents) trades at about 3X FY2014 earnings. Chart: Yahoo!

Sino Grandness (26.5 cents) trades at about 3X FY2014 earnings. Chart: Yahoo!

Progress of IPO of Garden Fresh

Mr Huang has expressed confidence in submitting the required forms to the exchange before the bonds expire.

But the share price weakness suggests that the market does not think that Garden Fresh can get listed at all and the company will not have RMB 580m, let alone RMB 650m, to pay off bondholders.

Developments to be closely watched  Huang Yupeng, CEO of Sino Grandness, view placards promoting his company's beverages at a trade fair. Photo: CompanyMr Huang has been buying Sino Grandness shares in recent times.

Huang Yupeng, CEO of Sino Grandness, view placards promoting his company's beverages at a trade fair. Photo: CompanyMr Huang has been buying Sino Grandness shares in recent times.

Investors are hoping that the Thai investors too will raise their combined 12.8 % stake in Sino Grandness as further demonstration of their faith.

Four corporate matters that will be closely watched are:

(1) will the international banks provide the contingency loans?

(2) will the next quarterly results to be released in May show a stronger cash position?

(3) will bondholders roll over their bonds in anticipation of a successful listing of Garden Fresh (they have to indicate one month before bond maturity); and

(4) will the required IPO forms be submitted to the exchange in time to lessen the sum payable to bondholders if the listing takes longer than expected to complete?

Confidence boosters

√ The entry of Garden Fresh beverages into Thailand in the second half of this year should point to the Thai investors being serious in working with Sino Grandness.

Their strategic alliance with Sino Grandness will entail more financial outlay aside from the subscription of placement shares. For example, the Thai investors will have to commit resources to import Garden Fresh juices into Thailand and undertake the distribution.

√ Sino Grandness has announced the incorporation of two companies, in Hong Kong and the Cayman Islands. Does that signify that preparatory work of IPO is at an advanced stage?

Garden Fresh has been operating as an independent entity with its own assets and board of directors as it was Sino Grandness' intention at the outset to list it.

A cumbersome restructuring to be conducted before IPO has therefore been obviated.

A successful listing of Garden Fresh will provide tremendous relief to investors. Garden Fresh will be spared the need to redeem the bonds for RMB 650m (or a lower RMB 580m if an application for listing is made).

Moreover, money raised from issuing new Garden Fresh shares will enable Garden Fresh to grow further.

And Sino Grandness may release some of the Garden Fresh shares it owns for sale as vendor shares during the IPO, and use the money collected to pay a special dividend to shareholders.

but the trend is away from drinking fruit juice to eat fruits.

This week, it looked as if fruit juice might finally lose its claim to healthiness and be put into the same category as fizzy drinks. It emerged that a headteacher, Elizabeth Chaplin, who runs Valence primary school in Dagenham, wrote to parents about a new rule to confiscate juice cartons from children's lunch boxes. Instead, pupils would only be allowed to drink water.

Days earlier, Susan Jebb, a government advisor and head of the diet and obesity research group at the Medical Research Council's Human Nutrition Research unit at Cambridge University, told the Sunday Times that the government's official advice that a glass counts towards your recommended minimum five-a-day servings of fruit and vegetables should be changed.

It appears that the Thais are not all talk but are working together to seal their ties. It is great to know that they are working on the distribution of Garden fresh juices to Thailand and to rest of SEA. Will they also work to bring in local Thai beverages to China as reported in the edge magazine? Will the Thais bring in Nestle to expand the distribution of Garden fresh juices globally?