James Chong (left) is self-employed and began his investing journey exploring various approaches, incurring huge losses on the way. He now sticks to a core investment philosophy and has since recouped the losses while earning a decent profit. He believes that a high price can turn stocks of good quality businesses into a speculative purchase and likewise, a low price can turn a speculative stock into an attractive investment. The following content was recently published on his blog (The Secret Investors), and is republished with permission.

James Chong (left) is self-employed and began his investing journey exploring various approaches, incurring huge losses on the way. He now sticks to a core investment philosophy and has since recouped the losses while earning a decent profit. He believes that a high price can turn stocks of good quality businesses into a speculative purchase and likewise, a low price can turn a speculative stock into an attractive investment. The following content was recently published on his blog (The Secret Investors), and is republished with permission.

|

|

The following data are based on my 30 Dec 2014 post:

Price = S$0.074

Shares outstanding = 342,422,096

Market Cap = S$25.34M

P/E = NA (losses)

EV/EBIT = NA (losses)

P/NTA = 0.63

INVESTMENT THESIS

The results in this class of stocks depend a lot on corporate events which in some sense serve as a catalyst to close up the price-value gap, hopefully in a fairly short period of time. My investment decision is premised on the following:

The management has destroyed huge value over the years through the 2 loss-making subsidiaries. Many shareholders could have lost confidence in management's ability and decided to sell / cut losses.

The poorer fundamentals and financial results combined with the recent inclusion into the SGX watch-list due to 3 consecutive years of pre-tax losses led to a stock price decline that is likely exaggerated.

This has led to a fair degree of undervaluation which also means a potential investment opportunity to the shrewd analyst.

Directors have been mopping up the shares recently with their own money and to that extent, agreeing with my view that the stock price might be undervalued.

The disposal of subsidiaries which were the main contributors of past years' losses may improve future earnings at least in the short term and this may prop up the market price.

KEY RISKS / UNCERTAINTY

Management indicated that it will “continue with its plans to seek new areas of growth whether through mergers and acquisitions, or any structured transaction or business, which will add value to shareholders.”

Has management really learnt their lesson from previous experiences? Are they capable enough to continue ‘adding value’ through acquisitions? I feel it’s foolish for them to do that considering their core business isn’t doing as well as before too (more details below).

Also, we can’t deny that they are in a difficult semi-conductor industry which presents a challenge to the management (that is perhaps why they insist on growing through acquisitions etc) and a risk that the investor needs to be wary of.

SAFEGUARDS AND CHECKS – IN CASE THINGS DO NOT TURN OUT WELL

As I have said, the need for intensive analysis is not really required for the event-type part of my portfolio and I hope to realize some profits in a reasonably short period of time. However, as a safeguard, I had better ensure there’s some sort of margin of safety if I have to hold on to it for a longer than expected timeframe. Since this will be a minor position in my portfolio, a brief analysis should be sufficient.

Financial Position

The balance sheet is generally cash rich with net cash equivalents of about S$23.5M which compares favorably with the market cap at S$25.3M. Book value is about S$40M. If the company is liquidated now, I believe we can get back more than what we pay now. Of course, if management continues eroding value by doing unprofitable expansion, the intrinsic value on a liquidating basis may drop below our price paid.

Earnings

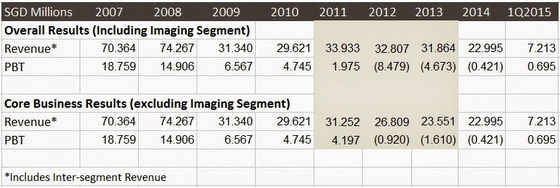

I’ve cleaned up the effects of the loss-making subsidiaries in the above table and it is clear that these subsidiaries have indeed eroded earnings between 2011 and 2013, before management decide to discontinue operations in 2014. The core operations haven’t been doing well too considering that they also have registered some losses from 2012 to 2014. Core business revenue has declined drastically from S$70M to S$23M over 7 years. However, keep in mind that the bulk of the negative earnings is attributed to the subsidiaries (contribution by subsidiaries was -S$12.8M compared to +S$1.7M for core business from 2011 to 2013).

