James Chong (left) is self-employed and began his investing journey exploring various approaches to stock investments, incurring huge losses on the way. He now sticks to a core investment philosophy and has since recouped the losses while earning a decent overall profit. He believes that a high price can turn stocks of good quality businesses into a speculative purchase and likewise, a low price can turn a speculative stock into an attractive investment. T he following content was recently published on his blog (The Secret Investors), and is republished with permission.

James Chong (left) is self-employed and began his investing journey exploring various approaches to stock investments, incurring huge losses on the way. He now sticks to a core investment philosophy and has since recouped the losses while earning a decent overall profit. He believes that a high price can turn stocks of good quality businesses into a speculative purchase and likewise, a low price can turn a speculative stock into an attractive investment. T he following content was recently published on his blog (The Secret Investors), and is republished with permission.

IN MY ANALYSIS on Avi Tech Electronics (See Avi-Tech Electronics - Is Quick Profit Possible?), I highlighted the reasons -- both quantitative and qualitative -- why I felt the company was undervalued and that the various ongoing corporate actions may serve as a catalyst to drive up the price towards its true value.

Since my initial post on 30 December, the price has risen from S$0.074 to S$0.091 -- a reasonable gain of >22% in about one and a half months.

My own average purchase price of S$0.699 equates to a 30% gain since around 2-3 months back in November. With the release of the half-yearly results, this post is an update on how the story has unfolded so far and my intended actions.

Much Improved Continuing Operations - Industry or Management Actions?

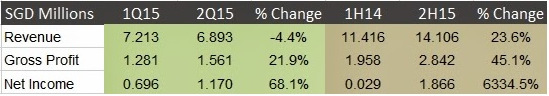

Table 1: Avi Tech Electronics 1H15 Financial Summary (Continuing Operations)

Table 1: Avi Tech Electronics 1H15 Financial Summary (Continuing Operations)

As can be seen clearly from Table 1 above, revenue, gross profit and net income show marked improvements.

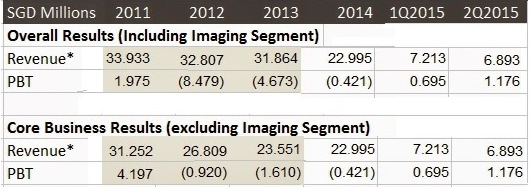

Similar growth may be observed in its operating cash flows (you can find out more from the company's latest earnings release). Table 2: Avi-Tech Results Including & Excluding Disposal Group

Table 2: Avi-Tech Results Including & Excluding Disposal Group

I believe it is important to pinpoint whether the improvements in core operations are the result of improvement in trends of the industry or due to specific actions undertaken by the management. From the announcement, the management mentioned that the semi-conductor industry as a whole appears to be in an uptrend recovery and they 'remain optimistic of continued improving performance if this uptrend continues'. With improved results seen across all business segments, it is pretty clear that the industry recovery did play a large part in the increase in revenue for the past few quarters.

However, I would argue that the management played a significant role in retaining these revenues especially since the company's inclusion into the SGX watchlist in 4Q14. The gross profit margin has grown from 11.3% in 4Q14 to 22.6% in 2Q15 and this is, to quote the management, 'partly the result of effectiveness of the ongoing cost control measures and the enhancement in productivity across all business segments'. This is made clearer if we observe the drop of COGS as a percentage of revenue from 88.7% in 4Q14 to 77.4% in 2Q15.

Another factor that plays a part is the significant decline of its operating expenses as a percentage of revenue from 18.9% to 9.9%. Although we do not have much information about the specifics of operating expenses, in the typical case such expenses should not provide future economic benefits to the company and thus such cost-cutting measures usually will not have serious undesirable consequences.

To sum it all up, an investor of the company should be heartened to see that the better set of results are not solely due to general improvements in the semi-conductor industry but also due to active steps taken by the management to ensure that more money flows into the bottom line.

BONUS: CASH FROM DISCONTINUED OPERATIONS

I just want to highlight the fact that the discontinued operations did contribute a decent amount to the bottom line in the past 2 quarters. Although non-recurring in nature, its always good to know that its disposal will continue to throw in some amounts of cash for the company. The net asset value of this group under disposal currently stands at about $966,000.

INTERIM DIVIDENDS - 1ST TIME SINCE 2011

Another positive note is the resumption of dividend payments after a hiatus of more than 3 years. Coupled with the purchase of shares by directors in the past 6 months, the interim dividends declared is a clear show of confidence from management that they believe that the company has indeed turned around. The interim dividends of $0.3 cents per share represents about 3.3% dividend yield at current market prices (4.3% based on my own purchase price).