Lian Beng's investments in associates and joint ventures in property development projects have been paying off handsomely: Share of results from associates and JVs contributed over half of its 1HFY2015 pretax profit.

Lian Beng's investments in associates and joint ventures in property development projects have been paying off handsomely: Share of results from associates and JVs contributed over half of its 1HFY2015 pretax profit.Above: Artist's impression of Lian Beng's development of retail mall Hexacube at Changi Road.

CONSTRUCTION SECTOR margins may be under pressure due to rising labor costs, but Lian Beng has been defying the tide with healthy profits, thanks to its successful property investments.

The construction group recorded 1HFY2015 (June to November 2014) profit attributable to shareholders of S$35.5 million, up 105.2% year-on-year.

Gain from disposal of its investment in the hotel development at Middle Road as well as recognition of profits from its residential property development projects boosted pretax income by S$21.5 million.

1HFY2015 revenue grew 26.1% year-on-year to S$367.6 million, boosted by an increase in construction revenue and rental from its workers dormitory. However, there was a decrease in ready-mixed concrete revenue.

The Group’s share of results from associates and JVs turned from a loss of S$1.0 million in 1HFY2014 to a profit of S$21.5 million in 1HFY2015.

Share of results from associates and JVs contributed 52% to pretax profit of 41.2 million, and was lifted by the following:

» Profits were recognised from property development projects NEWest, KAP Residences, The Midtown and Midtown Residences.

» The Group sold its 19%-owned JV company, 122 Middle Investment Pte Ltd, which owned the hotel development at 122 Middle Road. The property was sold at S$270 million last September.

Last month, the Group's joint venture with leading workers accommodation player Centurion Corp secured a licence from trade association ASPRI to build and operate a workers dormitory to house 7,900 workers and a 3,000 sq m training centre at Jalan Papan.

Last August, it announced plans to foray into the Australian property market by co-developing two residential towers and a hotel at a Brisbane tourist hotspot with Heeton, KSH and an Australian property developer.

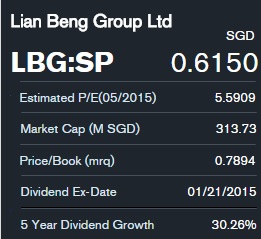

Bloomberg dataOther highlights of 1HFY2015 results Bloomberg dataOther highlights of 1HFY2015 results » Healthy dividend yield The Group declared an interim one-cent dividend. This translates into a rolling 12-month dividend yield of 5.3% based on its recent stock price of 61.5 cents. » Robust order book Construction order book stood at S$821 million as at November 2014. » Strong cash position Cash reserves increased by 12.6% year-on-year to S$166.9 million as at last November. The Group's cash reserves had grown even after excluding reserves accumulated by associates and joint venture investments (as a result of adopting new financial reporting standards with effect from 1 June 2014). |

Executive director Ong Lay Koon. NextInsight file photoDiversified property investments

Executive director Ong Lay Koon. NextInsight file photoDiversified property investments"We have been acquiring industrial and commercial real estate assets," said executive director said Ong Lay Koon at the Group's results briefing on Wednesday.

Last June, Lian Beng completed its acquisition of a light industrial property in the prime Leng Kee Road motor belt for $46.2 million.

The Group invested 80% in a joint venture to develop the land at 24 Leng Kee Road that houses the body shop operations of authorised Toyota distributor Borneo Motors Singapore.

Its joint venture partner is well-known parallel import company, VinCar, that currently occupies several units at the neighbouring Alexcier Building.

Last September, it completed an investment in Prudential Tower through a consortium that paid S$512 million for a 92.8% stake in the prime office building.

In July 2013, it won a bid from JTC to build an industrial building at Mandai Link that will house food factories and central kitchens.

|

Below is a summary of questions raised at its 1HFY2015 results briefing, and the answers provided by Ms Ong.

Q: What plans do you have for the Leng Kee Road building?

The building is for car rental business. We will redevelop it using alteration and addition works. We intend to hold it for rental income. We have rental income from the existing tenant of this property. Q: Do you use project financing? No, we don't. We use bank loans to finance 70% to 80% of the construction costs. For example, we are taking a bank loan to finance 75% of the construction cost our upcoming project at Tampines. The loan term is for 3 years, matching the project construction timeframe. Our cost of funds is based on floating rates (currently up to 2.5% a year). We are hedging our cost of funds as interest rates are likely increase in the 2nd half of this calendar year. For example, we are hedging the interest payable on large projects like for the S$5.1 million loan we took to finance our investment in Prudential Tower.  Lian Beng's asphalt plant at First Lok Yang Road. Lian Beng's asphalt plant at First Lok Yang Road.Photo: Company Q: How is the construction progress for your asphalt plant?

Our new asphalt plant is expected to be operational in a couple of months. We own 40% in the plant. Elvin Koh, the ex-CEO of Samwoh, owns the remaining 60%. (Samwoh is a leading civil engineering contractor and a market leader in the supply of building materials such as asphalt premix and concrete.) There are currently relatively few players in Singapore that supply asphalt premix. We believe there is business opportunity in this niche and will tap on Mr Koh's experience to kick start this business. Potential customers include large players like OKP. |

Recent story: LIAN BENG: One-Off $8.45 M Boost From Sale Of Midlink Plaza