|

|

Insider Selling & Overriding Rules

One of our long standing rules is to never invest an undervalued business if management is engaged in significant insider selling.

This was the most troubling aspect of the investment thesis then. From the 2009 – 2012, Mr Chou Cheng Ngok engaged in significant insider selling of his shares throughout this time period at an average price of $0.150 to $0.175. (Click on this link for the details)

Without the benefit of hindsight, it would have been impossible to predict that he would then spend the majority of 2012 – 2015 buying shares from $0.180 to $0.290.

It is perhaps hard to derive any sort of hard principle of this behavior. On principle, it will probably best serve investors to be more wary than not when insiders sell. However, such rules are not hard and fast, and can be broken in certain circumstances. In this instance, we overruled it in view of the large margin of safety afforded by the high quality assets that are predominantly located in Singapore.

The idea of an asymmetrical risk reward investment dominates many of our holdings in Singapore. A significant number of our investments have a significant margin of safety derived from hard assets in the form of cash, short-term investments, and investment properties. This coupled with their earnings power provides the potential for substantial capital appreciation with considerably less downside risk.

Price vs. Value

If one examines the price history of Popular Holdings, it makes for an interesting study of investor emotions. Since our initial article in 2012, the price proceeded to appreciate by slightly over 90%, declining then by slightly under 30%, before rallying back by over 30% to its current $0.315. (Click here for chart).

Interestingly, the year on year change in Net Tangible Assets over the same time period is of a much lesser magnitude – an interesting phenomenon considering the rather stable nature of Popular Holding’s core business. And yet, this is not unique to Popular, but many other stocks in which stock price movements are far more volatile than the underlying change in business conditions.

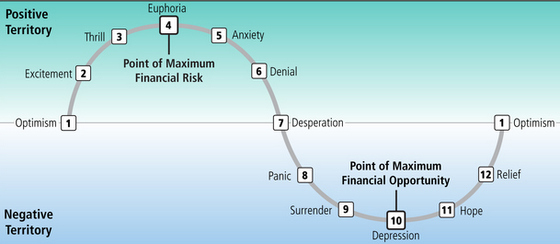

We believe that the answer to this mystery lies in the behavioral decisions that guide investors. Price changes are often the result of a multitude of buy and sell decisions that are as much guided by emotional instincts (greed and fear), as they are rational decisions. Ascertaining the intrinsic value of a business purely from a price chart is in our view, a risky and often dangerous proposition as such charts are in our experience more reflective of human emotions rather than fundamental value.

Undervalued Situations Provide a Wide Range of Positive Outcomes

We often invest in companies or businesses that receive little analyst coverage, have a bleak outlook or that are shunned outright by investors for a wide variety of reasons. The positive aspect to such an approach is that we are often able to purchase such investments at a wide discount to their underlying value. Unfortunately, we are often too early to the game, and short term declines or long periods whereby price remains stagnant are common.

This can be contrasted to momentum or even “growth investing”, whereby price movements up are often a big part of the underlying thesis, if not the thesis itself, and where prospects appear far brighter than those of our portfolio holdings. Such an approach offers a “feel-good” feeling, as investors hitch onto the latest innovations and growth stories that permeate the market.

The challenge we face with such an approach is that too often, too much money chases too few good investment candidates. Companies that offer obvious growth prospects are often overpriced, thereby driving their future returns down when they disappoint the lofty goals that investors have set them.

Our defense to this is to purchase stocks with a sound dividend policy backed up by considerable earnings power and hard assets. This gives us the opportune cash flow to re-invest annually in other situations. Furthermore, time and history on our side, as the nature of business is more often cyclical than not. Such an approach requires patience, and eschews the use of leverage.

We believe such an approach to be rewarding for those willing to take the long term view, and is one that we are determined to continue with going forward.

Previous article: JUN HAO: "Investing lessons I’ve learnt in the past 4 years"