Thanks to these loss-making subsidiaries, share price has declined more than 60% since 2011. The discontinuation of the subsidiaries has stemmed losses greatly and results in 1Q2015 shows a positive profit. Could there be turnaround which can lift share price higher? No one can say this for sure.

Let's use 2010 and 2015 results for comparison since in both years, the loss-making subsidiaries are non-existent. A back-of-the envelope calculation shows PER of 2010 is about 15.6X while forward PER of 2015 appears to be about 9.1X (I annualized 1Q15 earnings per share of S$0.002 here as an approximation). Assuming all else remains the same, this could be another indication that share price decline has been exaggerated and the market probably has not factored in the positive effects from the disposal.

If the valuation in 2010 is any guide, the market price should be around S$0.12! Of course, I’m not saying these assumptions are reasonable but at least it gives me some level of comfort here knowing that I'm not buying at a ridiculously high price.

Because the earnings have been quite unstable, probably the balance sheet can give better insights about its intrinsic value. Taking a haircut of 50% to PPE (NB: this part of the balance sheet is throwing in some S$500K-S$700K rental income annually), 25% to inventory and 10% to receivables, we get a liquidation value of S$0.094 per share as compared to the price of S$0.074. (Potential Bonus 1: I did not include the proceeds that the company may receive from the disposal of subsidiary in this valuation).

CONCLUSION

A high price can turn stocks of good quality businesses into a speculative purchase and likewise, a low price can turn a speculative stock into an attractive investment. My opinion is that Avi-Tech belongs to the latter category.

Considering the pros and cons, I think the low price coupled with the existence of potential catalysts make the purchase of Avi-tech too attractive to be denied by the security analyst. However, the risks mentioned above also means that the position in the portfolio should be kept relatively small - just in case the business does not perform well again. (Potential Bonus 2: we have already ensured there's some margin of safety to absorb unfavourable future developments but what if future acquisitions are so successful that future earnings improve dramatically? This is definitely not accounted for yet).

SOME FINAL THOUGHTS

Due to its classification in my portfolio & unless there’s any clear-cut change in circumstances, my guess is that I will take most of my profits (if any) within the next 12 months. I mentioned that my average price including costs since November ‘14 is S$0.0699.

The price now at S$0.078 would mean that my current returns is about 12% in slightly less than 2 months. Obviously this is not the best business in the best industry and I have the urge to take my profits initially when it touched S$0.08.

After some deliberation, I figured that my estimate of S$0.094 is really a minimum valuation which is so conservative to the extent that it is a reasonably dependable guide. Moreover, one of the directors bought back shares a couple of days back at about S$0.078. Maybe somewhere around S$0.09 I can consider trimming my stake. I would be more than happy to get some opinions about this.

PS: I’m surprised that I took about an hour of analysis before deciding to purchase Avi-Tech but it took me more than 3-4 hours to write about it in this blog!

Did a quick look and personally feel Eucon is very different from Avi-Tech -

1. It is clear that based on the balance sheets, Avi-Tech is in a better financial condition than Eucon. Eucon has a poorer working capital position and much of its PPE is tied up to plant & machinery which may or may not be worth as much as stated. This is compared to Avi-tech where the better portion is in building and leasehold improvements that have been throwing in rental income, potentially indicating some value there.

2. One key investment thesis for Avi-tech is the discontinuation of its major loss-making subsidiaries. The disposal of the laser drilling segment for Eucon doesn't seem to help much overall as other segments have shown a relatively huge loss over the previous years. This is different from Avi-Tech in which the discontinued subsidiaries has contributed a majority of the losses in the previous years. The remaining segments at Avi-Tech did show small losses previously but has turned in positive results in the latest quarterly report.

Of course, Eucon may turn out to be a better investment in the end but based on the above analysis, I believe Avi-tech is a much safer bet.

My apologies for not replying soon enough as I don't really check comments here on a frequent basis. You may want to comment directly in my blog at http://secretinvestors.blogspot.sg/